Survey Results: How 126 Small Businesses Responded to Coronavirus

Updated on July 15, 2021Now that small businesses nationwide are largely allowed to reopen in some capacity, I was frankly eager to learn how this pandemic affected them.

So I asked YOU — small business owners from every industry across our country.

I would be remiss if I didn’t mention that this crisis has affected every industry differently.

Although regulations vary from state-to-state, the cosmetic (salons, barbershops, spas) and hospitality (nightclubs, bars, restaurants) industries were without question hit the hardest, oftentimes being forced to mandatorily close indefinitely.

However, it’s refreshing to see how the rest of you have been able to adapt so well to this completely unprecedented scenario.

This pandemic has forced small business owners everywhere to learn how to foolproof their business strategies, and although it may seem bleak at times, it is a learning experience that will undoubtedly make many small businesses more resistant to future economic turmoil.

The survey results speak volumes on the strength of human resiliency to rise to any challenging occasion, and it gives me comfort that we will make it through this together.

My survey dug into a number of important small business topics, such as:

- Who pivoted to stay open and in service

- Who cut, increased or maintained their marketing

- How many applied for/received PPP funding

- Where they expect 2020 to end, revenue-wise

- If staff are returning to work and much more

Over 100 small business owners answered my call, each with their own business survival story.

I was floored by your responses, and today I’m sharing those survey results with you…

Let’s get right to the results.

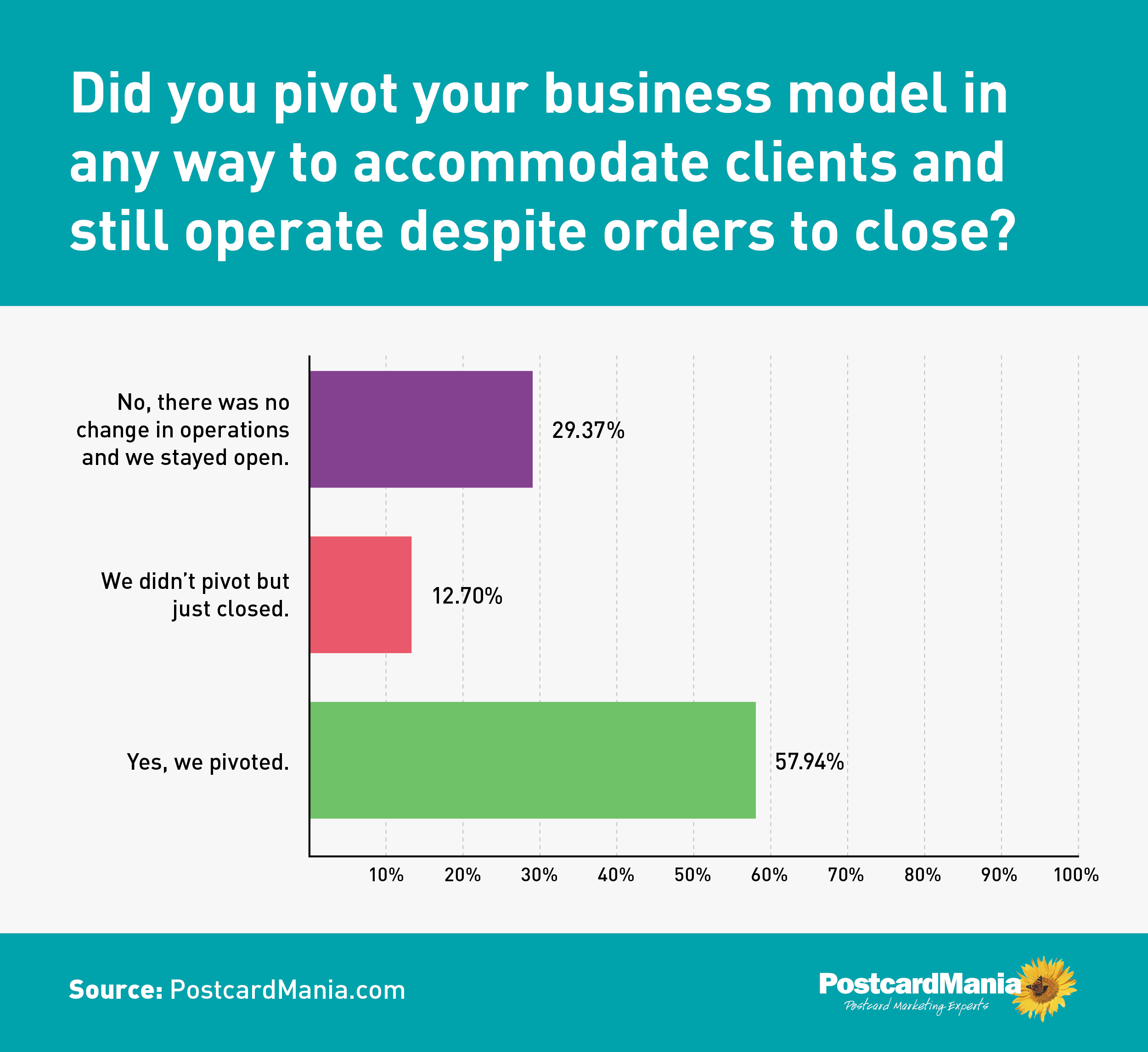

1. 58% of small business owners had to pivot and adapt as a result of coronavirus.

More than half of SMBs — 58% — surveyed said that the pandemic and shutdowns forced them to change the way they conduct business.

We asked:

Here’s a sampling of this question’s responses, to give you an idea of how your fellow SMBs compensated for closed doors:

- Working from home or virtually by offering classes online and hosting Zoom meetings

- Shifting business online/conducting business remotely

- Offering “try before you buy” incentives to generate interest from otherwise nervous prospects

- Changing hours of operation

- Expanding services by offering delivery and eliminating in-person contact — as just one example, one IT company asked customers to leave basement doors open so techs could just enter and diagnose issues to avoid unnecessary contact

- Ceasing marketing emails instead offering only guidance and tips

A local restaurant here in the Tampa Bay area, Mise en Place, started hosting wine tastings at home – delivering the bottles to the homes and then having everyone on zoom learning about the wines!

I’ve always known that small business owners are scrappy and resourceful, and these pivots prove it. SMBs truly rose to the occasion with flexibility and creativity.

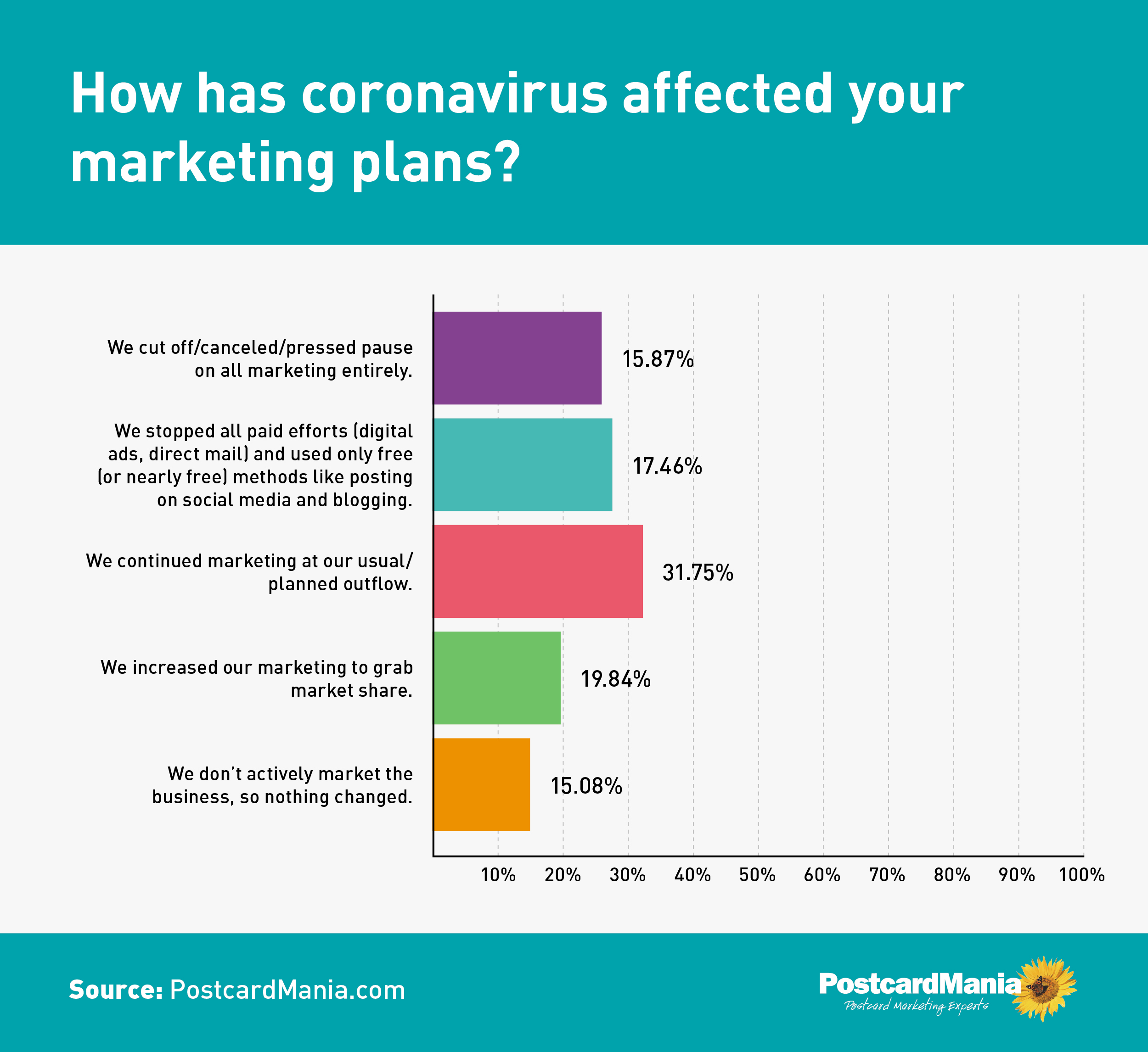

2. The majority of businesses (52%) continued marketing or actually increased their marketing during the pandemic.

We asked:

These results honestly impressed me, as the top two responses are businesses continuing their marketing as planned (the highest at 31.2%), and businesses increasing their marketing to grab market share (20%).

I’ve written about how to safeguard your business and approach your marketing during a down economy (which we’ll likely still be dealing with for months to come).

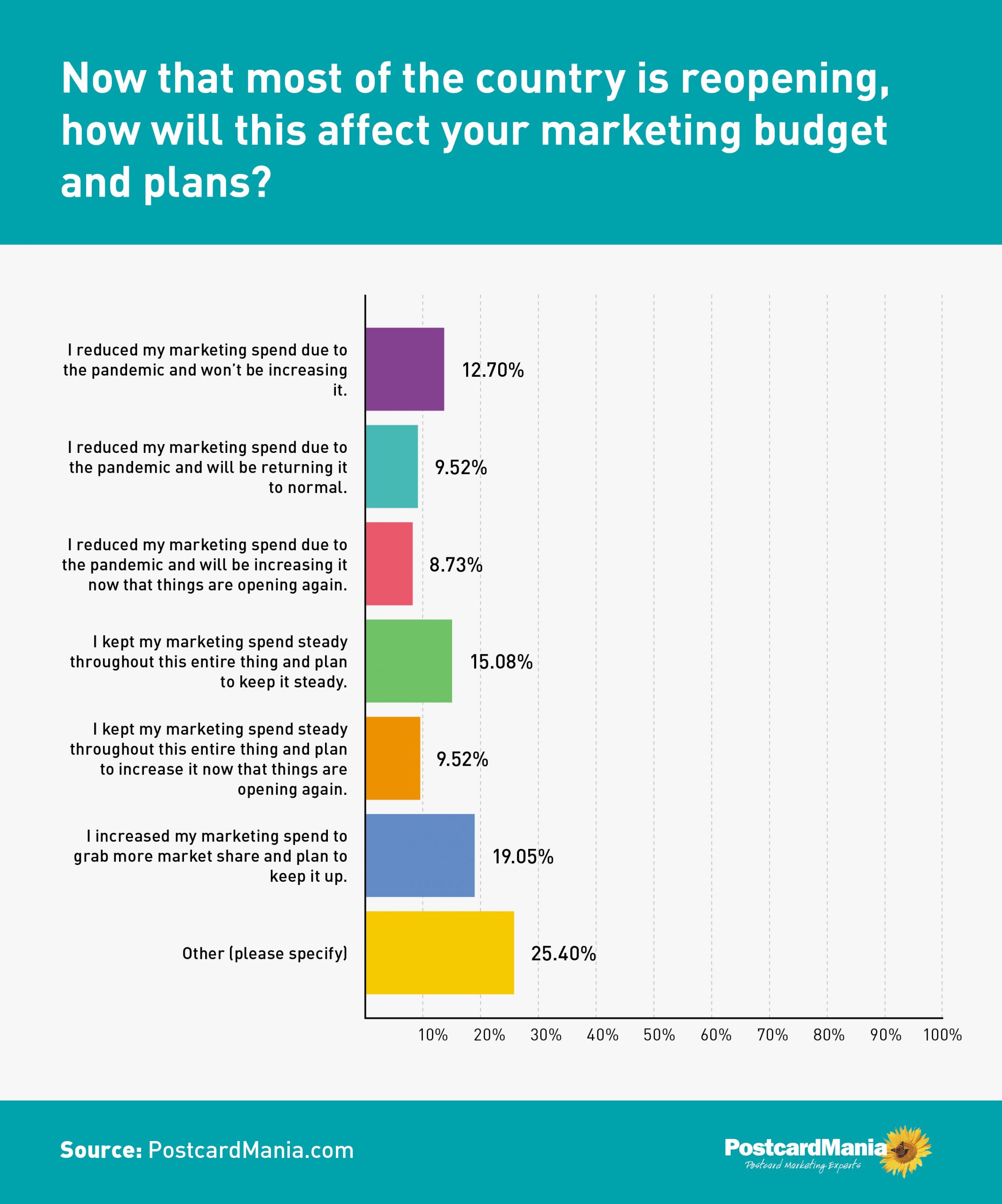

3. 44% of small businesses are continuing to market or increase those efforts while only 31% are still in scale-back mode.

We asked:

Those who responded “Other” (the most, at 25% of responses) stated they are…

- Waiting for further updates on the economy before making marketing decisions.

- Not allowed to reopen quite yet.

- Leveraging word of mouth.

- In the process of starting their marketing journey from scratch.

After “Other,” the next most popular response (with nearly 20%) indicated they had already increased their marketing to grab more market share and would keep it up.

Research indicates that these businesses are likely to fare better in the years to come as the overall economy rebounds. I even wrote about Harvard-based recession research lately and definitely credit our continued marketing with PostcardMania’s quick pandemic recovery.

Point being:

Continue marketing as usual or increase your marketing for the best results.

Saying that, I understand it won’t be fiscally feasible for every business to invest capital in marketing right now.

A little over 30% of respondents indicated they had cut their marketing in some fashion since the pandemic emerged. If you’re in this camp and looking for low-cost marketing strategies, check out this guide to 4 budget-friendly marketing tactics that I wrote for Business.com.

Whatever marketing you can afford, get it going now rather than later.

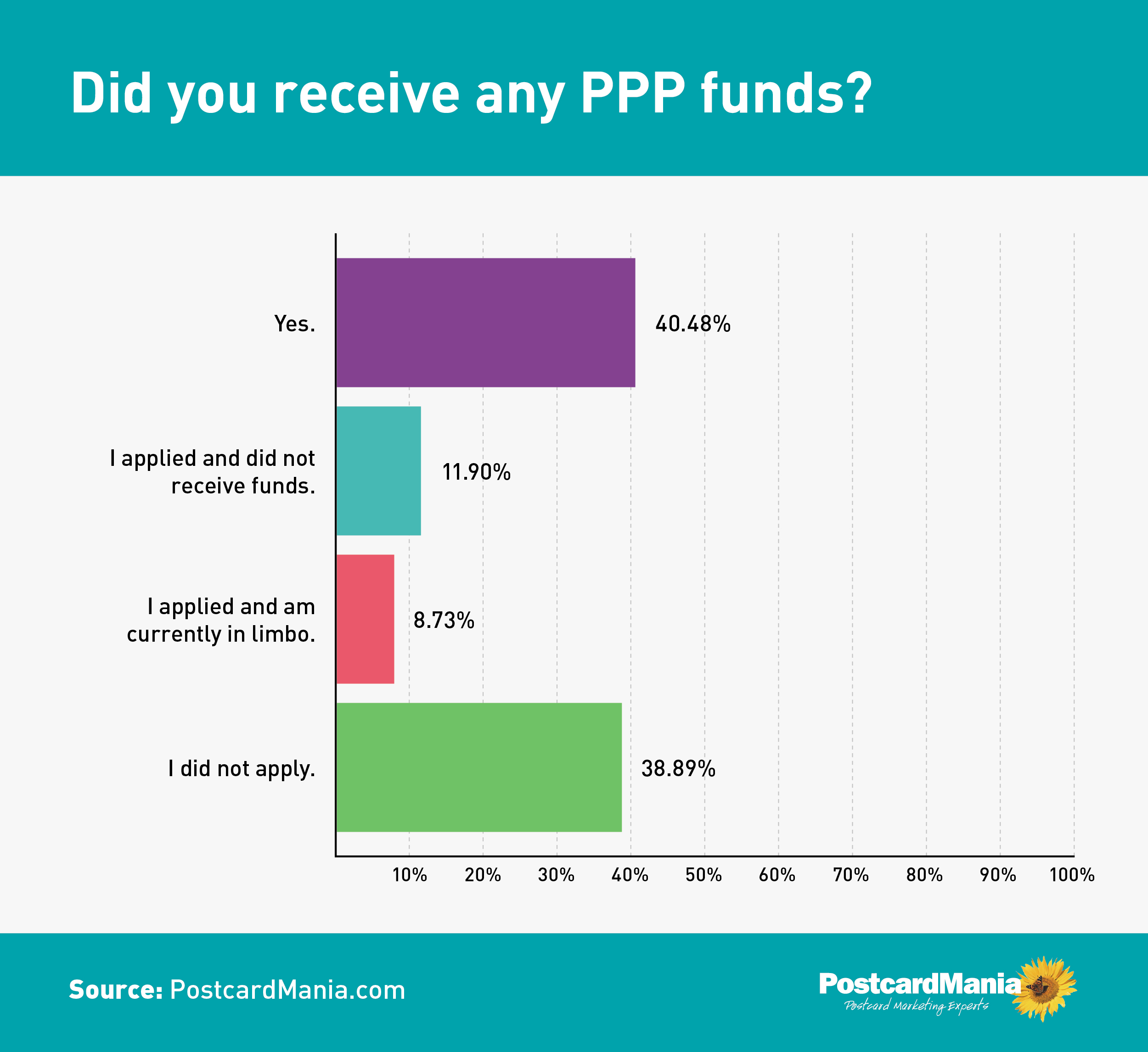

4. Most business owners (40%) applied for and received PPP funds while almost the same amount (39%) didn’t even apply.

We asked:

The majority of respondents that applied did receive PPP funds. I’m in this basket as well, and I can say that receiving the loan definitely helped set my mind at ease about meeting payroll every week.

Now that we’re over the application hurdle with PPP, those of you who received funds should shift focus to ensuring your loan can be forgiven in full. The Small Business Administration (SBA) has released guidance on PPP loan forgiveness that I definitely suggest you study, and you should download your loan forgiveness application if you haven’t already.

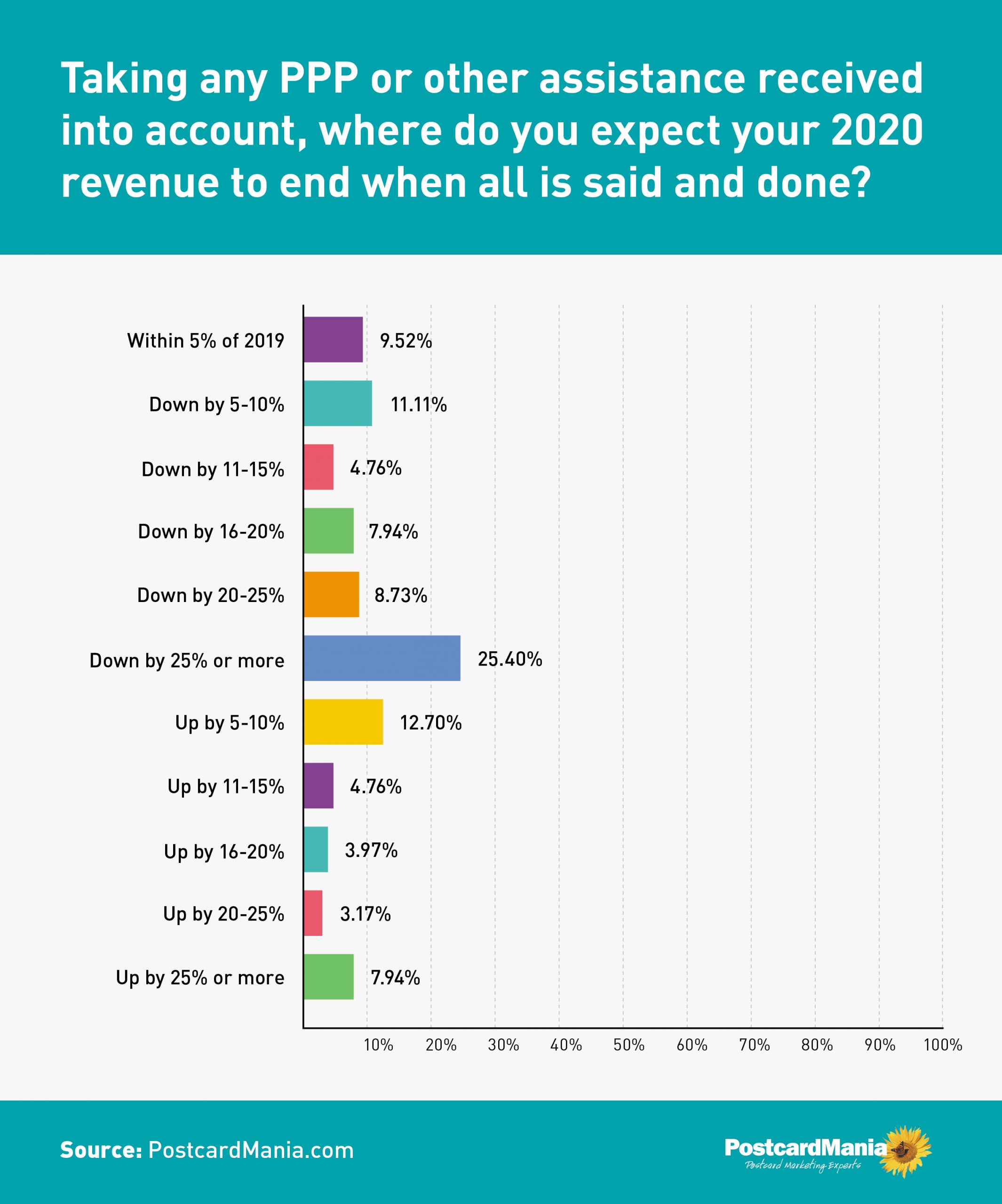

5. 2020 revenue outlooks are bleak for small businesses as 58% expect to be down by 5% or more

We asked:

These responses are a grim reminder of the effect this pandemic has already had on our small business community.

The majority of respondents indicate that revenues will likely be down this year, with 25% anticipating they’ll be down by 25% or more.

To cope with this revenue loss, there are a number of financial resources still available to businesses. We collected and cataloged a number of these resources personally at the height of the shutdowns:

- State and local financial resources for small businesses

- Tools and support currently being offered for FREE for small businesses

- Other resources, such as webinars, foreclosure/rent relief and more

We’re not completely out of the woods just yet, so it’s important to stay vigilant and adaptable to keep your business operational and profitable.

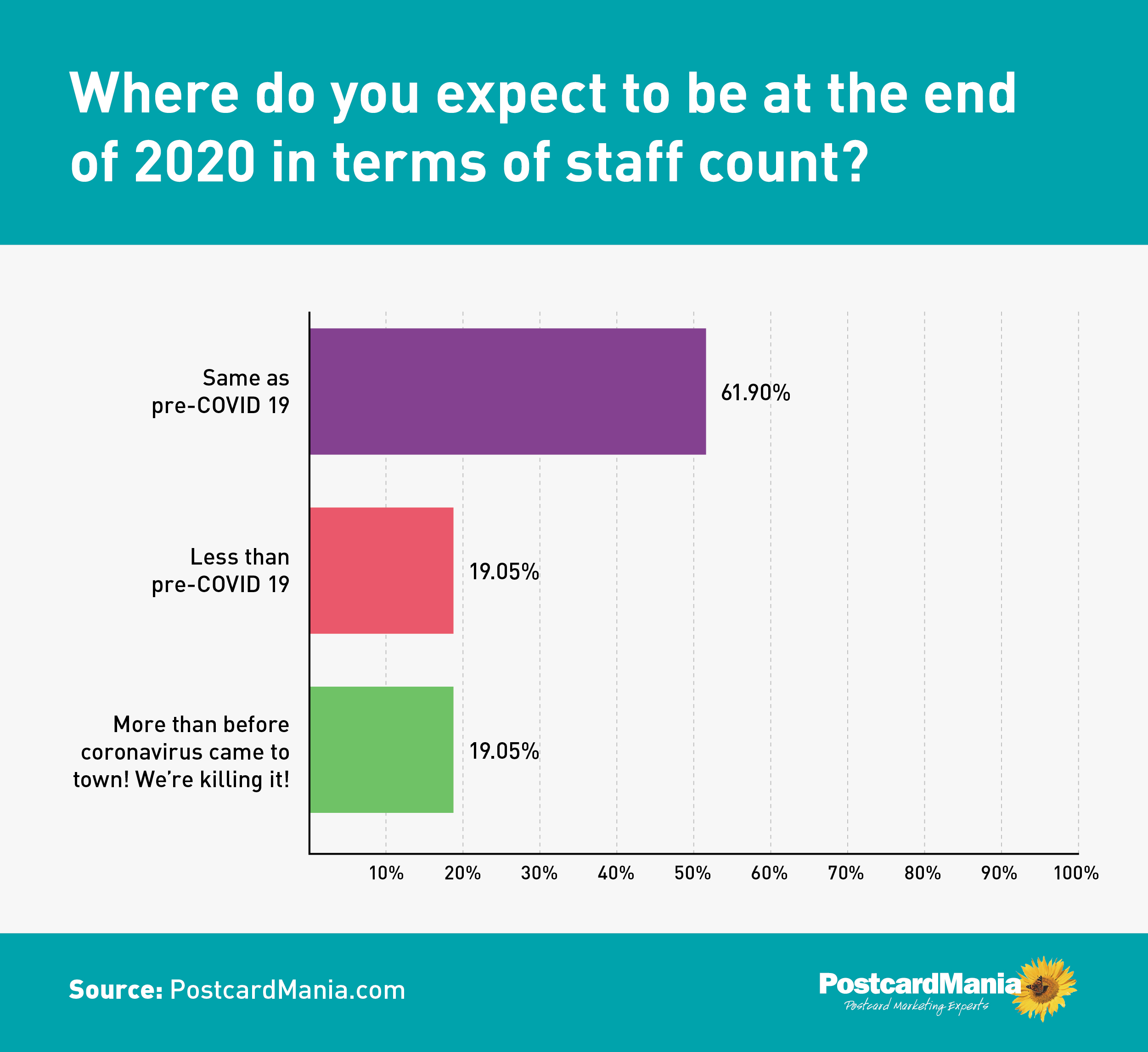

6. Despite down revenue projects, 62% of small business owners will fight to keep staff counts steady through the rest of the year.

We asked:

I have to say, I was SO heartened when I saw the majority of our SMBs surveyed did not have to permanently lay off staff!

Small business owners carry the burden of supporting not only themselves, but their employees as well, and I know that — with revenue expectations largely down, per the question above — it isn’t easy maintaining a full staff.

My hat is off to the 80% of you who plan to end the year with the same number of staff or more!

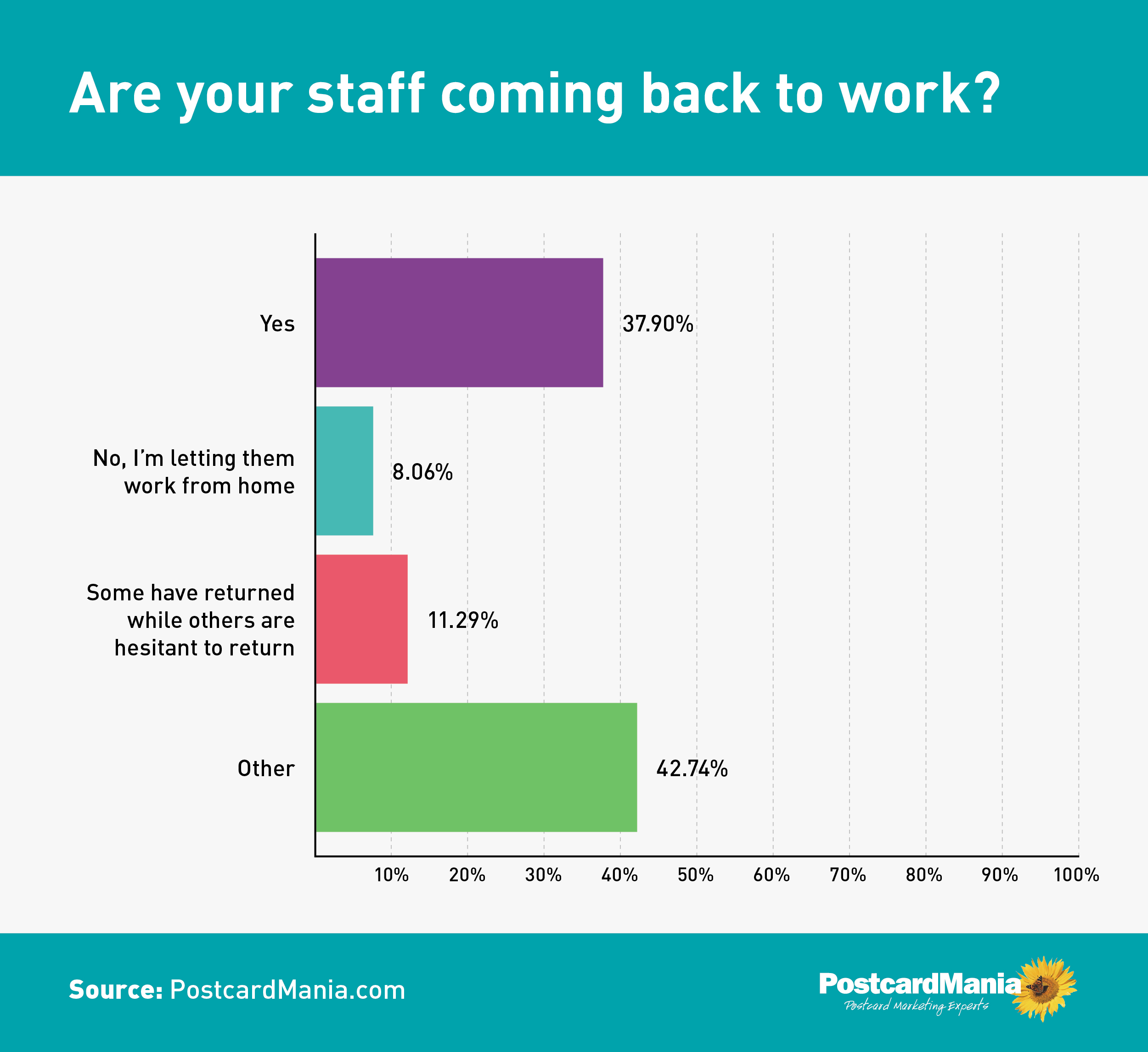

7. It seems like the jury is still out on how and when to bring staff back to work safely.

We asked:

Those who replied “Other” (the majority) indicated:

- They’re a one-to-two man/woman show and don’t have staff (about 75% of the “other” answers)

- All staff already worked from home pre-pandemic

- Still waiting on government direction before deciding

- Staff had left or were let go without plans to replace those positions

By and large, this survey revealed that small business owners have been on their toes throughout this entire ordeal and adapted fairly quickly.

After reading through these results to get a grip on where SMBs near and dear to PostcardMania stood, two things stuck out:

- Most are expecting to be down 25% or more in revenue compared to 2019

- Yet, most are not laying off staff.

This tells me that small business owners are willing to take a temporary financial hit in lieu of the fact that the economy will bounce back.

And that’s a good bet.

Because we KNOW from previous recessions that downturns are temporary, and how you react dictates if you rebound or shrink completely.

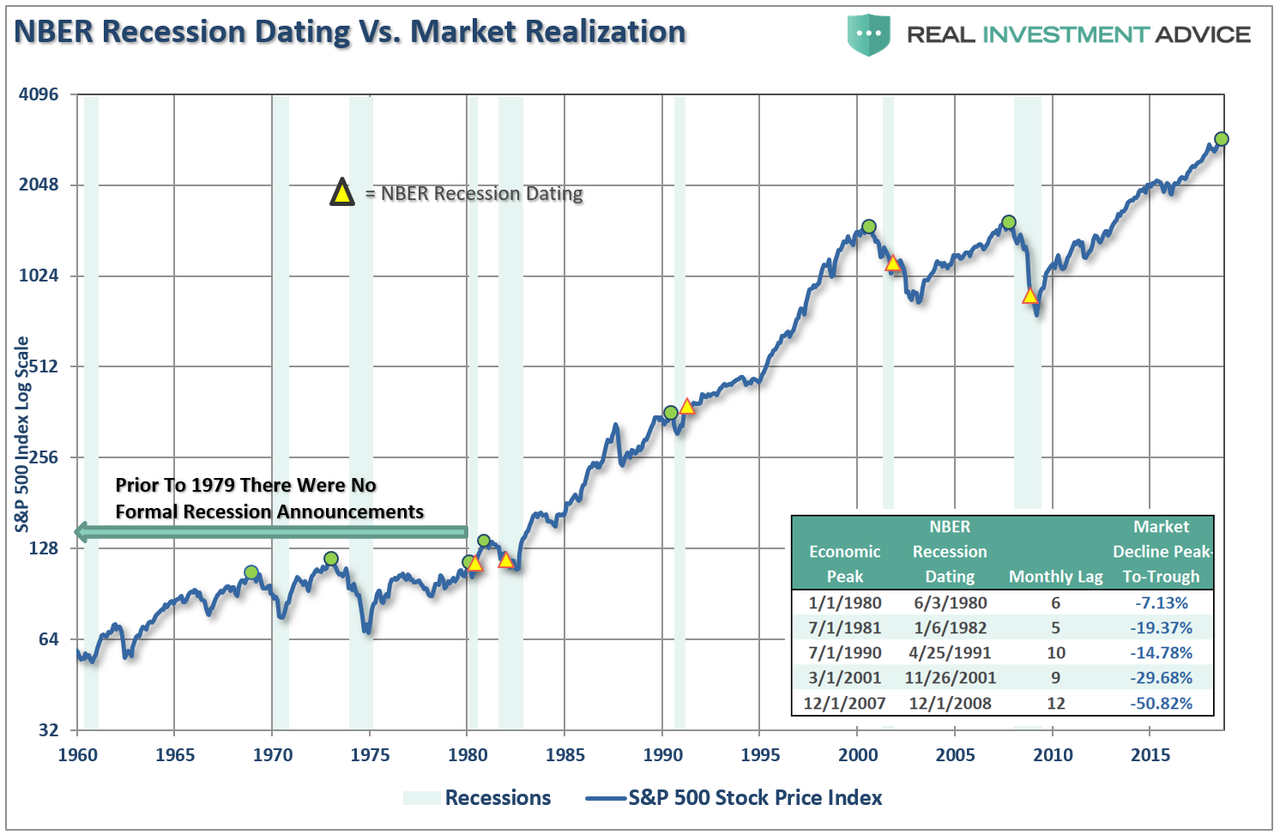

Just look at this graph showing the overall growth of the American stock market compared to historical recessions (marked by the yellow triangles):

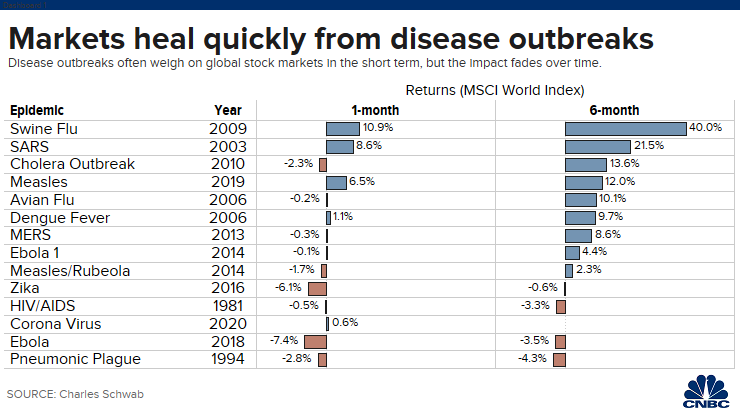

Or this one that shows how the market responds to disease outbreaks at one-month and six-month intervals:

(You can read my paraphrased take on a Harvard Study about which 4 actions successful companies took in the wake of 3 scary economic slumps from the past century.)

Most of us have accepted that the rest of 2020 will be touched by coronavirus — how severely likely depends on where you live.

I can’t argue that times will remain difficult for small business owners, but I know for certain that, if you’re going to get through this intact, you need to watch your resources carefully.

If you need some assistance with resources, I have some uplifting news — to the 39% of you out there that have not yet applied for PPP funds, this past Monday the government pushed the deadline extension to apply to August 8th. There is still $134 billion left, so there’s still plenty to go around.

Even better news, the loans will be fully forgiven if they are used for payroll costs, interest on mortgages, rent, and utilities (with at least 60% of the forgiven amount going to payroll).

However, if you have some wiggle room, this is an exceptional opportunity to use this peculiar situation to grow your business. Aside from the fact that you don’t need to personally guarantee the PPP loan or have a great credit score, the PPP loans have a small interest rate at 1%, so it’s a smart move to move some funds into your marketing, if able.

For example, some of our clients have taken this chance to invest in themselves. I personally know a family-operated dental practice that has invested $15K of their PPP funds into marketing efforts with us, and it will undoubtedly pay off.

Marketing during these times can be incredibly fruitful — many attribute this to the nationwide spike in media usage. Likely due to social distancing, quarantines and stay-at-home orders, media consumption in March 2020 is up a massive 215% compared to March last year.

You know what else people really look forward to while stuck at home all day? Getting and opening their mail. A beautiful postcard advertising that your business is there for them, even in these fretful times, will go a long way.

This all translates to your marketing efforts having more impact than ever before. Every SMB owner should take a close look at their budget to see if there’s room to grow.

However, the only necessary marketing effort that is critical to attend to is to continue to let your prospects and customers know you are there and safely open for business and able to serve them.

There is NO way to make sales if people don’t know you’re open.

So, as you continually observe your business to see what needs to be done to keep the lights on, don’t ditch your marketing.

You don’t need a massive marketing budget to stay in front of prospects, but whatever you can do, you need to do it consistently.

If you need any support in regenerating your business, we offer plenty of free resources to:

- Safeguard your business

- Plan budget-friendly marketing

- Re-open your business

- Take advantage of slower sales

And we’re open and ready to help you with your marketing with FREE one-on-one marketing consultations to find the solution that’ll work for your business and budget right now.

You can call 800-628-1804 to get your free consultation with a trained marketing expert anytime.

Or, you can email me directly at joy.gendusa@postcardmania.com.

Best,

Joy

P.S. Want to send “We’re Back Open!” postcards to announce you’re open again? See our new designs here!

2 Comments

Thanks for reading, Mark! 🙂

Interesting reading thanks for sending it out