13 Simple Marketing Steps to More Tax Preparation and Accounting Clients in 2025

Updated on November 6, 2024Certified public accountants (CPAs), tax preparers, and financial experts alike who own their own small businesses have A LOT on their plates. On top of everything that comes with running a business, namely:

- Paying bills

- Hiring qualified employees

- Keeping up with new tax laws (especially this year!!)…

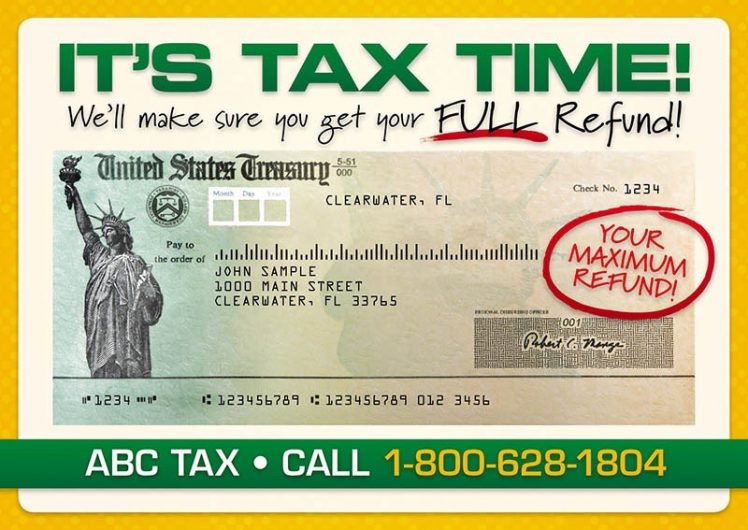

You need to MARKET your tax services so that you receive new clients. And you want you to advertise your tax business when prospects are needing you, you know: During tax season! Tax preparation marketing does NOT have be complicated… It can be as easy as sending income tax postcards — You know, this stuff…

However —

How can you run tax season marketing that gets YOUR tax business seen — and called! — over big-box brands like H&R Block and Jackson Hewitt??

Well, guess what:

The best way to generate clients during tax season doesn’t have to implode your marketing budget!

I’m going to lay out an easy-to-follow tax preparer marketing plan to help you make 2025 your most prosperous year in business yet!

Here we go:

1.) Send a Tax Postcard to the People Who are 12 Times More Likely to Use Your Services.

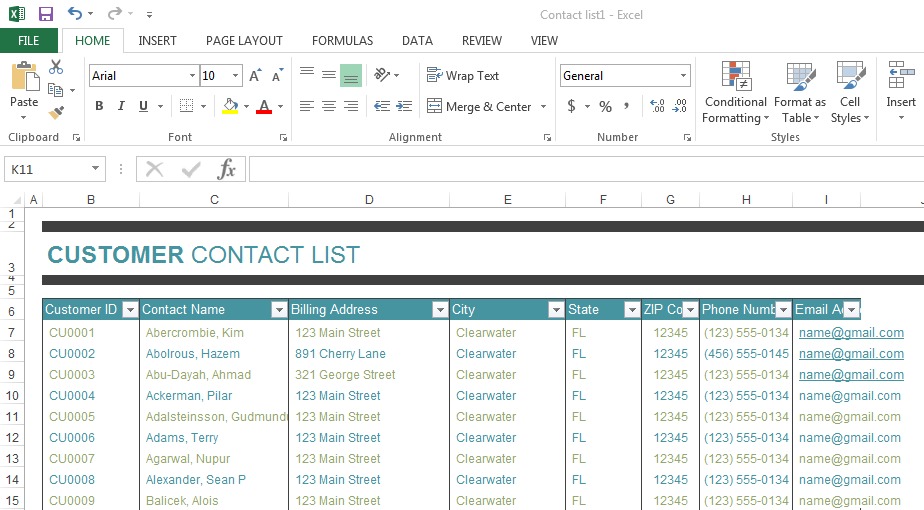

For tax preparation marketing, your current tax clients are your BEST target. They’ve already given you the ultimate vote of confidence — Their money! I know you probably have an entire rolodex of tax clients who come back to you year after year, which is ideal. But a little refresher couldn’t hurt! (If you’re 110% sure you have this wrapped up and only want to focus on generating new clients with your tax preparation marketing, skip down to #2.) Here’s the statistic you need to know: An existing customer is 12 times more likely to ask you to prepare their taxes again over a brand new prospect, according to Marketing Metrics. If you don’t advertise your tax business to your past customers, you’re flat-out leaving money on the table!!! Here’s what I recommend you do: First, you should have a database of your tax and accounting clients with their contact information ready to go. If not or if you’re just starting out, it’s vital that you start building your customer list. You don’t necessarily need fancy software if you’re still in the building phase, you can use an Excel spreadsheet like this:

Once you have a list of all your past (and current) clients, you need to advertise your tax business to them in a new unit of time! Sure — since they’ve used you before, they may just show up again on your doorstep… But what if your competitors have done their own advertisement for tax preparation?? You can’t assume past clients will just come back!!! You need to TELL them to! Here’s one way to do that: Sending personalized postcards is a unique way to grab prospects’ attention by calling them by name with your tax season postcards… In fact — Check out these 2 relevant stats on personalizing marketing:

- 79% of consumers say they’ll engage with an offer IF it’s been personalized to reflect previous interactions with the business

- 78% of consumers said personally relevant content increases the likelihood that they’ll buy

Using a digital printing process called “Variable Data Printing,” personalized postcards automatically customize the elements of the tax practice postcard design based on the details of the recipient (from your mailing list) —

- Their name

- Gender

- Industry (for businesses)

- Or really, ANYTHING!

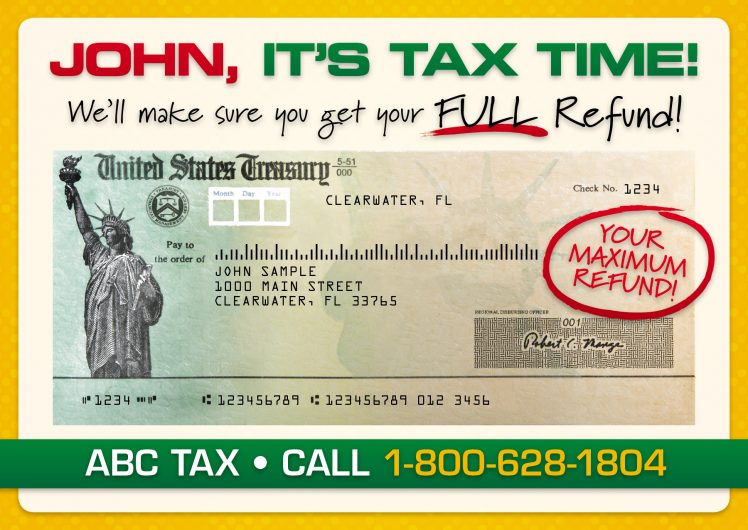

Here’s an example so you can see:

See how the first name jumps off the postcard design? Love that! Plus, personalizing your income tax postcards costs mere pennies extra per piece. Something else to consider: You can add a magnet to the back of your tax postcards to encourage customers to pop it right on their fridge — Keeping your advertisement for tax services front and center in the best room in the house!

Whatever you do — DON’T treat your customers like prospects. Not overtly recognizing that someone has already spent time and $$ with you comes across as an insult. Customers like to be feel valued, after all! So, here’s an idea — Send income tax business postcards that say something like: “$50 OFF Your 2018 Tax Preparation — Valued Clients Only! Call [your #] to book your appointment today!” Now check out the next one…

2.) Send Email to Keep Your Practice Top of Mind for Up to a 3,700% Return on Investment on Your Tax Preparation Marketing.

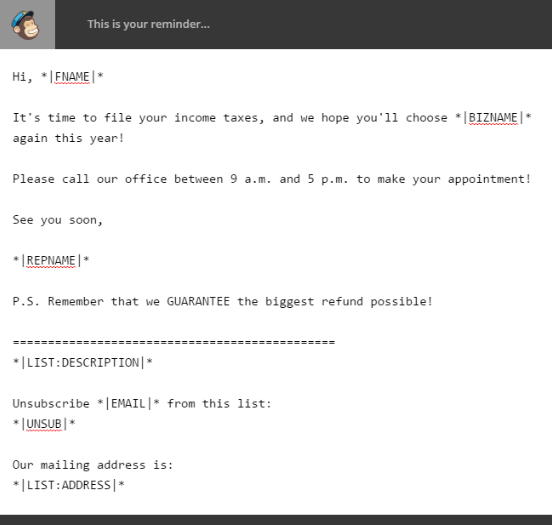

Email marketing softwares like MailChimp or ConstantContact can pull email addresses directly from your database and fill in your customers’ names automatically. Or, if you don’t have a database of customers, you can manually enter their emails or upload an excel spreadsheet.

When you compose your tax preparation marketing message, you can use a placeholder for your recipient’s name or other variable information, and the software automatically populates it with the correct data for each customer.

So instead of sending out hundreds of emails manually and sucking up your time, you just create one.

Like this:

Make sure your email is coming from a name prospects will recognize though. The “from” field of your email should use your first and last name if that’s how your clients know you. If your clients know you by a different business name, use that. After all:

- 68% of Americans say they base their decision to open an email on the ‘From’ name!

- 70% of people say they always open emails from their favorite companies.

Remember — Your clients are busy, so keep any writing in your tax season marketing short and to the point! CPA solutions pro Rita Keller recommends sending out a brief newsletter regularly with tax and accounting articles. We heartily agree! This will establish your practice as a trusted accounting and tax thought leader with clients and prospects. Tip: Send out 3 emails over the course of several weeks to ensure you captivate their attention (but without clogging their inbox with “too much” tax season marketing)!

3.) Talk to Your Past Clients Where 79% of Them Go Every Day

I’m talking about Facebook! And love it or hate it, Facebook is definitely here to stay… Just check out these stats:

- 79% of the U.S. population uses Facebook

- 68% of American adults alone are on Facebook

- Users spend an average of 50 minutes per day on Facebook

- 70% of users login every single day

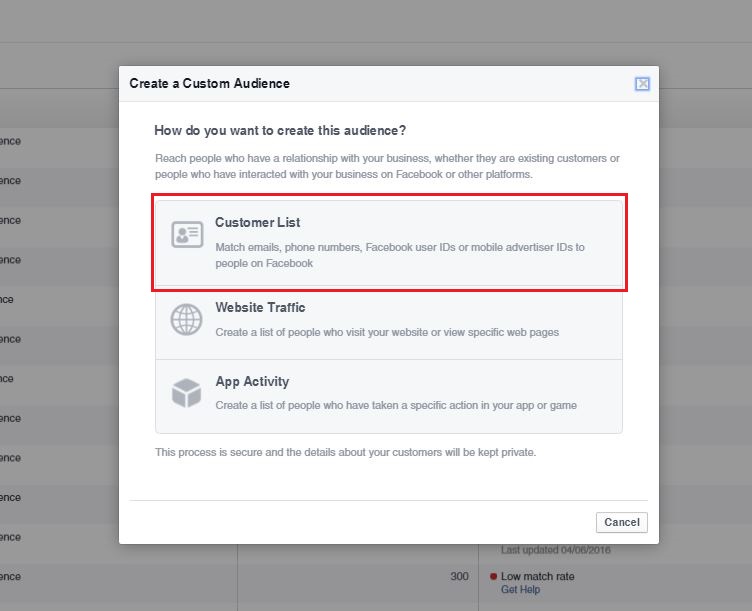

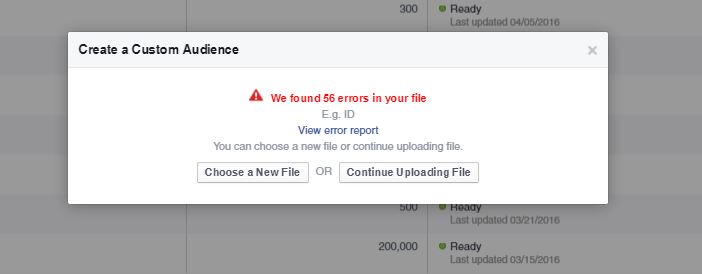

If you don’t have a Facebook business page yet, click here for an easy-to-follow tutorial. If you do have a Facebook page, you can upload your database of your customers’ email addresses and Facebook will match them to their profiles and allow you to target ads specifically to them. Here’s how: First, save your list in CSV format. Then go to Facebook to create a custom audience. Start by clicking on Customer List, then follow the directions to upload your CSV file.

Facebook will ALWAYS find some errors in your file (these are usually people they can’t find). Just continue.

Once you’ve uploaded your list, now you can create your tax preparation ad on Facebook and show your ads to that custom audience (YOUR list). (More details on Facebook marketing in a bit!)

Remember:

It costs 6-7 times more to acquire a new customer than to retain an existing one, according to global management consulting firm Bain & Company. So hit those past clients on every possible channel you can!

4.) Analyze Your Top Client Demographics To Avoid Wasting Money On Your Tax Season Marketing.

Who is your target market? Easy: It’s the people who are most likely (and qualified) to use your services! But how do you find them? Go through last year‘s returns! As you’re looking through your files, note the commonalities amongst your most profitable clients… Some things to pay attention to:

- Are your customers mostly personal or business filers?

- Married joint filers or singles?

- How old are they?

- What is their income bracket?

- What deductions do they have in common?

- Are they homeowners?

- Where do they live?

- Do they own businesses or rental properties?

Were your most profitable clients mostly young, active, married homeowners with multiple children and a household income of $100k or more? Then THAT’S who you target with your tax preparation ads!

But the question remains: How do you find more people like that to target with your marketing? Here’s one way:

5.) Get an Exact Count of Your Best Client Matches With This 60-Second Online Count.

Don’t waste money on any advertisement for tax preparation by marketing to people who aren’t qualified to use your services… You need to make sure you get the best possible return on investment (ROI) when you advertise your tax business. Here’s how to do that: Purchase a mailing list that’s chock-full of your ideal prospects. You can narrow down your list by any number of factors (based on the who your ideal prospects really are!):

- Income

- Investable private assets

- Homeowner

- Home value

- Zip code

- Marital status

- Gender

- Children present

- Even interests and what they’ve recently purchased!

We allow our prospects to run a list count for FREE on our website so they can see how many people in their area fit your their demographic.

Our online list-count tool is EASY — plus, you can receive 1,000 records for FREE when you do it! Even if you don’t end up buying your mailing list from us though, this free list count will provide you an accurate count of how many matches there are for when you mail tax practice postcards. However, this is important: If you decide to purchase your mailing list elsewhere, ask your list company the following questions:

- How often is your data updated? (If it’s less than monthly, move on!)

- What amount of deliverability do you guarantee? (The answer should be 90% deliverability or more.)

- Will they refund you for postage and production costs for anything beyond the deliverable guarantee?

You’ll ALWAYS get some undeliverables (pieces that couldn’t be delivered), that’s normal — people move all the time! But if you use a reputable list company, you should get no more than 10% (at the VERY MOST) of your pieces returned. (PostcardMania’s lists generally have closer to a 5% undeliverable rate.)

6.) Receive High-Quality Leads with this Tax Season Marketing Tactic 81% of People Will See.

I’m talking about income tax postcards! Because guess what: Even in our digital age, the majority of people (81%!) still pay attention to their mail! However, it’s not enough to mail out one tax practice postcard and call it a day. NOPE… because honestly, how many times have YOU purchased a service after hearing about it ONE time? You need a consistent, repetitive, multi-faceted tax preparation marketing campaign. Direct Mail gets 50X the response rate when you’re targeting prospects (#5!), according to the Direct Marketing Association (and 10X the response rate of pay per click advertising)!

And check this out: 39% of consumers try a business for the first time because of direct mail advertising. After helping more than 82,401 small businesses (4,002 tax prep and accounting clients — and counting!), PostcardMania can create a revenue-generating tax prep postcard based on proven results. My team of marketing experts recommend including these 10 essential postcard elements in your tax preparer ad design:

- A clear, bold headline: Don’t sacrifice clarity for cleverness. Tell your recipient right away what service you’re advertising. A good guideline is for the headline to take up at least 15% of the postcard front.

- A graphic that supports the message: The main image should be easy to understand and should help convey the message (it should be of money or something related to money — like a piggy bank).

- Color that pops: Make the headline and other important text stand out in a color that contrasts well with the rest of the postcard elements. Ask yourself what you see first when you look at the card — it should be the headline!

- Sub headlines that lead into text: This gives recipients a “point of entry” on the back of your card — it tells them where to start reading! If you just slap a ton of text on the back of the card, no one will bother to read it.

- Benefits, not features: This is the one our clients struggle with the most. Don’t just tell prospects how great you are, tell them what YOU can do for THEM. For most of them that’s going to mean either saving them money or getting them more money back.

- A valuable offer: Your prospects have hundreds of options when it comes to where they’re going to file their taxes. Give them a good reason to come to YOU. Be sure to include an expiration date to encourage them to act sooner rather than later!

- Your business name and logo: This is important, but it can be small. Don’t let it overshadow your message.

- A call to action: Many business owners assume people know what to do once they see your marketing piece: THEY DON’T! Tell them exactly what step to take next with a clear call to action (CTA), i.e, “Call today for an appointment!”

- Your contact information: Make it easy for your prospects to reach you. We suggest our clients include this data on the front AND back of the card.

- Your return address: You need this not only to get back those undeliverable postcards, but it adds legitimacy to your business. People like to know they’re dealing with a real business with an actual location.

Click here to see examples of tax preparation postcard templates that are working for our current tax clients (and request FREE samples, too)!

7.) Maximize Your Results with 2 Campaigns: Early Filers and Late Filers.

When thinking about the best way to market tax businesses, I want you to consider this: Our results data — from previous clients’ successful campaigns — suggests splitting your tax preparation marketing into 2 campaigns yields a better ROI: One for early filers and one for late filers. You want to reach each group with the right message.

Using the options listed in #5, you can easily create 2 mailing lists:

- Early filers, who are generally in the lower income brackets and are eager to receive their refund

- Late filers, who generally have higher incomes and may owe money

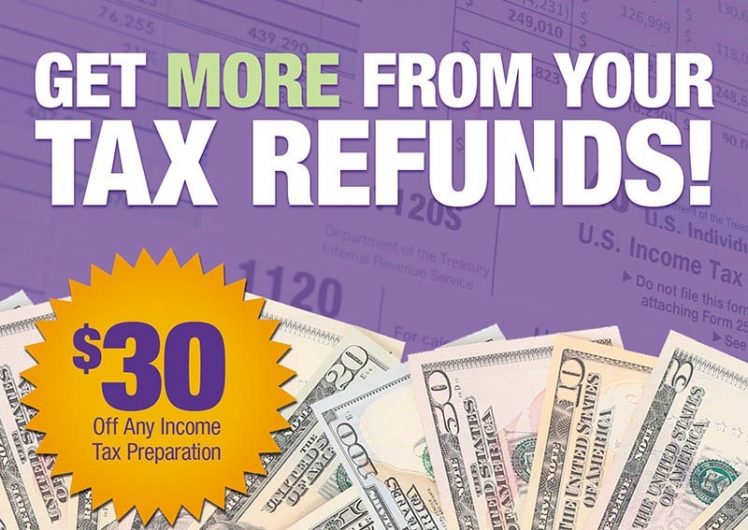

You’ll want to include a valuable special offer that makes switching income tax preparers — or having them done by a professional for the first time — worth their while! For early filers, our successful tax prep clients have found that using dollar amounts is effective, like these:

- $50 tax prep

- $30 off tax prep

And for late filers:

- Flat fee ($99, for example)

FREE e-file

8.) Increase Your Response Up to 400% with Google Follow-Up Ads.

Repetition and follow up are the keys to success in tax preparation marketing! Not only does repetition get your prospect’s attention, it keeps your advertisement for tax services top-of-mind when they’re ready to call someone for help. Repetition also helps create a sense of familiarity and credibility — sending multiple time to file tax postcards to your prospects tells them you’re not going anywhere any time soon!

In addition to sending multiple tax season postcards, studies show that retargeting (also called remarketing) your prospects online can provide awesome returns. According to CMO.com:

- Google follow-up ads can boost ad response up to 400%

- Website visitors who are shown Google follow-up ads are 70% more likely to convert

Plus — If you add Facebook (#3!) and even Instagram ads to your Google ads — and you’re consistently mailing income tax business postcards — you’re likely to have your business seen EVERYWHERE prospects spend their time…

- On hundreds (and thousands) of internet websites online in the Google network

- On Facebook where 79% of Americans hang out “liking” media

- And on Instagram, specifically — the mobile app! (Smartphones, anyone?)

We call this online-offline, multi-channel marketing program Everywhere Small Business. Here’s how it works:

- An unobtrusive piece of coding is added to your website that “cookies” your visitors

- Your prospects receive your tax appointment reminder postcards in the mail

- They’re interested in your special offer, so they visit your website to check you out

- They’re not ready to make an appointment, so they leave your site without taking action

- They start seeing your ads on other websites all over the internet, reminding them that they were interested in you!

- AND — they see your matching ads on Facebook

- And in their Instagram mobile app too!

Everywhere Small Business extends your friendly reminder postcards for tax preparers into a laser-targeted digital marketing strategy — and one that YOU don’t have to manage. It costs pennies per extra piece to add Everywhere Small Business to your income tax postcards… watch the 1-minute video here!

9.) Send Google Searches to Your Website and Snag Tax Filers Looking for Help.

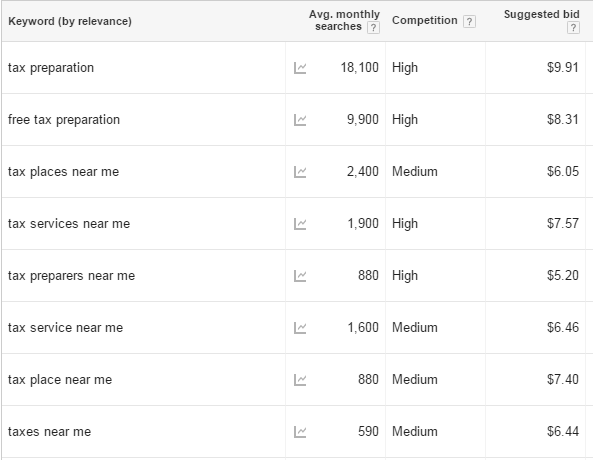

Pay-per-click (PPC) is when you run a “sponsored ad” with Google and pay every time someone clicks on your ad. In a competitive industry like tax preparation, creating a cost-effective PPC campaign can be an expensive operation. Here are some of the suggested bids for tax-related keywords:

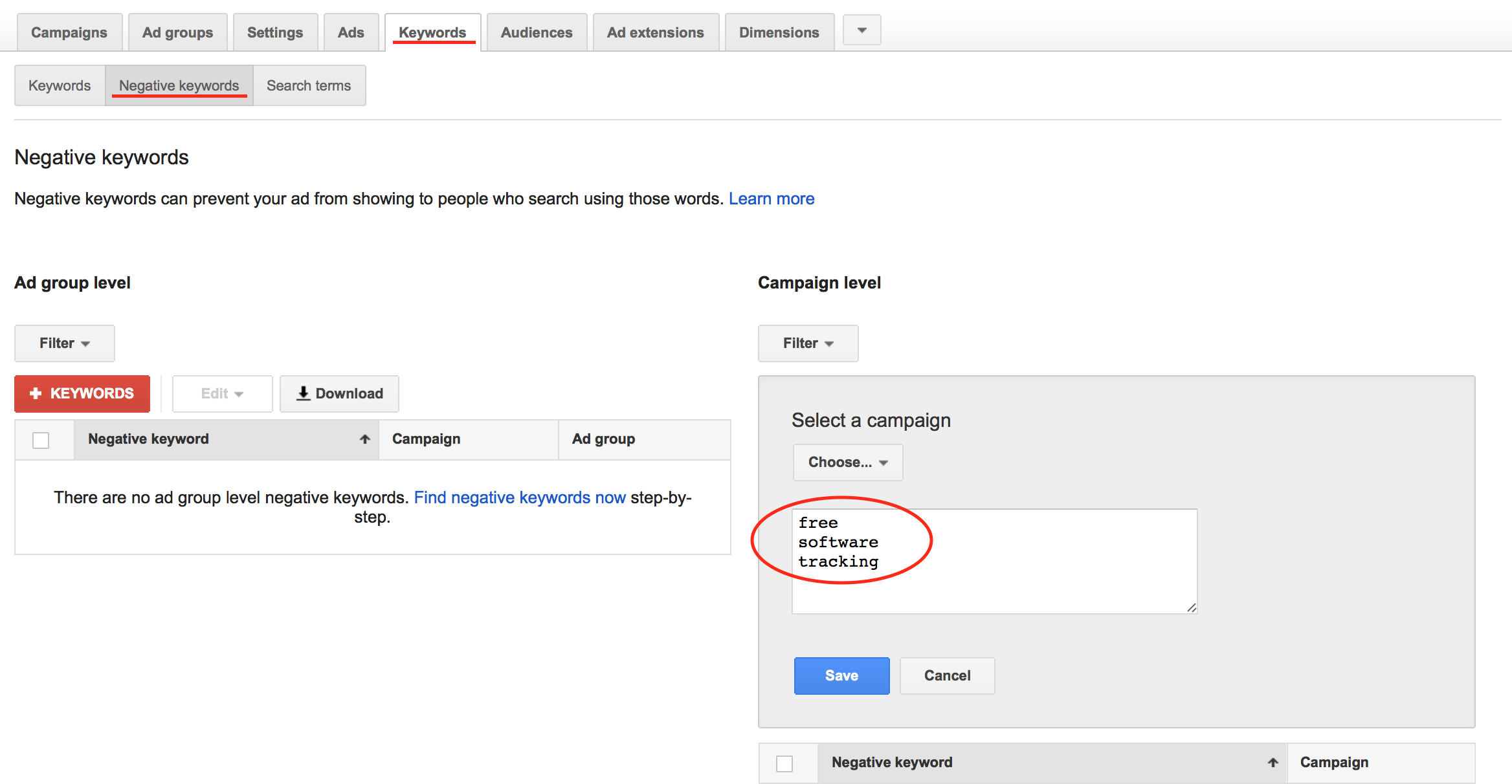

The key to Pay-Per-Click success when advertising tax services is showing your ad to QUALIFIED prospects and avoiding wasted clicks. One way to do this is to include negative keywords in your bids. For example: Someone searching for “Free tax preparation” is NOT a qualified prospect, since they are looking to file their taxes for FREE. If you include the negative keyword “free” in your bid, your ad won’t appear in searches that include that word. Likewise, people searching for “tax preparation software” aren’t good prospects, since they are looking to file their taxes themselves. People searching for “tax refund tracking” have already filed — so they’re not good prospects, either. You see where I’m going with this. You can include MANY other negative keywords — get creative! As your PPC campaign progresses, you can add more and more — negative keywords cost you $0. On the other hand, unqualified clicks DO cost you — literally! With so many variables and the constant monitoring necessary to maintain a profitable campaign, it might be worth the expense to hire a PPC specialist to handle it for you. The key to Pay-Per-Click success when advertising tax services is showing your ad to QUALIFIED prospects and avoiding wasted clicks. One way to do this is to include negative keywords in your bids. For example: Someone searching for “Free tax preparation” is NOT a qualified prospect, since they are looking to file their taxes for FREE. If you include the negative keyword “free” in your bid, your ad won’t appear in searches that include that word. Likewise, people searching for “tax preparation software” aren’t good prospects, since they are looking to file their taxes themselves. People searching for “tax refund tracking” have already filed — so they’re not good prospects, either. You see where I’m going with this. You can include a million other negative keywords — get creative! As your campaign goes on, you can add more and more — negative keywords cost you $0.

On the other hand, unqualified clicks DO cost you — literally! With so many variables and the constant monitoring necessary to maintain a profitable campaign, it might be worth the expense to hire a PPC specialist to handle it for you.

10.) Optimize Your Website for Local Search — it’s FREE!

Your prospects are looking for you or SOMEONE local who provides tax preparation services online — and given Google is the #1 search engine in the world… You need your business showing up on Google for local searches! According to recent Google research, people who conduct local searches are ready to take action:

- 50% of consumers who conducted a local search on their smartphone visited a store within ONE day

- 34% of people who searched on a computer or tablet did the same

That’s why you should create your FREE

All of the major search engines offer these free listings, but they don’t always make the sign-up pages easy to find. (This local business listing tutorial has links that will take you directly to the forms you need.) Tip: The more information you can add, the better!

11.) Close 50% More Customers with an Email Drip Campaign.

Smart email marketing is one of the most effective ways to build relationships with your prospects and customers, generating 50% more sales for businesses savvy enough to do it. It’s easy to set up an email drip campaign to keep your message in front of people who reach out to your business but didn’t close right away. An email drip campaign, if you’re not familiar, is just a series of messages that are sent out in a predetermined order on a predetermined schedule. For example:

- Someone joins your email list and they immediately receive email #1

- A few days later, they get email #2

- A week after signing up, they get email #3

- And so on!

Sounds like a lot of work, doesn’t it? It’s not. MailChimp and other free or super inexpensive email marketing softwares can automate this for you so that as soon as you get a lead, that person receives a series of nudging emails — and you don’t have to even think about it. You do have to write the emails, though! Some tips:

- Keep them short — or no one will read them!

- Use their name in the subject line to increase open rate up to 26% (Capterra)

- End the email with a question that they will feel compelled to respond to (e.g. “Do you need help figuring out your deductions?”

You can also hire a company (like us) to write and send your email campaigns for you! But wait — how do you get those email addresses in the first place?? Like this:

- Create a dedicatedlanding page for your prospects to visit that continues the message on your marketing materials.

- Include alead capture form on that landing page that offers prospects something of value — an extra 10% off your services or an email newsletter full of money-saving tips, for example — in exchange for their name and email address.

- Or use our Catch & Close tool, which includes #1, #2, and massive time-saving for you!

See how the Catch & Close tool grabs leads from your website and turns them into leads (and sales!):

12.) Start Blogging For a 13x Better Return on Investment on Your Tax Season Marketing.

A blogging platform like WordPress is easy to use and can be hosted right on your website. Starting a blog today might not help you this 2018 tax season, but by the time NEXT tax season rolls around, you will have established yourself as a knowledgeable source and built up a lot of good content and keywords for Google to find… And that means more prospects finding your website through search engines!

- 55% of business bloggers are getting at least 5% of their web traffic from their blog

- Marketers who prioritize blogging are 13x more likely to see a positive ROI

The best part about blogging? All it costs is your time. Learn how to get started on your business blog here.

13.) Attract 88% More Clients with Online Reviews of Your Accounting Services.

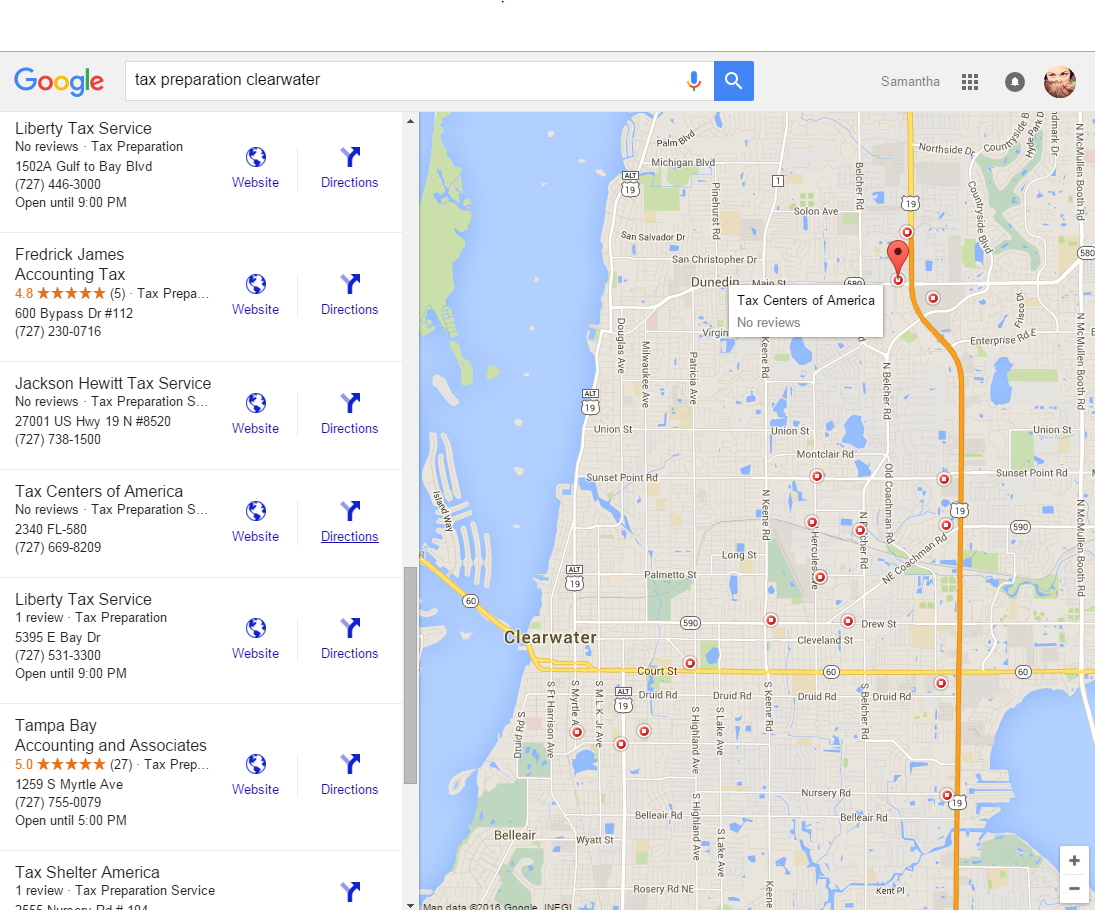

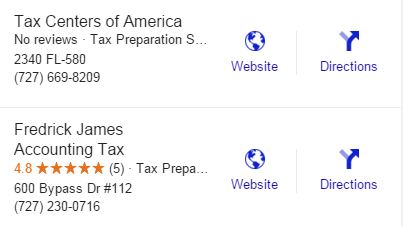

Let’s take a closer look at some of those Google search results.

Which of those listings capture your attention first? The one with the 5-star ratings, right? Not only do those stars help your business listing stand out in the search results, but they add IMMEASURABLY to your credibility. All other things being equal, I’m going to call the business with the 5-star ratings over an unknown quantity. And I’m not alone:

- 88% of consumers trust online reviews as much as personal recommendations

- 72% of consumers say that positive reviews make them trust a business more

Don’t assume that just because a client leaves happy, they’re going to run straight home and give you a 5-star review. YOU HAVE TO ASK! Online reviews have become SO important today in online marketing, I wrote 4 ways to generate more Google Reviews for your business that you read here.

Further, I want to share an interview I did with our VP of Sales, Rob Bradshaw, which answers some of the tough questions that crop up with CPA marketing, especially during tax season.

Rob has been helping CPAs and tax professionals get better results from their marketing for more than a decade, and knows the industry ropes.

Here is the interview:

Me: Let’s start with tax preparation businesses who are targeting consumers (think franchises like Jackson Hewitt, H&R Block and Liberty Tax), what is the best type of mailing list for them to use when they are targeting pretty much all consumers in their area?

Rob: I have seen the most success with carrier lists that target every home on a particular postal worker’s route. They are called carrier routes. These lists make it easy to saturate an entire area with your message. You want to make sure the area you are targeting has an income overlay of 50K or less — maybe even 30-40K or less depending on the area. Many businesses we work with supply us with the ZIP codes they want to hit, but we can simply run a search for addresses within a certain distance of their address if they don’t have this info already.

Me: Should these franchise type tax prep companies and CPAs think about including an income specification on their lists? If so, in what cases?

Rob: Yes, they should. As I mentioned, 50K or less is generally the best guideline to use, as these are generally early filers.”

“Me: How many times do you recommend they mail to their list?

Rob: In this case, just once to target early filers – but as many as you can possibly mail. It’s all about timing with early filers, so the more the better. For late filers, you need to work them a little bit with more mailings, but early filers are low hanging fruit, and if they don’t respond to your fist mailing, the second isn’t going to do any good. The caveat to this is if you start your mailings before they can actually file for the purpose of getting your name in their head. This is a good idea. In this case, mail a couple times but stop after the first week of the year.

Me: What time of year do you see most tax prep companies do their mailings?

Rob: Most CPAs mail the last week of December so the postcards hit the first week of January. Consumers can do taxes as early as January 1, and a lot do them in January, so anytime in January is optimum.

Me: Do you have any other campaign ideas for CPA marketing or tax prep companies targeting consumers?

Rob: If you are targeting high income late filers, use IPA (income producing assets) as a specification on your list and start mailing in February. You want to do three mailings to them. They usually file later as they are paying more taxes, and it takes a couple times seeing your message before they will respond.

Me: Alright, now let’s look at an accounting firm targeting businesses for tax preparation, what kind of list should they be mailing to?

Rob: Definitely small to medium-sized businesses. I would say 50 or fewer employees. Also, you want to omit people that won’t use you from the list (Government, etc).

Me: Do you have any other campaign ideas for a CPA marketing to businesses?

Rob: Just one thing: use larger postcards, like a 6×11. It’s harder to get the attention of businesses, so the extra size really pays dividends. Also, don’t be afraid to mail year round for these campaigns, accounting help is usually a full-time need for businesses of this size.

So there you have it!

Questions about mailing tax postcards or Everywhere Small Business? Call one of our trained marketing experts at 1-800-628-1804 to ask about anything I discussed here — it’s FREE! Or you can email me directly at Joy.Gendusa@PostcardMania.com any time.

Best, Joy

18 Comments

I’m so glad it was helpful for you, Lillian! We are so excited to be working with you, and thank you for taking the time to read my blog. 🙂

Thanks for such informative Marketing Strategies

You’re welcome, Janice! I’m glad you found it helpful 🙂

I’m going to try and apply these tips to my accounting firm. Thank you so much!

Serika, that’s what I love to hear! Let us know if you need any help with your tax marketing!

Do you have a program where you do all of the above things for me? What are the fees?

Ron, absolutely! As far as pricing, we will need to discuss your particular needs so we can give you an accurate quote. Give our marketing consultants a call at 800-628-1804 for a consultation and quote – it’s totally free!

Thanks for sharing this, it’s quite informative and I will implement this in my income tax firm

I’m so glad you found the article helpful! Thanks for your comment!

Great tips! I plan to use this service by December! Don’t want to advertise too early or too late! Thanks

I’m so glad you found the article helpful, Katrina! Please don’t hesitate to call us at 1-800-628-1804 if you need any help!

Very useful information here. Thanks for sharing the knowledge will be of great help.

I’m so glad you found it useful, Sam! Thanks for your comment.

Hi there to all, because I am actually keen of reading this webpage’s post to

be updated regularly. It carries good material.Fotbollströjor Barn

Thanks for your comment, Jorge!

Good post highly educative

Glad you liked it, Austin! Thanks for reading!

This was very valuable information, thank you I will start preparing to use as many of them as I can on a budget. I will also stay in touch with my Rep, so that as soon as I can afford this form of ads I will let her know & get some leads.