24 Insurance Marketing Ideas: The Ultimate Guide (2020)

Updated on December 11, 2023To get more consistent insurance leads in 2020, I’ve outlined the 24 best, proven insurance marketing strategies you can use to grow your agency —

I’m talking about consistent leads, clients, and ongoing referrals!

It’s all here — have at it!

1. Become the #1 go-to insurance agency by creating name recognition

Having an attractive logo professionally designed for your insurance agency marketing is important for 2 reasons:

- It helps you look like a professional trustworthy business

- It creates name recognition

Both of which amount to more insurance leads and clients!

Something like this:

Put yourself in your prospect’s shoes for a moment…

Imagine you’re a homeowner who’s considering buying a new home insurance policy to bundle with his auto policy for 3 vehicles.

One insurance agency has some tattered old signs in their agency’s window…

While another one has a clean, professional logo both on their sign and website.

Like this:

Which one are you more likely to call?

The insurance agency that LOOKS legitimate and seems like a business you can trust with your policy and claims.

And good news:

Getting your logo and agency designed to look polished and professional doesn’t have to cost an arm and a leg.

You can get your logo designed AND put on multiple promotional items to easily (and inexpensively) boost your agency’s branding.

See:

Those prices are DEFINITELY worth it for branding that keeps your agency’s name out there!

Remember to use your logo in your email signature, too —

It’s a FREE way to remind prospects and customers of your agency’s brand and image.

If you skip this step in your insurance agency marketing plan, the rest of your insurance marketing won’t communicate the message that you’re worth calling or spending money with.

Plus, you can use your logo on handy wallet cards, which I talk about next…

2. Create branded wallet cards to help in emergencies

Even though almost everyone uses a smart phone today, you’d be surprised how helpful a wallet card can be, especially for people who’ve recently moved to the area.

Here’s an example:

Get wallet cards branded with your professional logo and include the following numbers:

- Your agency’s # for filing claims

- Fire department

- Police department

- Poison control

- Emergency # for animal hospital

Plus —

You can use these cards in your referral marketing, giving a handful to clients to pass out to their friends and family.

And this next one is even EASIER…

3. Reach 77% of mobile users by programming your # in smartphones

Don’t expect clients to save your agency’s phone # in their mobile contacts —

Encourage them to do it while in your office!

According to data from Pew Research Center, 77% of U.S. adults use smartphones…

So it makes sense to encourage your clients to program your # in their smartphone (while they’re sitting in your office), AND share it with friends and family with just a click of a button.

And speaking of referral marketing…

4. Generate a 1,722% return on investment with referral marketing

Since referrals generate the easiest new business for your agency, you can use insurance postcards to get your existing clientele bringing in their family and friends.

For example —

This California agency generated a 1,722% return on investment (ROI) with their insurance direct mail campaign, like this:

They mailed insurance postcards inviting their 3,000 clients to a dinner event they were hosting, and their postcard encouraged them to bring along a friend.

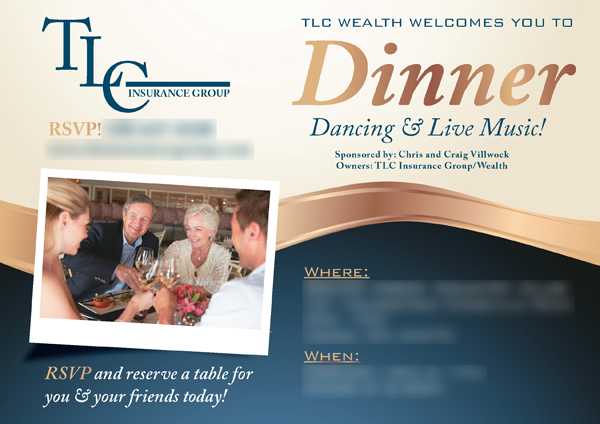

Here’s the design:

Their insurance direct mail campaign + dinner event were a success!

120 people attended the dinner…

And this insurance marketing plan generated $30,000 in revenue!

Note:

You don’t have to host a fancy dinner for your clients…

You can simply mail insurance postcards to your clientele and offer something in exchange for any referrals they send, like these:

- $25 Visa gift card

- $15 Starbucks gift card

- 5 tickets in a free TV raffle

See an entire postcard design gallery dedicated to marketing for insurance agents!

Here’s another way to follow up with existing clients for referrals…

5. Automatically follow up with clients to generate referrals

Set up an email marketing system — most offer FREE versions — to send out emails on a regular basis to your current clients reminding them that you accept (and reward) referrals.

Here’s a sample email sequence:

- 1st email- Thank you for your business!

- 2nd email (2 days later)- Win a $50 Visa Gift Card for every referral!

- 3rd email (5 days later)- Help your family save $$$ & win a FREE gift!

- 4th email (14 days later)- Rates DROPPED, you can save $$$

Each email that gets sent out should promote your insurance agency and remind clients you’d appreciate any referrals, especially if rates are dropping or any other money-saving deals are happening right now.

When you consistently follow up with clients, they’re more likely to send you referrals because the consistent communication reminds them that you’re there and happy to help.

6. Capture some of the 95% leads visiting your website

Your website isn’t just a fancy place for your prospects to visit you online…

Factually: it’s a MAJOR part of your insurance agency marketing plan.

Consider this:

95% of your prospects will visit your website before making any decision to buy from you (or not).

95% is basically almost ALL.

So your website must immediately communicate the following:

- Who you are

- Which services you provide

- That you’re a real (credible) business

- And how to contact you.

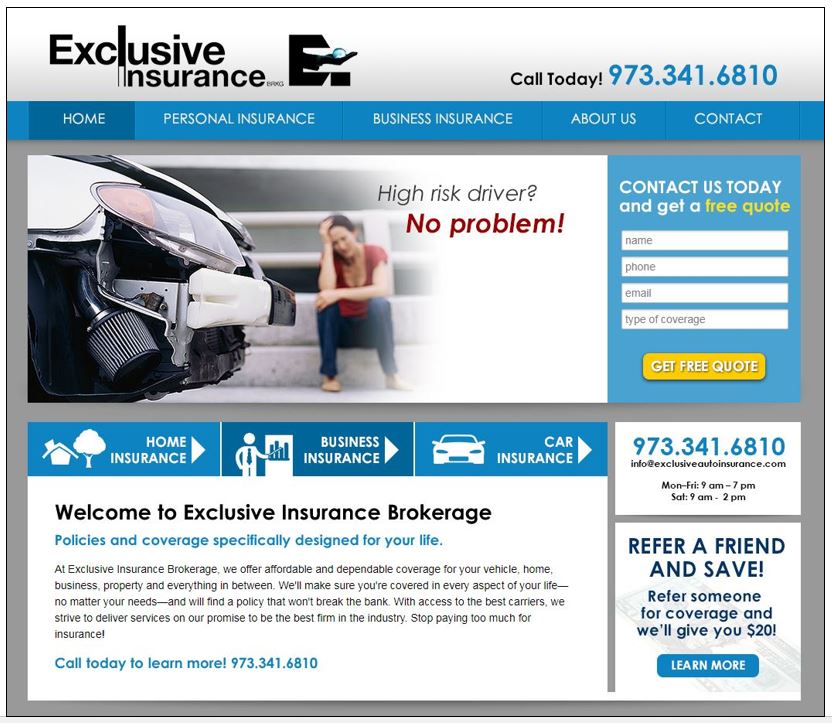

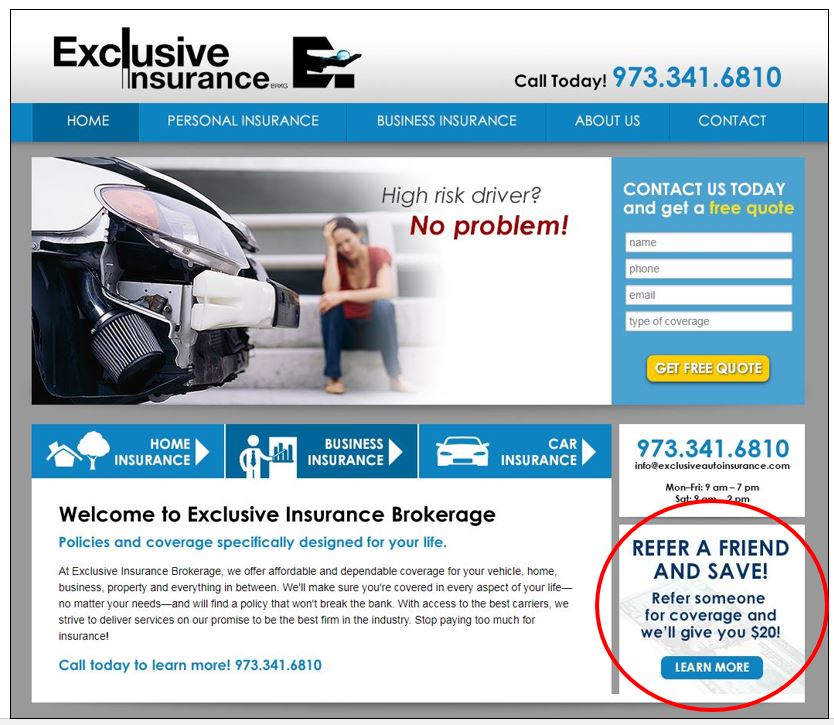

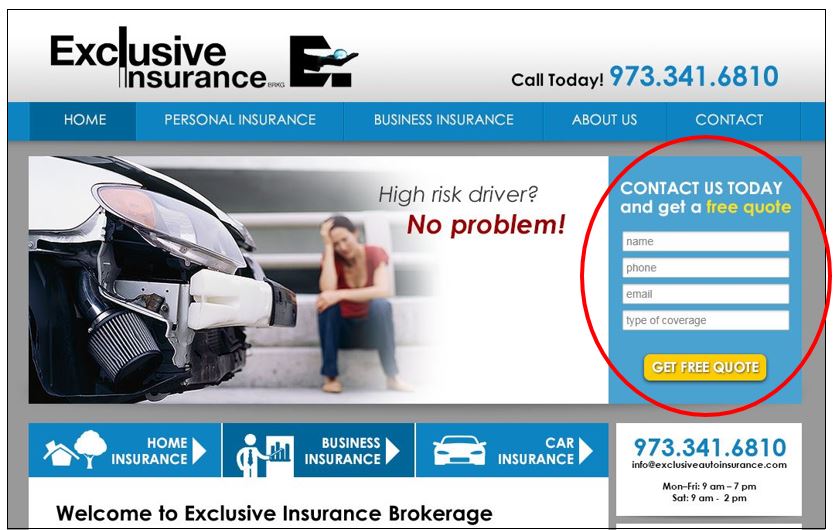

Take a look at this insurance marketing website:

Thanks to the professional logo, car accident image, and “insurance” copy everywhere, there’s ZERO doubt that you’ve arrived an at insurance agency’s website —

Which is exactly what you want!

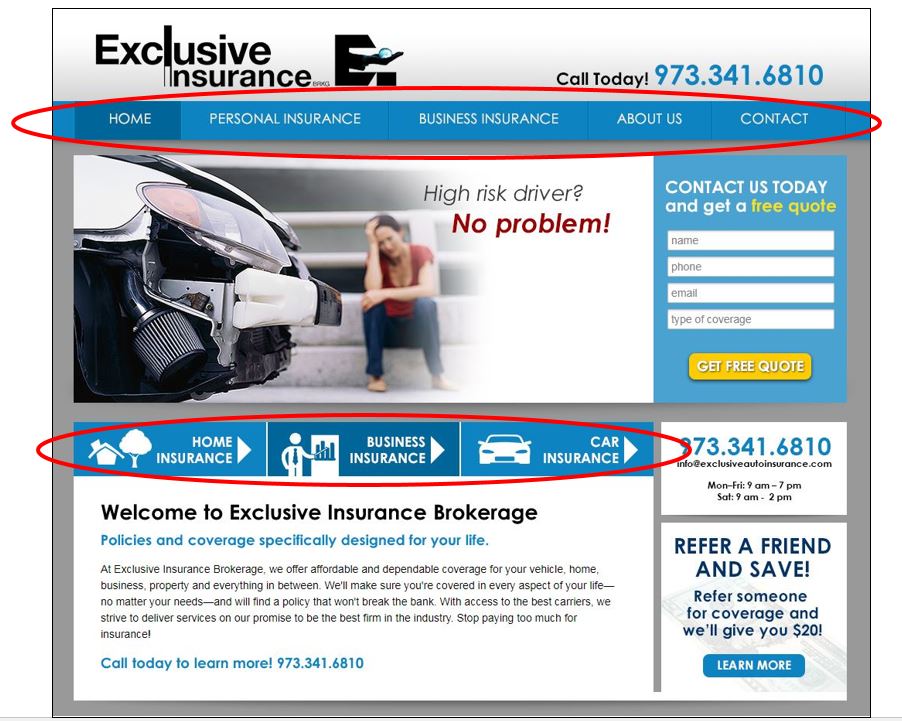

See the clean layout and simple menus which tell prospects exactly what you offer in nutshell:

Love that!

And, you can’t ignore that call-out for referrals…

Perfect!

Make sure you (or your website designer) adds a referral marketing section to your website too.

And while they’re at it —

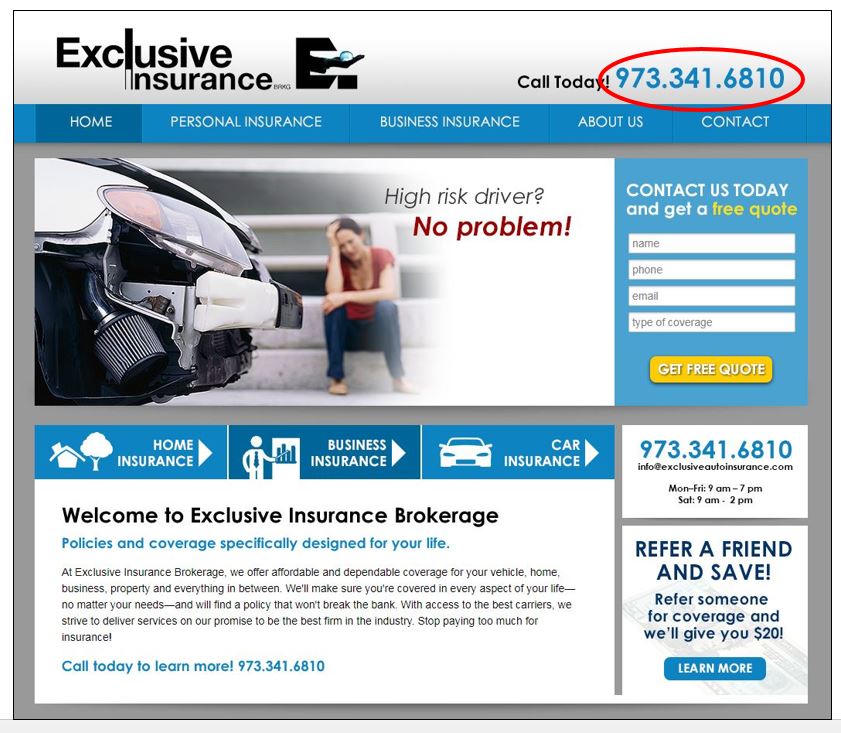

Put your phone number in the upper right hand corner of your website on EVERY page, like this:

When your phone number is on EVERY page of your website, in the same spot, your prospects get trained to know exactly where your # is so it’s easier to call you.

Plus:

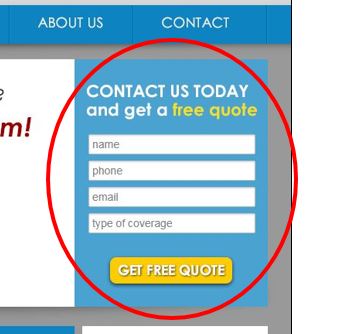

See that enticing lead capture form?

Easy to see, and I’ll go into that lead-generating strategy more in #7 (up next).

If you want your website done with an expert hand, our insurance marketing website design services start at an extremely affordable $495.

7. Avoid losing 96% of hard-earned leads with fill-in forms on your website

You’ve gone to the trouble and expense to generate an insurance lead with your postcards or insurance flyers (or commercial or whatever). Again, the MAJORITY (about 95%) of those people are headed straight for your website.

But 96% of those visitors are not yet ready to become a customer, according to Kissmetrics.

So what then?

They leave your website and go on with their lives…

But when they’re ready to call an insurance broker or agency, will they remember YOU?

Maybe — or maybe not.

To maximize your insurance marketing dollars, you need to capture the identity of those interested prospects so you can follow up with them, keeping your business top of mind so when they need a new or updated policy, they’ll call YOU!

How?

With that lead-capture form I mentioned above in #6.

This one:

An effective lead capture form works by offering your visitor something useful — a FREE quote, for example — in exchange for their email address.

FREE report: 128 steal-worthy special offers you can use for your insurance marketing

Once you have their email address, you can email them with special offers (like if rates drop) and updates regularly!

Tip:

The LESS information you ask for, the more likely people are to fill out your form.

Most people are pretty willing to share their email address — their phone number is a different story!

Now that you know your prospects will definitely be visiting your website, and you’re going to ensure you have a contact form on your website, here are even more marketing ideas for insurance agents:

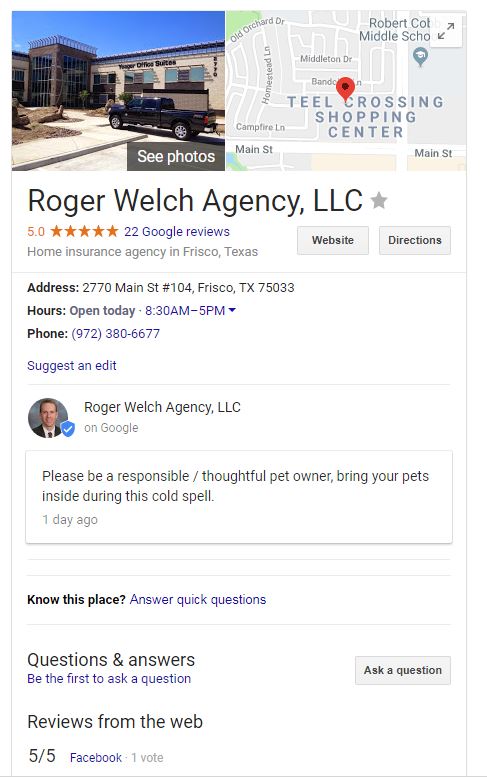

8. Nail your Google listing to generate FREE leads from Google

Register for a FREE Google Business Profile account. It’s how you’ll update your Google listing for your agency, meaning…

This:

When someone googles for insurance services like yours (or YOUR agency directly), one of the first things Google shows from its search is your Google business listing (like the one above).

Your Google listing can (and should) show pictures of your agency plus all information googlers want to see right off the bat. This information gets pulled from data you enter in your Google Business Profile account.

So you need to make sure you have this data entered correctly, specifically:

- Your business’s actual name

- Address (Google will verify it)

- Phone number

- Hours of operation

- Category of your business.

You’ll also manage and respond to any Google reviews directly from your Google Business Profile account — more on why that’s important in #9.

Again, make sure you keep ALL your contact information updated in your Google Business Profile account since inaccurate information about you will actually prevent Google from bringing up your business in searches. Meaning, your business may end up showing up LESS in Google searches —

Which is NOT what we want considering Google is the #1-used search engine in the U.S!

So if your address OR hours change (like for holidays) make sure to update it in Google Business Profile.

Another benefit to keeping your business’s information totally up-to-date is you’ll be found easier on Google Maps!

If someone uses Google Maps to search for a local insurance agency, your correct and updated information on the internet (including Google Business Profile) will enable your ranking in Google Maps to be higher than those other insurance agents who don’t take the time.

So make sure your business’s contact information is correct on these websites too:

- Yelp

- Other social media accounts

- yp.com

- Citysearch

- Agents Web

- Insurance Agency Link Directory

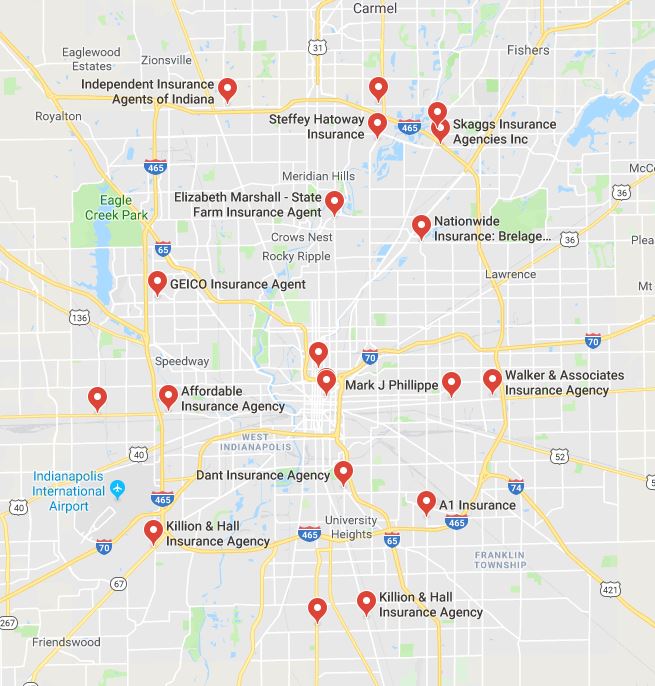

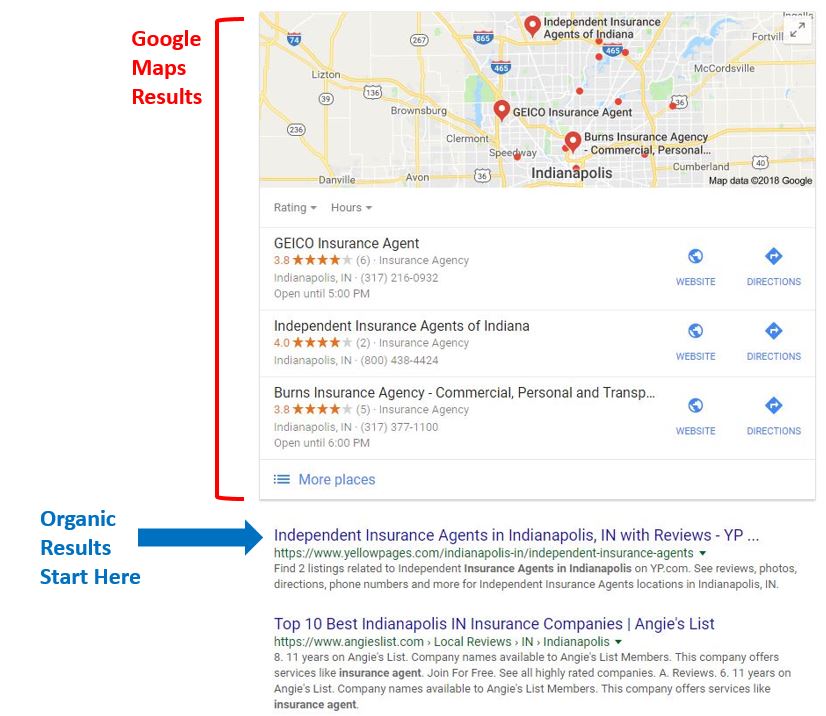

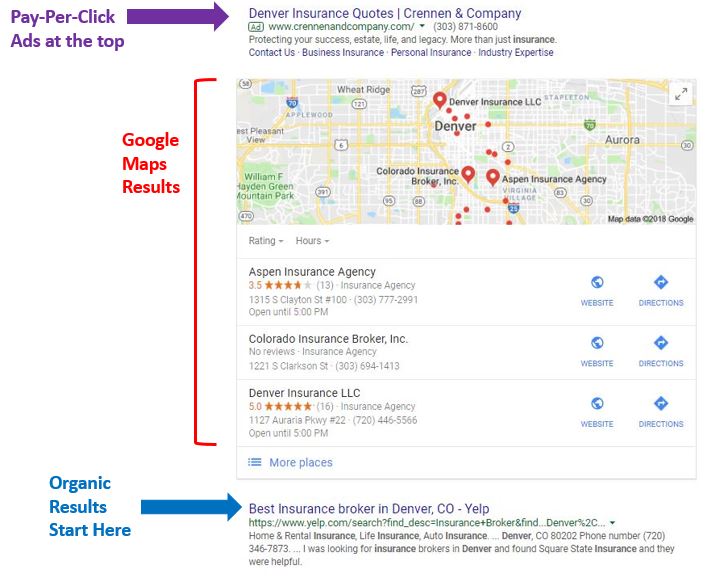

Plus, Google Maps results show up even BEFORE organic results…

Meaning, prospects see Google Maps results FIRST when they search on Google.

See:

The first organic listing for an insurance agency in the above search comes AFTER those Google Maps results.

Remember that Google LOVES consistency, so just keep your agency’s information updated across anywhere it’s listed online and work on getting lots of positive reviews too, which is up next:

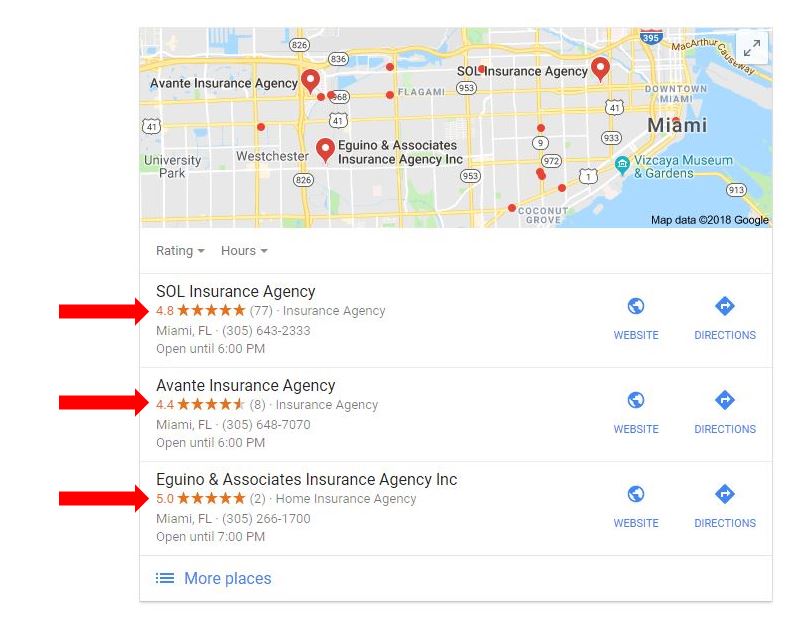

9. Use Google reviews as 90% trust and act on them

When prospects see positive reviews, they’re 90% more likely to trust and buy from you, according to research.

Plus, people are more likely to click on a business’s website when its Google reviews are positive, meaning those golden star ratings you see!

These:

It’s like Google has trained us to recognize that stars = ratings, and the more, the better!

So the game becomes:

Get LOTS of 4- and 5-star reviews of your insurance agency online!

Here are some ways to do that:

- Have your agents tell clients they’d appreciate a review

- Make sure clients know HOW to leave a Google review

- Add a link in your email signature

- Send gentle email hints that you’d appreciate a review

FYI, it’s against Google’s policy to outright solicit reviews from clients, so one way to add the Google review request in your email signature is like this:

“Have feedback about our service? Leave a review!”

FREE report: How to get more positive Google reviews to promote your business

When you’re done helping a client, tell them you’d appreciate a review online if they’ve enjoyed your service.

Also:

You also want to take the time to RESPOND to negative reviews.

When you spot a negative review online, make sure to comment on it and respond with a sincere apology and offer to remedy whatever occurred that was dissatisfactory with their experience.

The last thing you need is a disgruntled former customer bad-mouthing your business.

So handle the review well, and they could turn into a happy client!

But:

Even if the client can’t be satisfied no matter what you offer or do, your response online will at least show other consumers that you care enough to communicate and try to help.

10. Attract 75% more of your potential customers with Google pay-per-click ads

A whopping 93% of online experiences start with a search engine, but only 75% of those people will scroll past the first page of results, according to HubSpot.

With Google pay-per-click (PPC) advertising, your insurance ads appear above the organic listings when people search for your services.

Here’s what I’m talking about:

Notice the PPC insurance ads are even above the Google maps results!

Plus:

What’s extra great about PPC is that you only pay when someone clicks on your ad.

But —

What’s not so great is that it’s complicated, and you can easily waste money on unqualified clicks (when people click on your ad so you have to pay, but they’re not qualified leads who are likely to turn into new clients).

With PPC ads, you bid on keywords, like “home insurance” or “best car insurance.” Google AdWords (Google’s PPC platform) will suggest a bid for you, but you can actually bid however much you want.

Your cost per click is determined by many factors — your bid being just one — such as:

- How relevant Google thinks your website is to your targeted keyword

- “Dwell time” on your website (how long visitors stay there once they click on your ad)

- Your conversion rate (how many visitors take your desired action, such as filling out your lead capture form)

I know…

It’s complicated.

Download our FREE report: How to do Pay-Per-Click yourself (and not waste money)

When you’re first starting out with PPC, I recommend setting a budget (say, $15 a day) and playing around with your ads to see what gets the best results.

Remember:

The most clicks isn’t necessarily the best result. You PAY for each click (hence the name PAY-PER-CLICK). You want to make sure those clicks are converting into insurance leads!

Here are a couple of tips:

- Create a dedicated landing page for each ad that is a clear continuation of the message on your ad (if your ad says “Guaranteed Lowest Auto Insurance Rates Or We Pay You $50!” but your landing page says “Get a free home insurance quote,” people will click away faster than you can say “so long, lead!”

- Make sure your landing page has a lead capture form.

- Add call extensions to your ads (either your phone number or a “click to call” button for mobile ads), and the people who are ready to call can do so without you being charged for the click!

Honestly…

Managing a PPC campaign can feel like a full-time job — but as a business owner, you already have one (or 5)!

It’s probably worth it to hire a PPC professional to do it for you.

You can use PostcardMania’s PPC management services here.

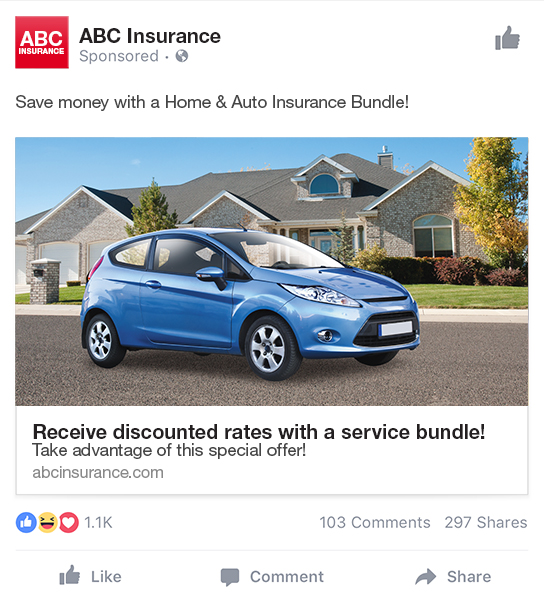

11. Reach 79% of potential insurance clients on Facebook

Facebook marketing is more popular than ever, and for good reason.

According to Pew Research:

- 79% of online Americans are on Facebook

- That’s 68% of ALL Americans

- 75% of them go on the site everyday

In other words:

It’s a huge opportunity for insurance broker advertising.

However:

Many business pages’ organic reach (that’s how many people you can reach for free) have declined sharply. For some, it’s as low as 2 PERCENT, and taking into account Facebook’s January 2018 newsfeed changes, you can pretty much say “sayonara!” to your page’s posts being seen by your prospects for free.

Which means you have to pay up for insurance ads, like this one:

I recommend running Facebook ads at the same time you’re mailing your insurance postcards.

In fact:

You can match your Facebook ad’s special offer and design with that of your direct mail campaign.

Like this:

So your prospects see ONE cohesive marketing message whether they receive your insurance broker advertising in the mail (or on a sign) OR they see your insurance ads on Facebook.

Plus, get this:

If you’re mailing your insurance postcards to all the homeowners in Baltimore, MD, you can then target those same exact people on Facebook in Baltimore, too — at the exact SAME time.

Smart, right?

This coordination of mailing insurance direct mail plus simultaneously showing matching Facebook insurance ads gives your prospects the perception that your insurance marketing is almost everywhere.

It’s called Everywhere Small Business. With it, your agency can simultaneously target prospects with:

- Direct mail

- Google ads (across thousands & thousands of internet websites)

- AND Facebook ads.

And YOU don’t have to do anything.

Essentially your insurance marketing will be shown EVERYWHERE your prospects already spend their time, generating the following:

- Calls to your business (that we track for you)

- Clicks to your website (we track these too!)

- Millions of online impressions (eyes on YOUR ads)

- Essentially MORE leadswith ZERO effort from you.

Watch the Everywhere Small Business video to see how exactly this program can increase your insurance agency marketing exponentially starting now.

And while we’re on the subject of insurance marketing running on autopilot…

12. Turn NEW movers in your area into automatic customers without lifting a finger

According to the U.S. Census Bureau, a little over 11% of the American population moves every year. Many of those people need insurance agencies and new policies!

With our New In Town program, you can reach new movers in your area every month without you even having to think about it!

Here’s how it works:

- You tell us your target demographic and service area

- We design a postcard for your business

- Every month, we automatically send all new movers that fit your targeting criteria your insurance postcards

- They call to redeem your offer, then you wow them with your service and create new clients!

And check this out:

Your insurance postcards are personalized with the name of the recipient (they can also be customized for each recipient to match their demographics), so they take notice!

Here’s an example:

By automatically mailing to all the new movers in your area, your insurance agency can receive a steady stream of new clients who need your help with their insurance needs.

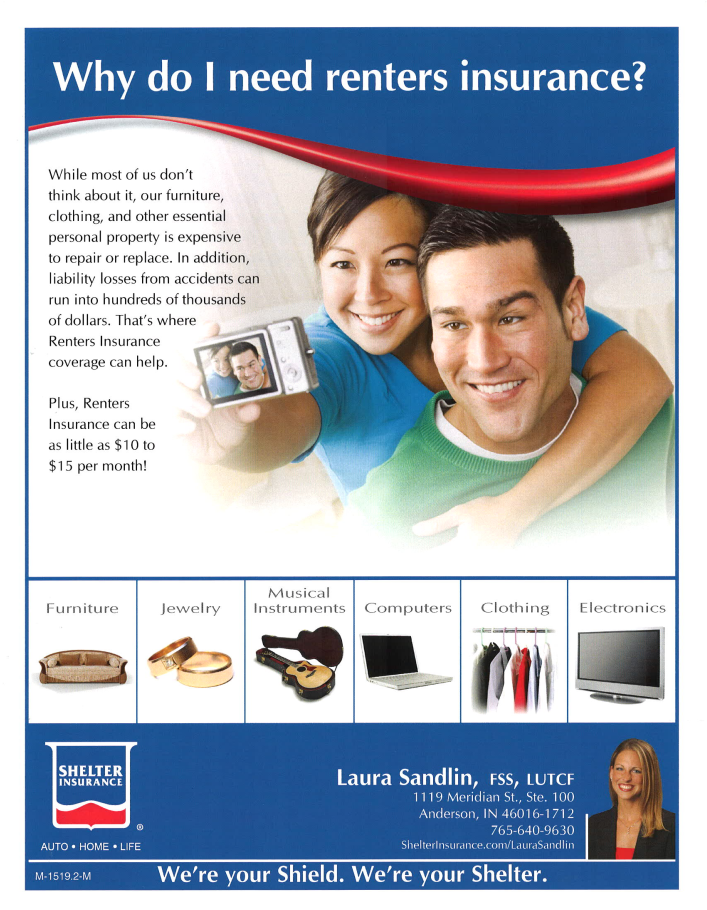

13. Attract up to 56% more clients by distributing insurance flyers & brochures

According to the Data & Marketing Association, 56% of consumers trust print marketing more than other marketing medium which is part of why insurance postcards can generate up to a 305% return on investment…

But guess what:

Insurance flyers, business cards, brochures, and safety info cards work too!

Plus:

They’re extremely affordable. If you’re a brand new business trying to figure out how to get new clients, insurance flyers (like the one below) are a good place to start.

If you’re not the creative type, you can find free templates online — Pinterest and Envato have tons of them — that you can customize for your own insurance agency marketing. (Don’t forget to include your professional logo from #1!)

To get your insurance flyers and other printed marketing out, you can:

- Pay someone to pass them out for you

- Or create and put a marketing kit in your car.

When you’re on the road insurance sales prospecting or running errands, you’ll always have stash of marketing items you can give out.

14. Make your insurance advertisement jump out at prospects

On top of the insurance marketing ideas mentioned above, you can use some untraditional but creative marketing ideas insurance agents can collect leads from…

Like these ideas:

- Wrap your car with a branded car wrap

- Brand pizza boxes with your logo & insurance marketing message

- Park a wrecked car in your parking lot with your auto policy offer

- Reward some kids to draw chalk art on your sidewalk

- Bring donuts (and brochures) to apartment complexes to woo the staff

- Broadcast your insurance advertisement on a gigantic billboard

- Hire a sign spinner to grab the attention of people who pass by

- Put up an inflatable “air dancer” to draw eyes to your storefront

Remember:

Even just buying a bunch of nice t-shirts (as low as $2.95 a piece!) branded with your insurance marketing and logo (from #1!) works to spread your name and create recognition…

Plus —

You and your staff can wear them at these…

15. Use local events as insurance sales prospecting

Get out of your agency’s office and interact with your local community members with fun events (and kids’ activities) that you can use to spread your name and even create insurance leads.

Here are some event and activity ideas:

- Hold a kids safety event (such as for car seat safety)

- Host a fun fingerprinting activity for kids at your agency

- Give away free lemonade in the summer (post it on social media!)

- Or — give away hot chocolate during the holidays

- Get a booth at local fairs, festivals, and events

Drive children (and their parents who need policies) into your booth by hiring a caricature artist to draw cartoon pictures of kids…

Or, you can hire someone handy with a paintbrush to paint up kids’ faces with cute designs.

Just remember to have LOTS of insurance flyers, pens, business cards, and other promotional giveaways to hand out when families find themselves hanging out in your agency’s booth!

Another idea:

Host a window etching event.

Window etching is a process in which ALL the glass on a vehicle gets permanently inscribed with the car’s VIN number. It’s a method of discouraging auto theft because a vehicle with its VIN number etched onto all its glass becomes MUCH harder for thieves to sell (for parts) or even dispose of.

Image: Etchworld.com

You can team up with the local police department or an organization against insurance fraud to bring even more people to your agency’s event.

Try this:

Offer a discount for the window etching in exchange for a FREE quote on insurance policies. This way, you create leads, and event attendees can get their windows etched and see if they can get better rates (save $) with you!

It’s a win-win for everyone…

Just like this next one:

16. Host a corporate luncheon event for FAST targeted insurance sales prospecting

Reach out to local businesses and offer to bring in lunch for their staff in exchange for you presenting on different insurance offerings they may need.

Prepare insurance flyers ahead of time to give out.

Key point though:

Make sure you don’t say any confusing terms during your presentation that you don’t clearly define first…

That way you keep your audience’s attention during the presentation, and they’re more likely to engage with you asking questions (and possibly getting quotes!)

Which brings me to:

Offer a corporate special offer for that business. You can give free quotes on the spot while you’re at their office to create leads and relationships for later follow-up.

And then down the road, maybe in a month or 2, you can do another similar presentation…

Like this:

Give safety classes for parents on how to safety-proof homes and cars with little-known but super useful tips.

By giving information — and traveling to offices where people work — you’ll become the insurance authority that people remember for being helpful!

If you give away your insurance marketing materials AND promote that you accept (and reward!) referrals, you’ll be an insurance sales prospecting expert in no time!

Especially when you do this next one:

17. Reach out to other similar businesses and form partnerships

Similar to #15 and #16 above, you want to spread your agency’s name outside your brick-and-mortar walls and become known by other organizations who could send you…

Referrals!

Here are some easy partnerships you should make:

- Local police department

- Fire department

- Home inspection companies

- Realtors

- Apartment and condo complexes

- Real estate investors

- Mortgage companies

- Banks

- Auto dealers

- Auto mechanics

- Local boat sales businesses

- Insurance fraud organizations

- Local consumer protection organizations

- Non-profits and churches

- Hospitals

- Health clinics

- The DMV (if possible)

- Business licensing businesses

- County Clerk’s Office

For all of the listed organizations above, you can offer a special offer or discount to their staff or clientele in exchange for providing a FREE insurance quote.

Plus —

Ask if you can submit a useful piece of information (or article) to their website, newsletter, or church bulletin, such as giving insight into the common claims filed in your area with tips on how to avoid common accidents and injuries.

Here’s the main idea:

Be SO helpful that you get your insurance agency featured in other business’s marketing, and then you’ll become “that” agency who’s all over the place, giving free tips and free quotes left and right!

18. Create goodwill (and leads) with neighborhood involvement

Here are some ideas:

- Sponsor a local sports team

- Sponsor neighborhood or highway clean-up

- Volunteer at a local church or non-profit’s food drive

- Help clean up after a strong and windy storm

- Sponsor a community garden (if available)

- Create any of the events I mentioned above in #15!

Of course…

Make sure you’re wearing your agency’s branded t-shirts for ALL of these activities —

It’s E-A-S-Y marketing for insurance companies!

19. Always keep communication open with your clients

Failing to stay in touch with existing clients is an extraordinarily costly mistake.

The biggest asset your company has, along with its employees, is its existing customer base — people who’ve already given you their ultimate vote of confidence:

Their money!

Plus:

Existing clients are not only a source for current business, but also for referrals.

So it’s VERY important you keep in touch with clients because they could generate MORE business for you!

One way to keep in touch with existing clients is by sending them a monthly email newsletter.

You can feature almost anything in your newsletter, but here are some ideas:

- Current specials or rate reductions

- Promotions

- New team additions

- New changes to your business

- New services you’re adding

- And how you help the community.

FREE report: 8 easy ways to turn your email newsletter into a MUST read

Plus:

Motivate your employees to be friendly to clients when they see them. I know this seems like a no-brainer, but a simple smile and “hello” to clients sitting in your waiting area goes a LONG way in positioning your insurance agency as one who cares and loves helping others.

Remember:

People love to buy from (and refer to) whom they LIKE and admire.

You can also mail personal, handwritten insurance marketing letters to clients. If your assistant or receptionist has extra time, personal letters to clients sends a message like:

“We TRULY value you as a client. THANK YOU!”

Not a bad communication to receive in the mail, right?

Or, we can mail insurance postcards that are personalized with clients’ first names for you — to save time.

Here’s an example:

20. Use your blog to generate 4.5X more leads

Think a blog is optional for your insurance agency marketing plan?

Get this:

Publishing helpful articles on your blog can actually generate up to 4.5 times MORE leads than businesses who don’t utilize this free marketing resource, according to Hubspot.

Need ideas to make your blog useful as insurance agency marketing?

Listen to your current clients.

And answer these questions:

- What do they need help with?

- What questions do they typically have?

- What helpful content can you write about that will prove you’re the best agency?

Plus:

When you arm your insurance agency marketing plan with helpful content that you feature on your website’s blog, you’ll have a better chance of ranking on Google.

How?

By using keywords.

Make a list of keywords that your prospects may use when googling for an insurance agency (just like yours), and include those keywords in both your blog and website pages.

When a prospect googles for an agent or broker like you, Google will more likely suggest your website if keywords used on your website mirror what your prospect entered into Google.

It’s like FREE SEO (search engine optimization) for your insurance marketing…

Speaking of which…

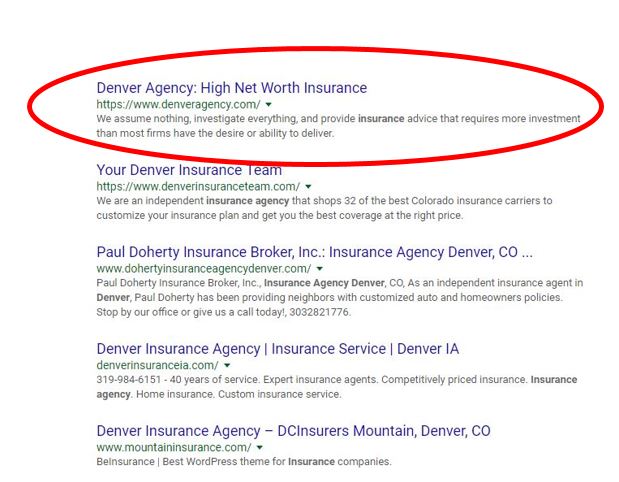

21. Improve your Google ranking with search engine optimization (SEO)

Search engines work by finding websites which match the keywords your prospects search with.

So if your prospects enter “[Your City] insurance agency” (aka “Denver insurance agency”), your website will rank higher in Google to the degree that your website pages have the keywords “Denver insurance agency” in them (as well as other factors that are more complicated that we won’t get into detail on here).

Above are the TOP results for “Denver insurance agency” when I googled for it. The insurance agencies you see above have websites that are built to be found by Google —

That’s SEO in action!

To get your website found on Google, your website’s data must be accurate and filled with keywords your prospects use to find business just like yours.

Again, make a list of these keywords using Google’s free keyword planner tool, and have your website designer (even if that’s you!) use them on the pages of your website —

Your homepage, your About Us page, etc.

But it’s NOT only keywords you need.

Here are some tips to increase your website’s SEO:

- Each page’s title (learn about page titles here) should be different

- Homepage’s page title should have “agency” plus your city & state

- Your contact data (on your contact page) must be correct

- Your business’s data must be referenced (cited) on other popular web pages

- You should have and use a free Google Business Profile

SEO is not a one-shot deal — much like insurance agency marketing in general. The helpfulness of your blog (#20) plus the quality of your online content and website design will increasingly play a more important role in how fast you get found on Google.

Beware of any company that claims to guarantee to get your website to #1 on Google in a short amount of time.

SEO is a continual process since Google and its algorithms (formulas) change all the time. That’s why getting reviews (#9) and making sure your website is set up to capture leads (#7) is 100% worth your time (and it’s less complicated too.)

22. Close up to 80% more sales by automatically following up with leads

Here’s the deal:

The majority of marketing for insurance agents will not close 100% of the leads on the first attempt. And neither will your BEST sales person.

Makes sense, right?

Take this:

Let’s say you receive an email from someone directly from the contact form on your website.

This person’s reached out to you with some level of interest —

That’s a lead!

They’ve asked you how much your pricing is for bundling their auto insurance with their home owner’s policy. You answer them with a free quote.

Then…

Crickets.

You email them, maybe call them (if they provided a phone number)…

And still no word back.

So, no client yet.

Now what?

NOW you follow up with them!

But instead of emailing and calling them every day, you can use email marketing to automatically follow up with this lead for you to save time.

In a free email marketing software, such as MailChimp for example, you can set up a simple campaign to automatically email leads so that you’re continually reaching out to them.

Also called an “email drip campaign,” it works in marketing by sending out emails on a predetermined schedule to prospects in a list that you create.

FREE report: Easily automate your email marketing to close up to 80% MORE sales

Instead of you remembering to manually email prospects on a set schedule, have your email marketing system do it for you.

Plus, you can use this same email marketing tool to send out monthly newsletters to your customers, making them feel like you care to keep them updated on things like:

- Special promotions you’re running

- New services you’re now offering

- Help you’ve provided the local community

- Pictures of your team

The idea is that the more prospects are followed up with consistently, the more likely they’ll remember YOUR agency (vs. your competition)…

And when someone remembers you, they’re MUCH more likely to BUY from you when the time comes.

If you want a done-for-you email marketing solution, you can use PostcardMania’s email marketing services.

23. Track your results like an insurance marketing expert

Only TRACKING will show you which insurance advertisements and marketing factually create insurance leads (and sales) for your business.

So — HOW do you track?

A new caller sheet is one way! Give one to your receptionist so they help you track where exactly leads come from when they call in.

Another way:

Google Analytics — a free tool from Google that tracks the following:

- Who visits your website

- Where they’re from

- What pages they visit

- How long they stay there

- And WAY more!

FREE report: Easily set up Google Analytics on your website for website tracking

Let’s say you mail out 10,000 postcards with an insurance direct mail campaign, and you check your Google Analytics account and notice 1,000 people visited your website with 200 people landing and spending 1-3 minutes on your “About Us” page.

But… maybe only 25 people made it to your contact page to actually contact you and become real leads for your business.

Here’s an idea:

Why not put a pop-up or lead capture form on that “About Us” page to capture more of the leads who read all about you and turn them into tangible leads you can actually call!

Genius!

However — the most important metric to track?

Return on investment (ROI)!

The ultimate measurement of your insurance agency advertising or insurance direct mail is how much sales they generate for your business.

Your response could even seem mediocre…

But your ROI could be HIGH.

Here’s what I mean, by example:

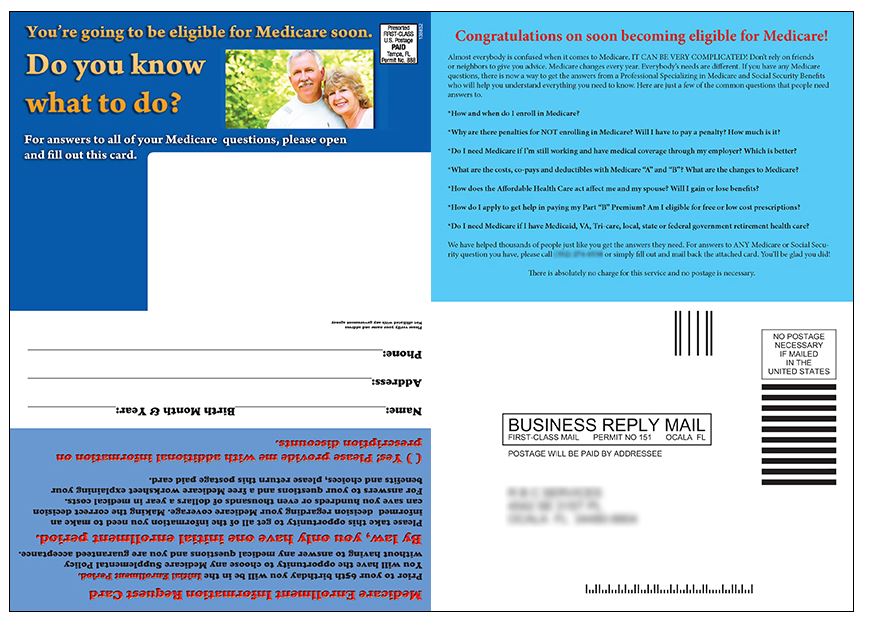

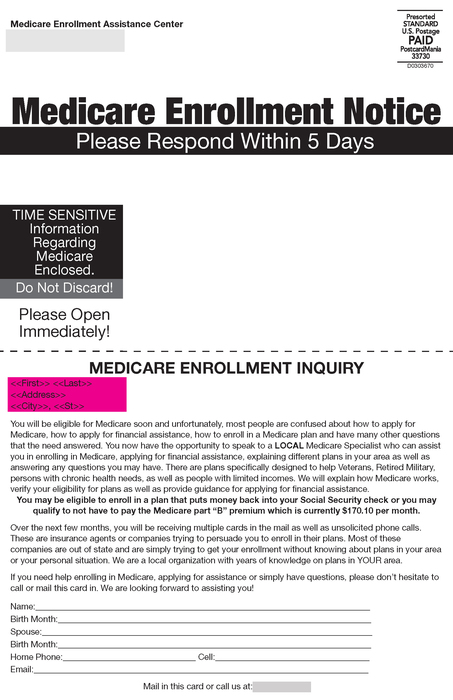

A Florida insurance agency wanted to help local prospects get their questions answered easily about Medicare, so they mailed out postage-paid business reply cards.

Take a look:

This agency provided their own insurance mailing list of 6,000 people who were about to turn 65 and thus, become eligible for Medicare benefits.

Here’s what happened from their insurance direct mail campaign:

- 20 people responded

- About 50% of the leads closed

- And $10,000 in revenue was generated!

That’s a 305% return on investment!

Not bad, right?

Plus —

You can buy insurance mailing lists to target virtually EVERY demographic available…

And when you mail consistently to them, they’re more likely to remember your insurance agency above your competitors because they see your logo, brand, and special offer repeatedly.

24. Sell more insurance policies every month without lifting a finger!

Nobody likes paying a lot for insurance.

Imagine someone learning just as it’s time for them to renew their policy, that they could save money if they switched to YOUR company.

(Even better, imagine this happening with ZERO effort on your part!)

Enter our Automatic “Transfer Your Policy” Insurance Expiration Mailers!

Here’s how it works:

- You tell us your service area

- We design a postcard for your business

- Each month, we automatically pull a list of people whose insurance policies are about to expire and mail them a personalized postcard

The Automatic “Transfer Your Policy” Insurance Expiration Mailers work by reaching out to your prospects at EXACTLY the right time with EXACTLY the right message. How genius is that?

The best part: Once you set it up, you never have to think about it again!

Want to see more real successful insurance marketing campaign examples:

Here are some WITH their results:

1.

RESPONSE: He wrote about 100 new policies which will mean over $60k in income over the next year (plus future renewals!)

MAILING LIST: Provided 8k – prospects within 10 miles of his locations

MAILING SCHEDULE: 6K 4X (1.5 weeks between mailings, hit list 3x total)

2.

RESPONSE: 6-8 new clients from each mailing of 2500 cards.

MAILING LIST: Purchased 2500 records: single family homeowners, radius around location

MAILING SCHEDULE: 3 weeks between mailings

3.

RESPONSE: “We’ve had over 200 reaches from that 1 mailing of 2500 cards!” MAILING LIST: Provided – active customer database

MAILING SCHEDULE: Mailed 2500, 1x

4.

RESPONSE: Signed on four new accounts and made approximately $8,000 on this $2,000 investment!

MAILING LIST: Provided (2,000 business records)

MAILING SCHEDULE: Shipped cards to customer.

5.

RESPONSE: “With the mailing we did earlier this year (only 6000 cards total) we got a fantastic response! We wrote at least 200 policies from it, and got many referrals as well!”

MAILING LIST: Purchased 2000 records: Homeowners, Year Built 2002-2008, surrounding zips

MAILING SCHEDULE: Mailed 2k cards 3x over 3 months to the same list.

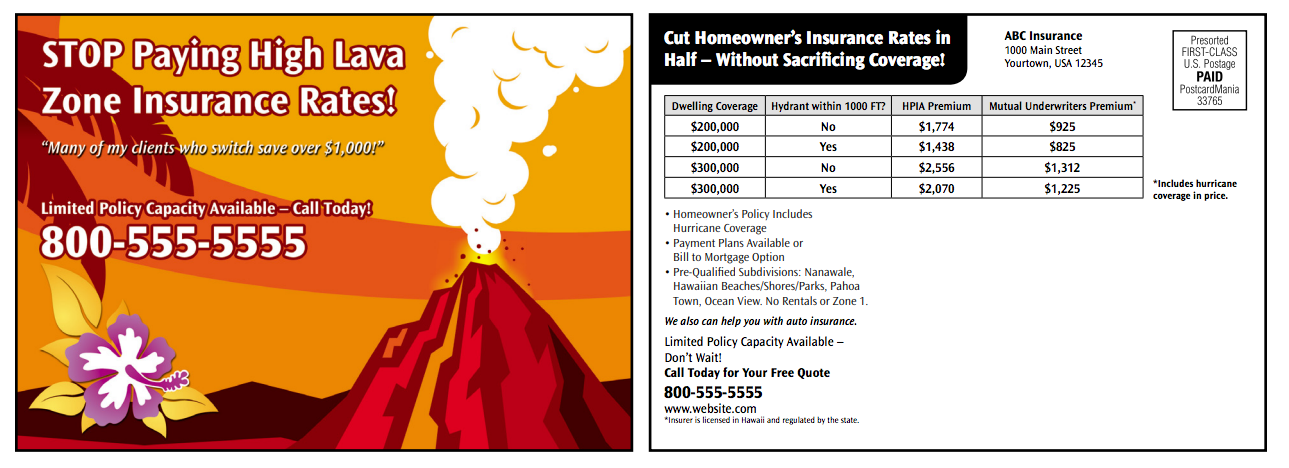

6.

RESPONSE: Wrote 100 policies!

MAILING LIST: Purchased 1800 records – home in a specific Hawaii zip codes in a “lava zone”

MAILING SCHEDULE: Mailed every 3-4 months

Remember:

Your insurance marketing campaign is only as good as WHO receives it.

Your mailing list is the main dish of your lead generation so DON’T skimp on it.

We guarantee at least 90% deliverability of your insurance direct mail, and so should ANY good mailing list provider, FYI.

Get 1,000 FREE records to start your campaign

So there you have it! 24 insurance marketing ideas to grow your agency starting now!

I hope you’re feeling inspired! For even more insurance marketing ideas, check out these insurance postcards that work! And if you have questions about anything mentioned here, such as marketing with Everywhere Small Business, leave a comment or you can email me at Joy.Gendusa@PostcardMania.com.

Want to start an insurance direct mail campaign? Call one of my experts at 800-628-1804 — the consultation is 100% FREE!

Best,

Joy

8 Comments

Thank you! Glad you enjoyed it!

very well

Thanks, Sunil!

6,000 people were mailed out the Medicare ad above and it only generated 20 leads? If yes, that is a very poor response rate. Usually Medicare ads pull 2-3%. Having said that…You do have some very useful information. Thanks

.Hi Edward! Sometimes the number of responses can look pretty mediocre – that’s why it’s so important to measure the success of the campaign by its return on investment (ROI). In this case, $10,000 in revenue was generated from those 20 responses (a 305% ROI)! That’s a success in my book. I’m glad you found the article useful. Thanks so much for your comment!

I think you have seeded some good informations which will be useful for those who work in insurance companies

I’m so glad you found it useful! Thanks for your comment!

Very Good Post!!!