One Year Later: How 254 U.S. Small Businesses Fared Covid-19

Updated on July 15, 2021Just over a year ago — on March 13, 2020 — then-President Trump addressed the nation and confirmed everyone’s worst fears: the novel Coronavirus, known to most by now as Covid-19, became a national emergency.

A two week stay-at-home order followed, and most states entered formal lockdown.

The rest is (and is still becoming) history.

Without question:

Covid-19 is now our shared national experience. The virus has affected every life in one way or another.

Small businesses, in particular, were thrown for a loop.

Now that it’s a year later:

We wanted to see how small business owners had fared a particularly challenging year. We drew on our own sampling of our 96,765 small business owner clients for this, and it wasn’t the first time.

We conducted a survey of small business owners in June 2020, after the initial mandatory closures, to gauge the small-business approach to Covid-19 as the nationwide pause was lifted and many states returned to some semblance of normal.

Here are the results of that survey in case you missed it. The big-picture results back then?

- 94% of respondents pivoted and adapted their small businesses to continue operating

- 59% continued marketing or increased their marketing during the pandemic

- Most anticipated ending 2020 down in revenue compared to 2019

- Yet 61.90% thought they would be able to keep all staff employed through the end of 2020

But that survey was conducted before the rippling effects in the latter half of last year, which saw Covid-19 cases and hospitalizations twice reach new highs.

We reasoned:

It’s about time to check back in with our 96,765 clients and our hundreds of thousands of small business subscribers to find out how they truly handled the year of coronavirus.

In total, 254 small business owners answered this survey.

Here are the results…

The small business owners that answered our Covid-19 survey: a profile

So, who answered our call?

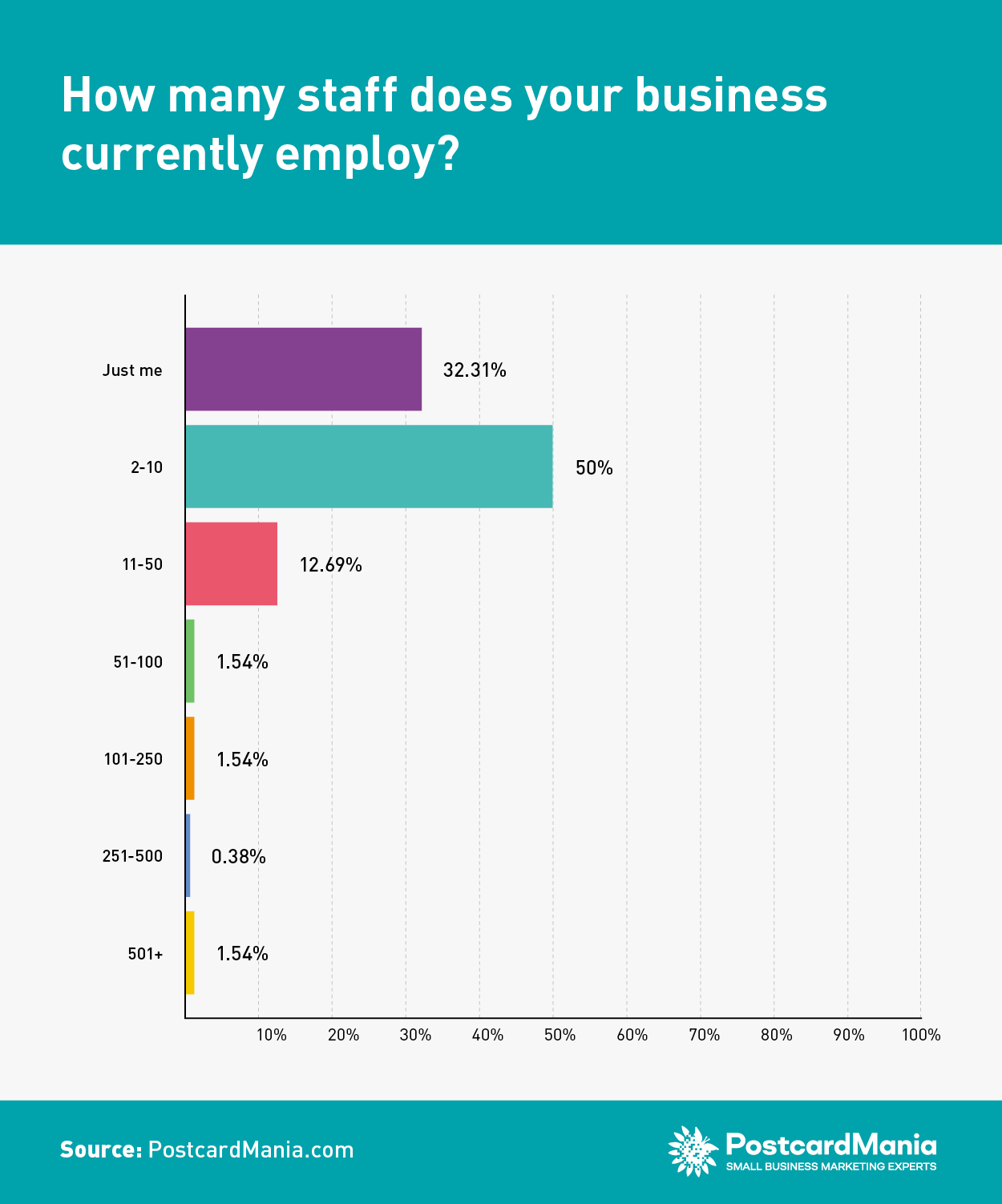

In our humble opinion, these business owners represent the lifeblood of the American economy with only 1.54% reporting having more than 500 employees. The overwhelming majority, 66.39%, reported employing between 2 and 499 employees. The rest (32.31%) are self-employed, sole proprietorships or “solopreneurs” without any staff.

The industries represented by the business owners we surveyed run the gamut. Here’s a rundown of some of the most common industries represented in these results:

- Construction

- Child care

- Cleaning services

- Beauty services

- Church/worship services

- Dentistry

- Education

- Financial services

- Fitness

- Health and wellness

- Insurance

- Landscaping/lawn care

- Massage therapists

- Nonprofits

- Restaurants/catering

- Pet services

- Real estate

- Retail

- Transportation

- Wholesalers

And these are by and large seasoned business owners.

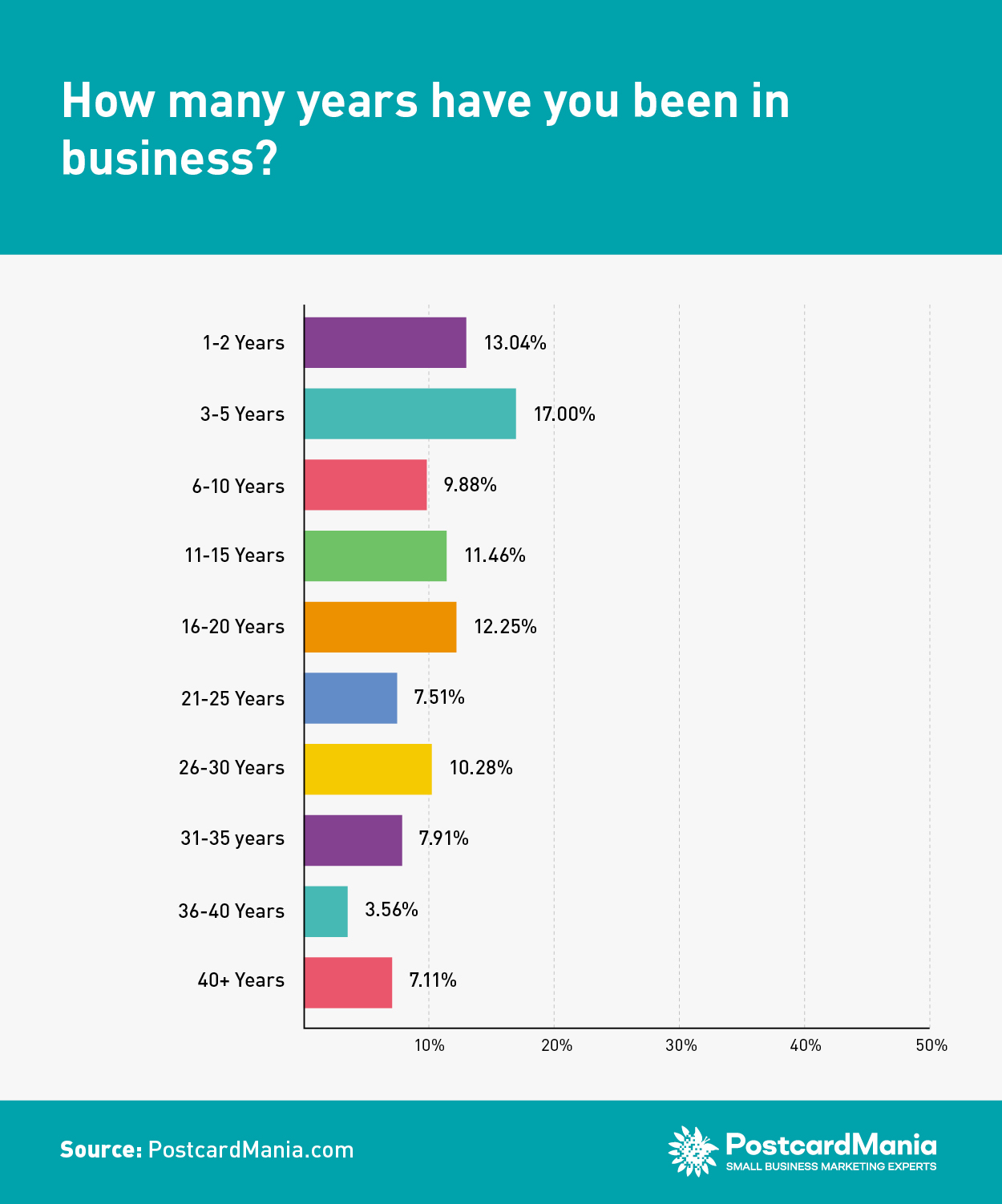

We asked respondents how long they had been in business. The average answer was 16.98 years in business.

The majority of respondents have been in business a substantial length of time. Most (69.96%) have been in business longer than 5 years and almost two-thirds (60.08%) have been in business more than 10 years.

Some estimates put the average lifespan of a small business at eight and a half years. Others are less optimistic, with data showing about two out of every three businesses with employees will last two years, and around half will last five.

It may well be the case that a majority of respondents have seen and adapted to a fair share of change over the years — something that may have helped them in 2020.

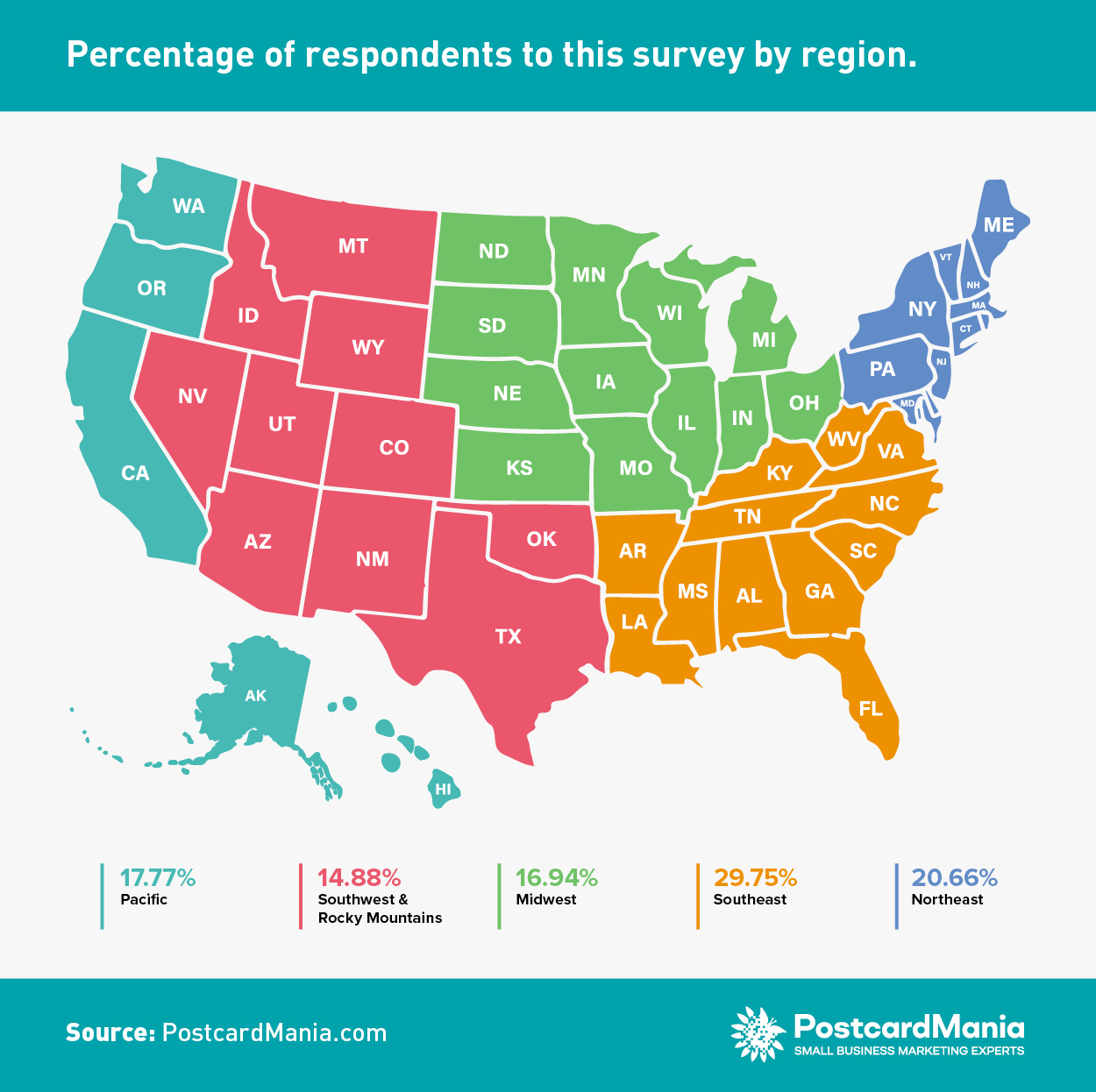

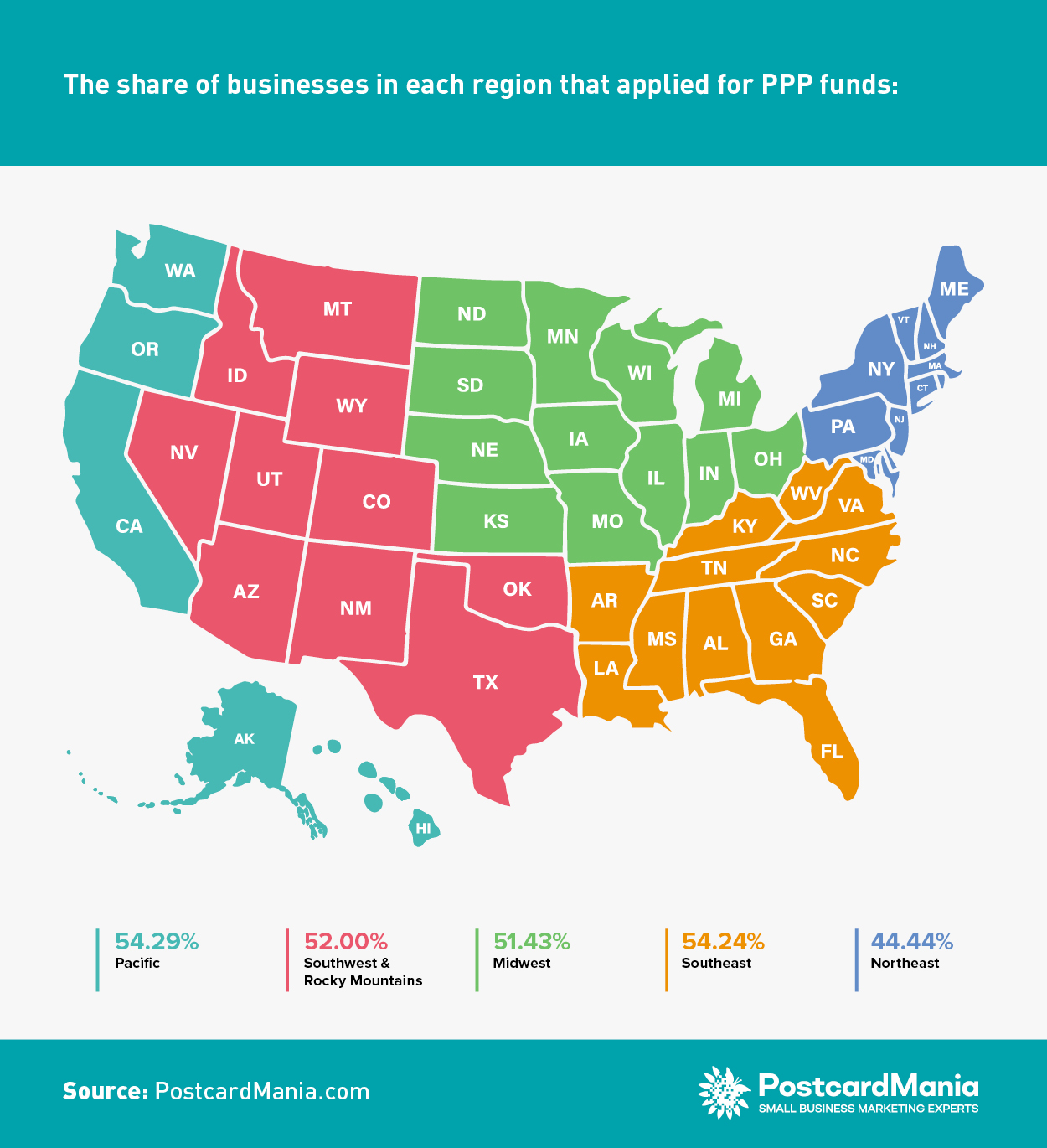

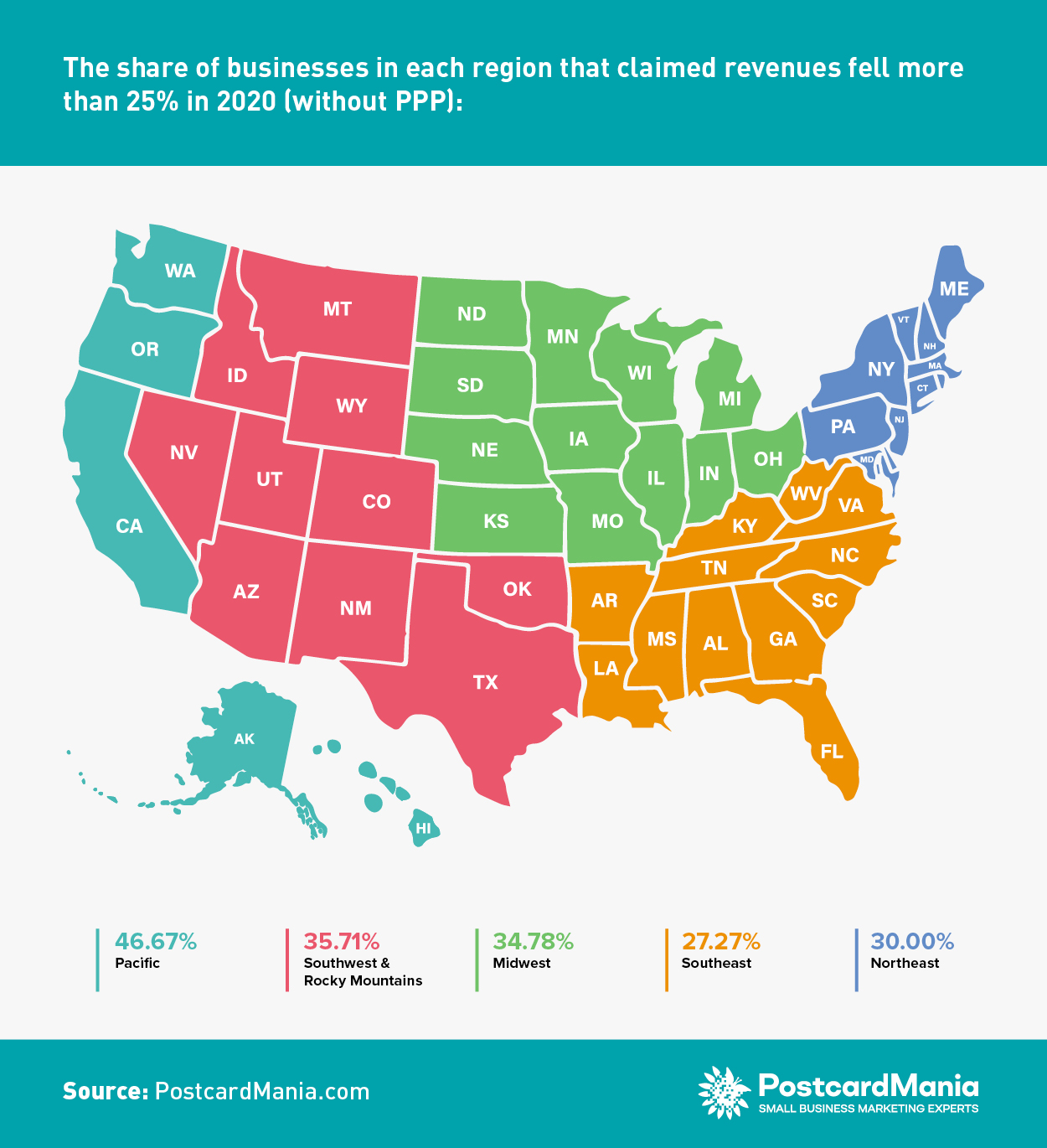

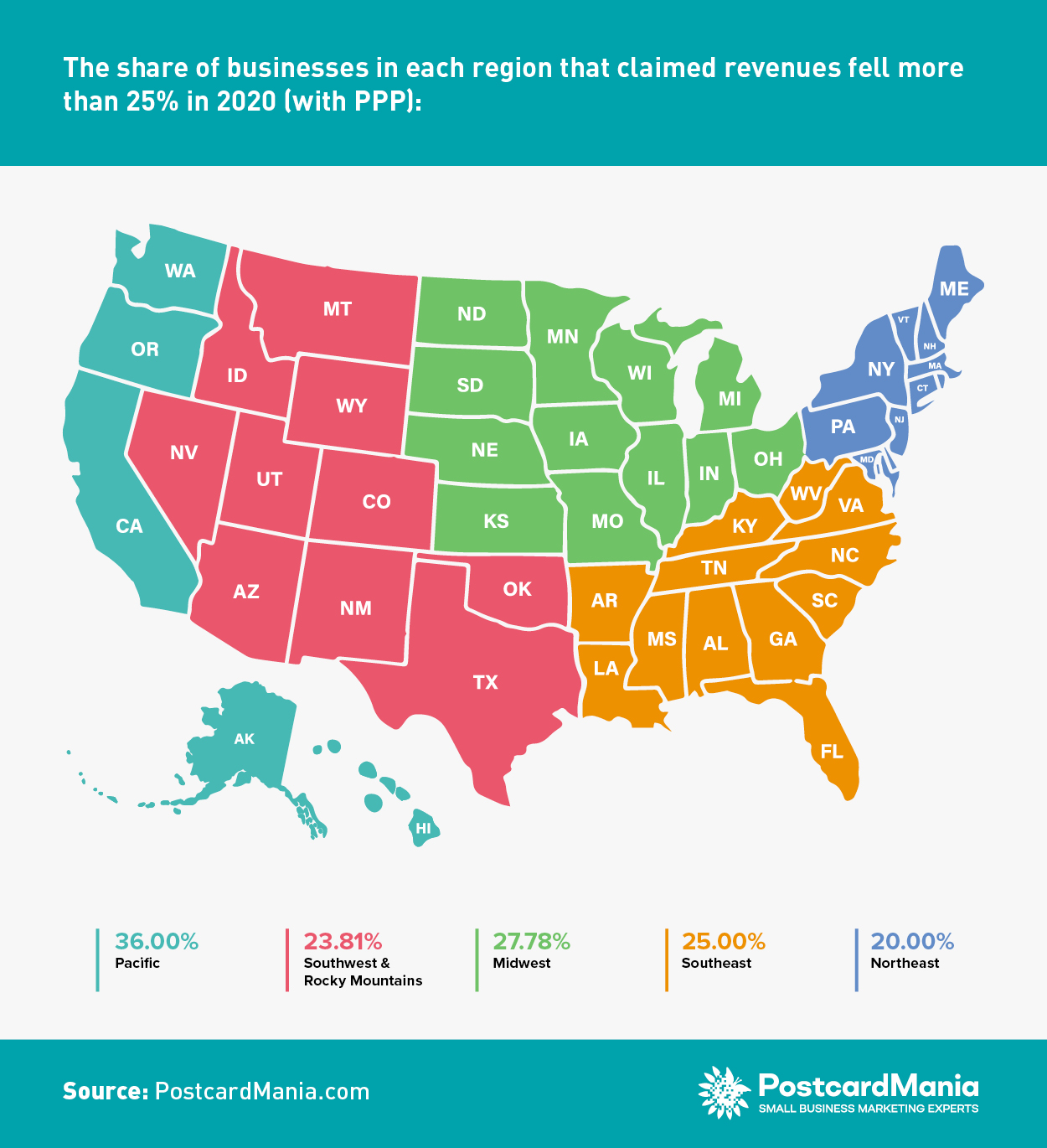

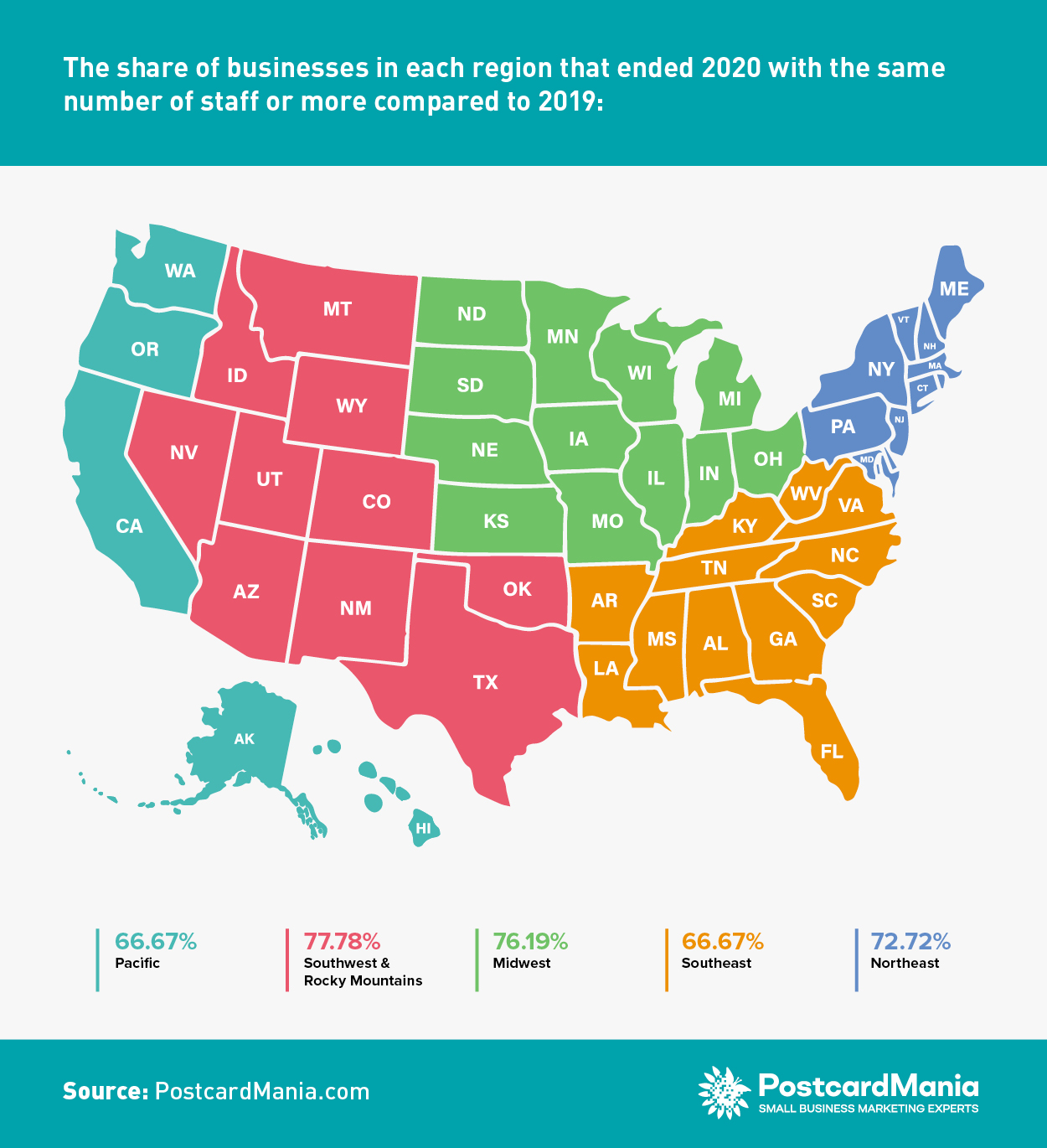

Respondents spanned the entire country, from Hawaii and Alaska to Maine and Florida. To give a regional analysis of the some of the results, we divided responses by region.

Those regions include: Midwest, Northeast, Pacific/Non Contiguous, Southeast, and Southwest/Rocky Mountain.

Now that we know who responded to this survey, let’s look at what they had to say…

Small businesses adapted quickly to Covid-19 and the new normal

Key Finding: Most business owners say they pivoted in 2020, with only 2% of them reporting pivoting later than May 2020 (between June 2020 and March 2021), signaling a quick response on the part of small business.

The results of our latest survey track closely with how small business owners answered this question back in June of 2020.

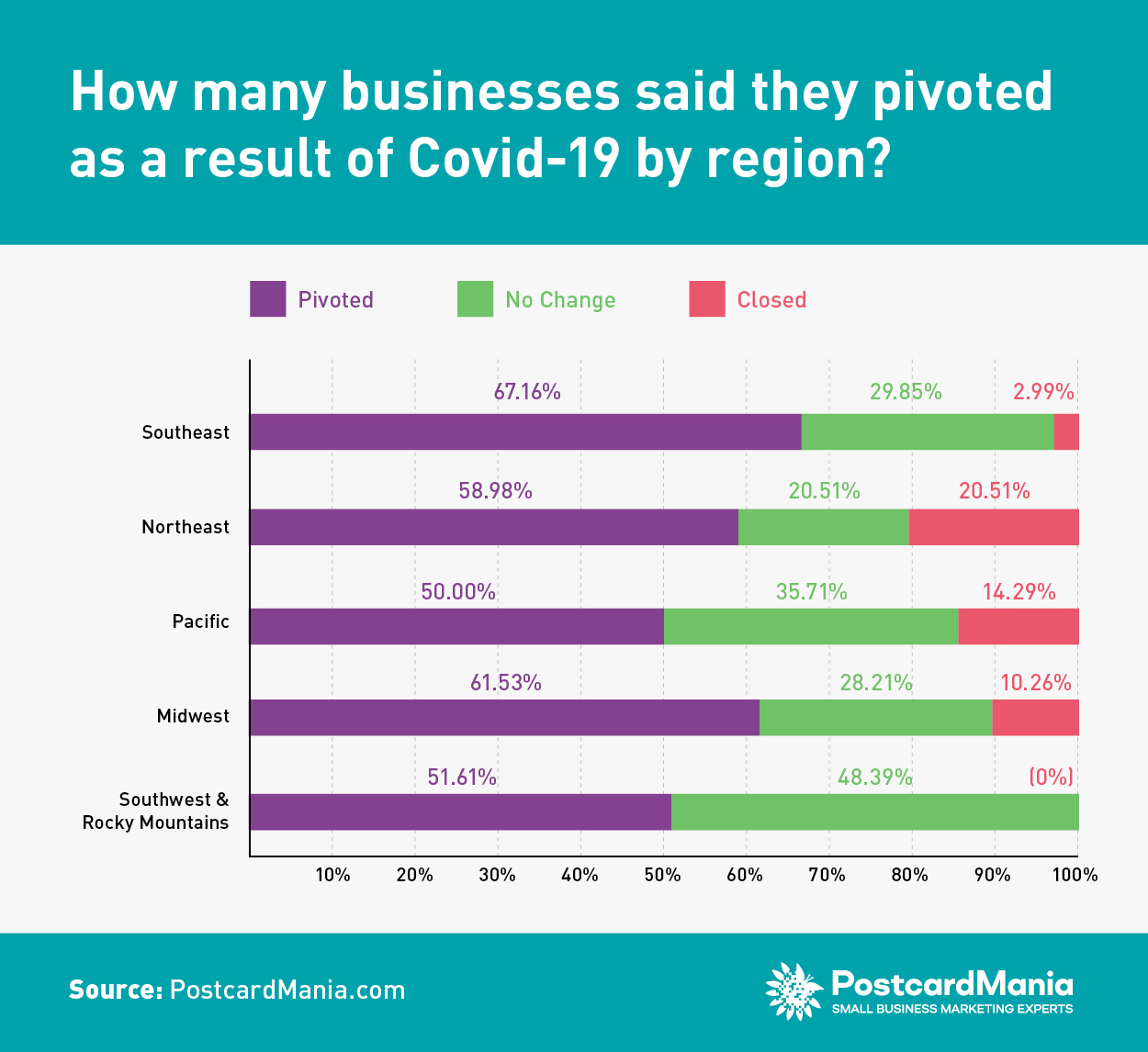

In our previous survey, 57.94% of business owners reported having to pivot their business operations in order to combat Covid-19 regulations. This time around, 59.75% reported a pivot, an increase of 1.81%.

One anonymous business owner offered this piece of advice in relation to pivoting:

Regional Take: The southeast pivoted the most, with 67.16% of respondents in that region claiming a pivot. The northeast had the most closures, with 20.51% of respondents claiming they closed as a result of coronavirus.

How likely are these small business pivots to be permanent?

Key Finding: By and large, the “new normal” is working as most businesses say they’re opting to mostly or fully maintain changes they made due to Covid-19.

We know, we know — we’re all sick of hearing about the “new normal,” but this new standard is inescapable.

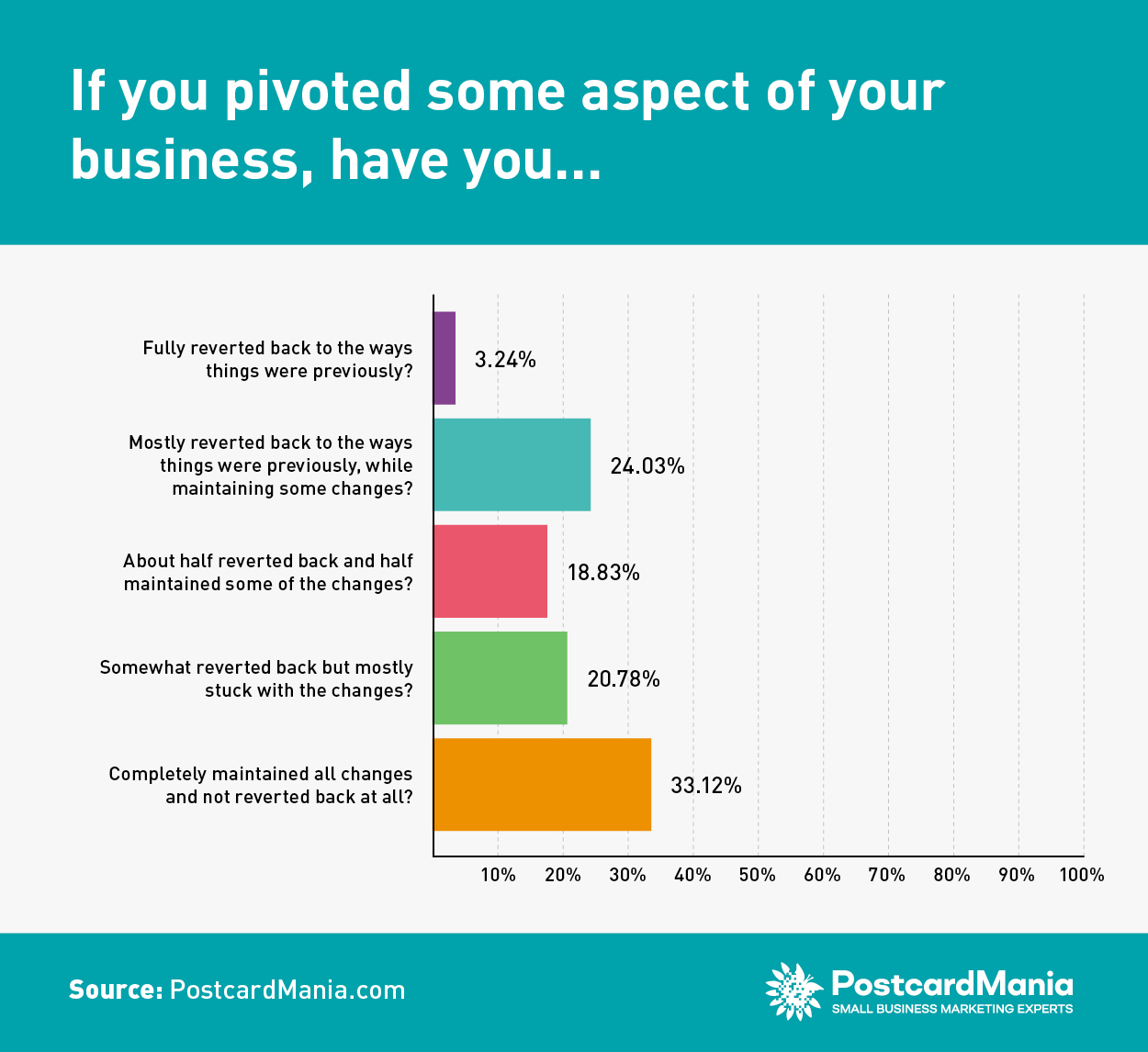

Our survey shows that a mere 3.24% of respondents had fully reverted back to the way things were pre-Covid-19, while the majority (53.90%) will mostly or completely maintain the changes they’ve made in the last year.

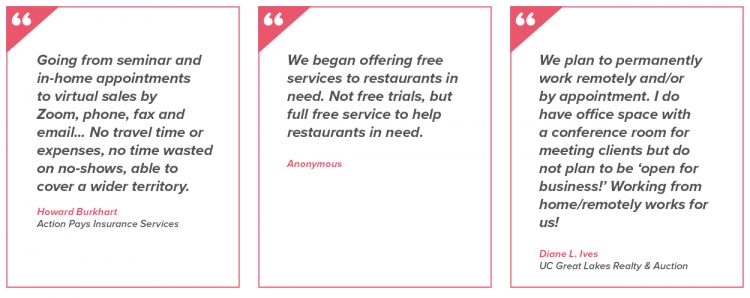

Here are couple anecdotes shared by respondents about their pivots (plus one business owner who started going above and beyond):

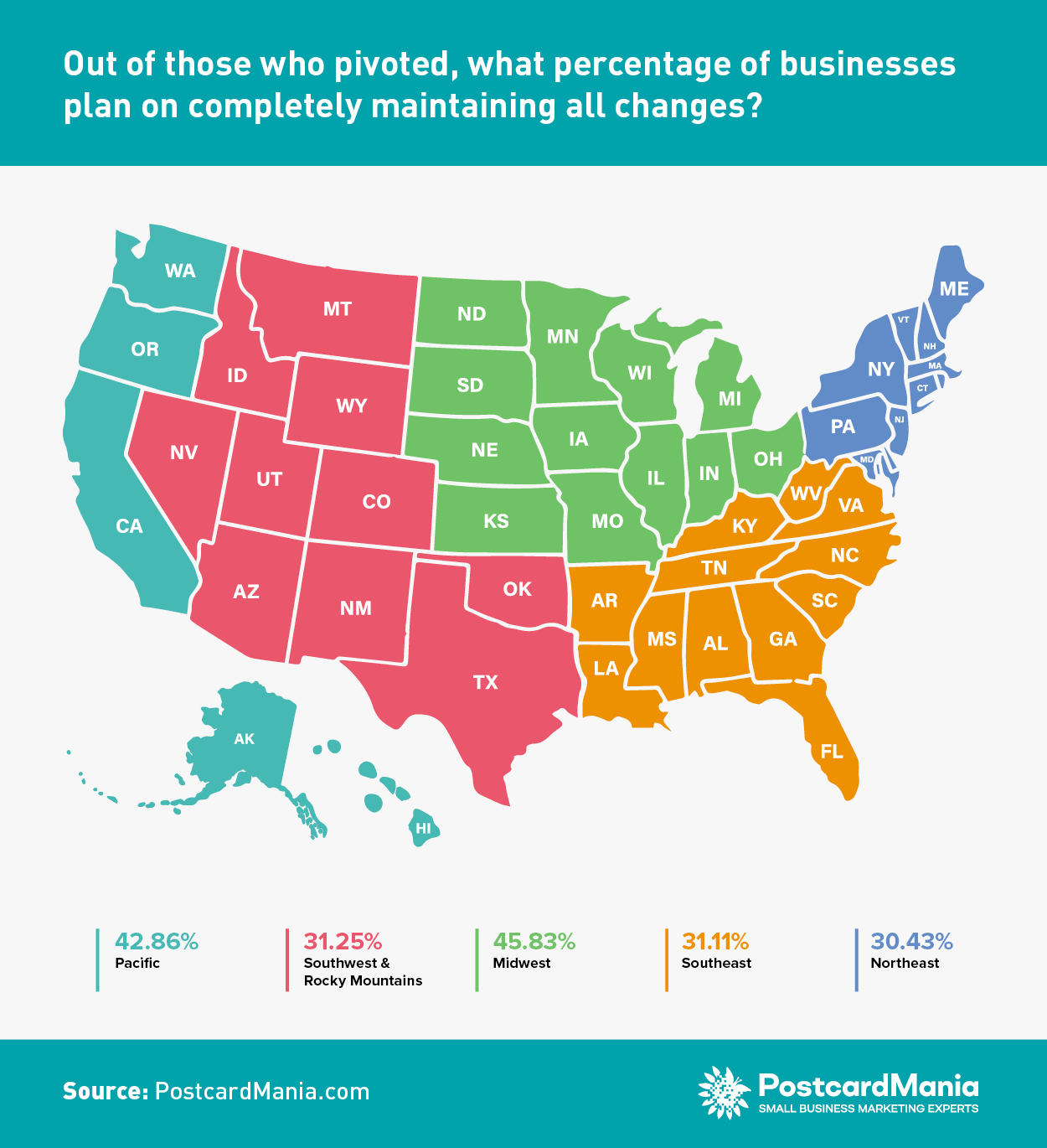

Regional Take: Businesses in the Midwest are the most likely to maintain all of the changes and adaptations made in 2020 due to Covid-19, while the Northeast had the lowest rate of businesses that pledged to maintain all changes.

Small business owners are split on bringing staff back to the office

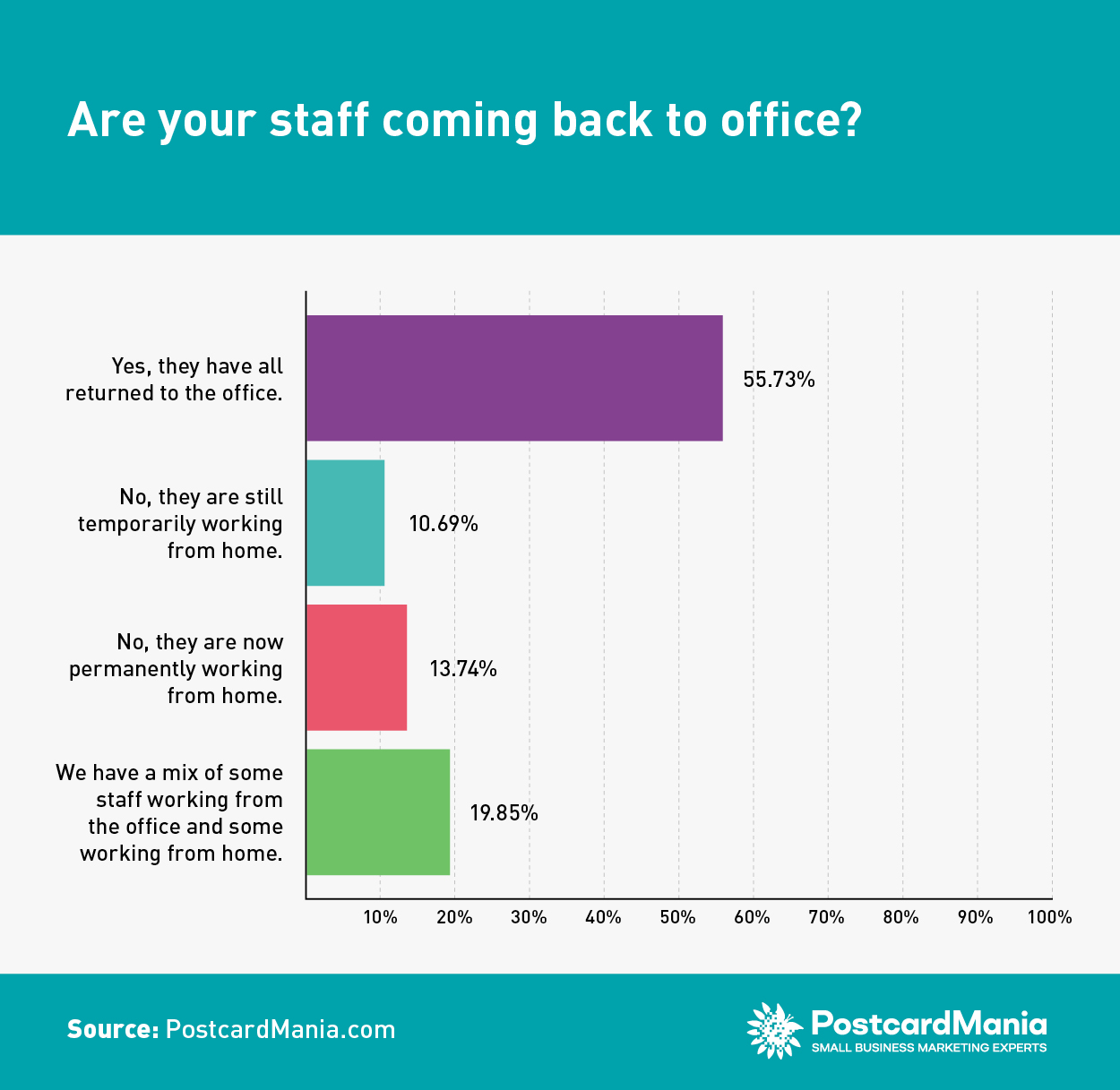

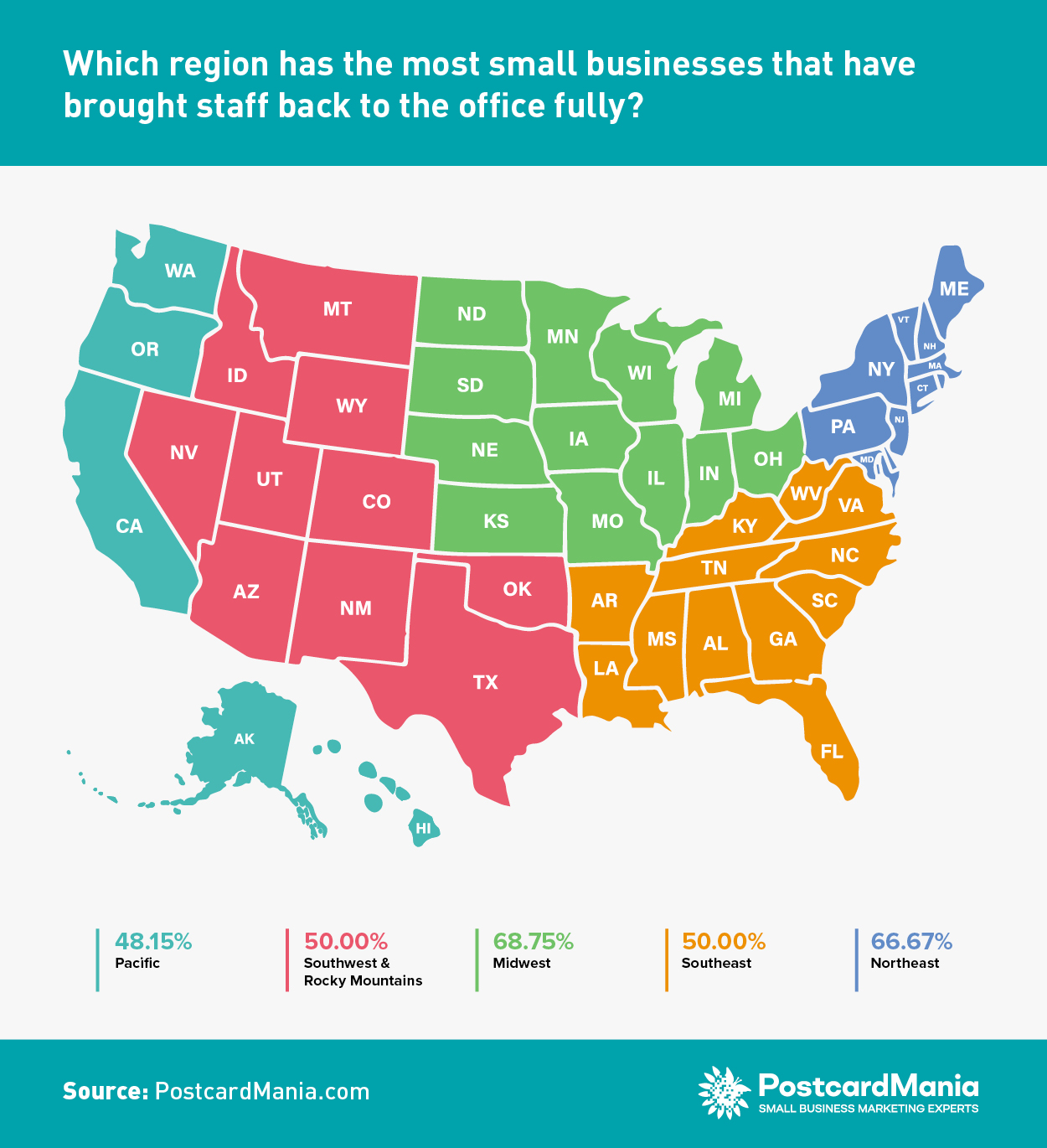

The verdict seems to still be out on what the new workplace will be. Just over half — 55.73% — of respondents have already returned to the office, while the other 33.53% are either mixed or still temporarily working from home. Only 13.74% are now permanently working from home.

Regional Take: The Pacific has the highest rate of respondents (14.81%) now allowing staff to work from home permanently. In the Midwest, you’ll find the highest rate of businesses that brought entire staff back to the office in full (68.75%).

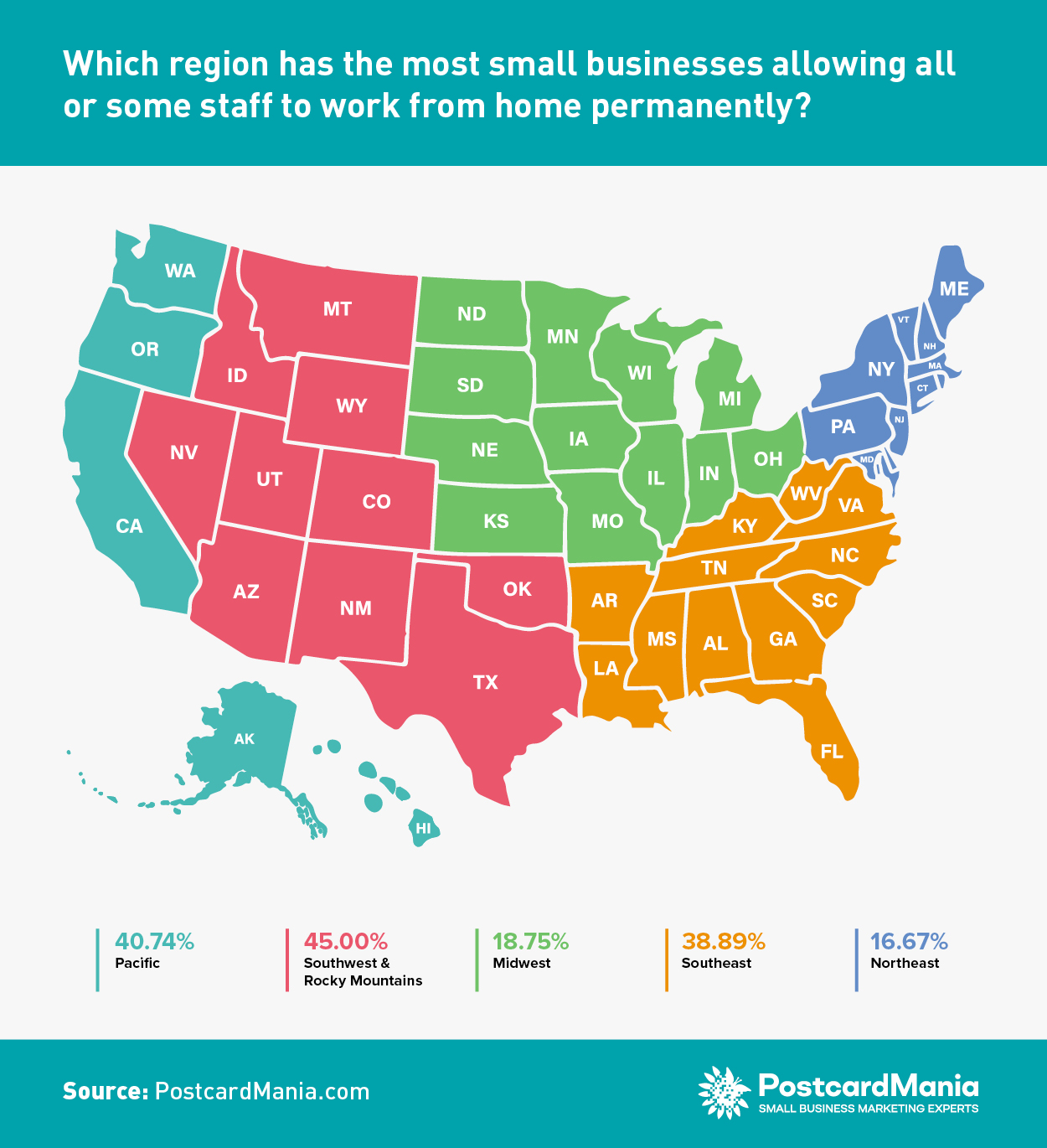

As you can see in the map below, the Southwest and Pacific lead the pack in the share of businesses making work-from-home (WFH) permanent for either all staff or a mix of staff.

What affect (if any) did Covid-19 have on small business marketing plans?

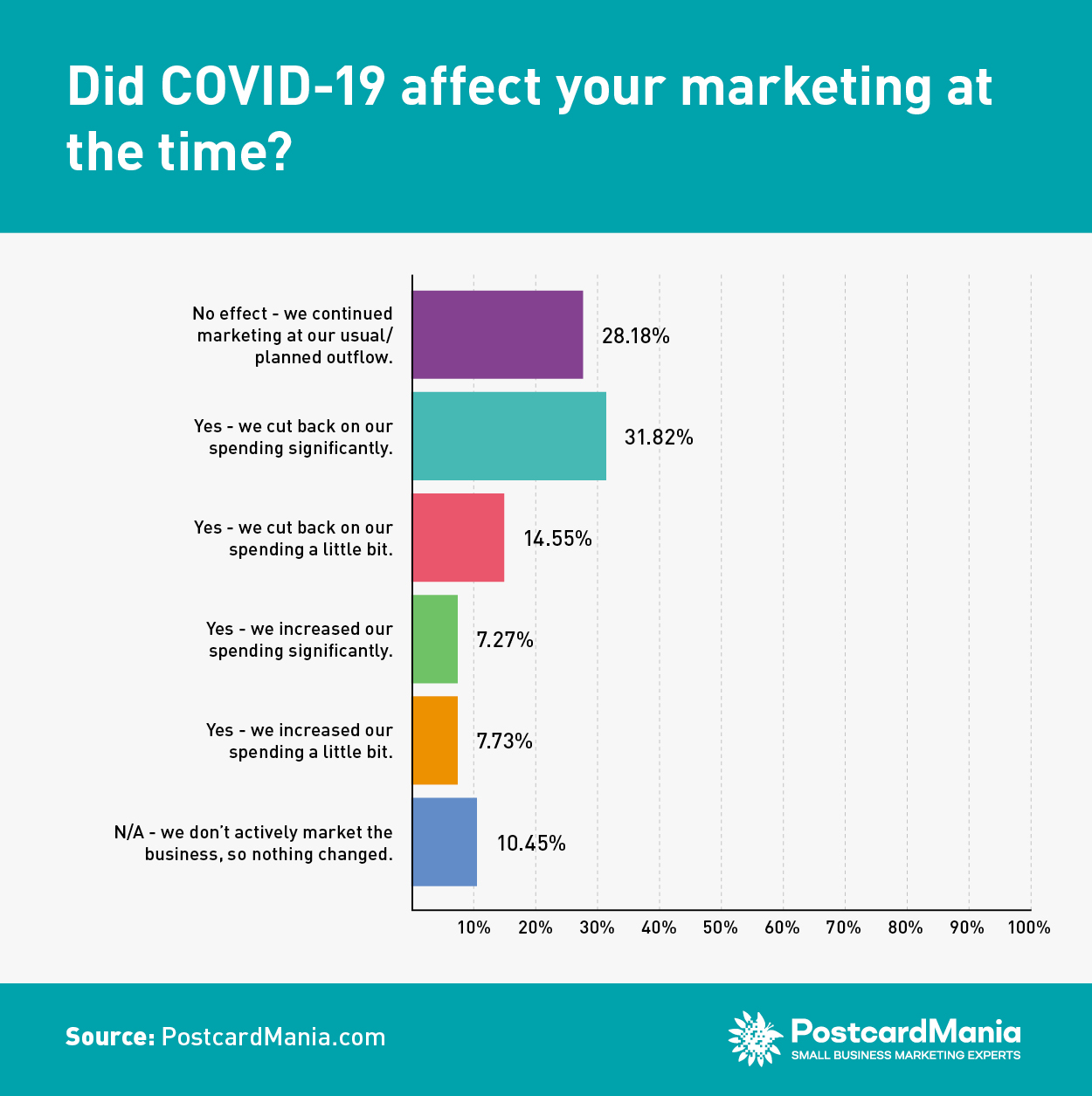

Key Finding: Most businesses (61.37%) responded to Covid-19 by adjusting how much money they were willing to spend on marketing — 46.37% spent less while 15% spent more.

A little less than 30% of businesses carried on marketing without any change.

Given that much of the country hit the panic button over coronavirus, it’s heartening that almost half of the small business owners who responded to our survey stayed the course and kept a level head when it comes to marketing.

(That isn’t to say that those who cut back or cut back dramatically didn’t do so without due justification — there are so many different factors depending on industry.)

In our experience, continuing your marketing during an economic downturn or recession is vital to how quickly you can bounce back and begin to thrive — versus prolonging how long you have to stay in “survival mode.”

Here are a few shared anecdotes from our respondents:

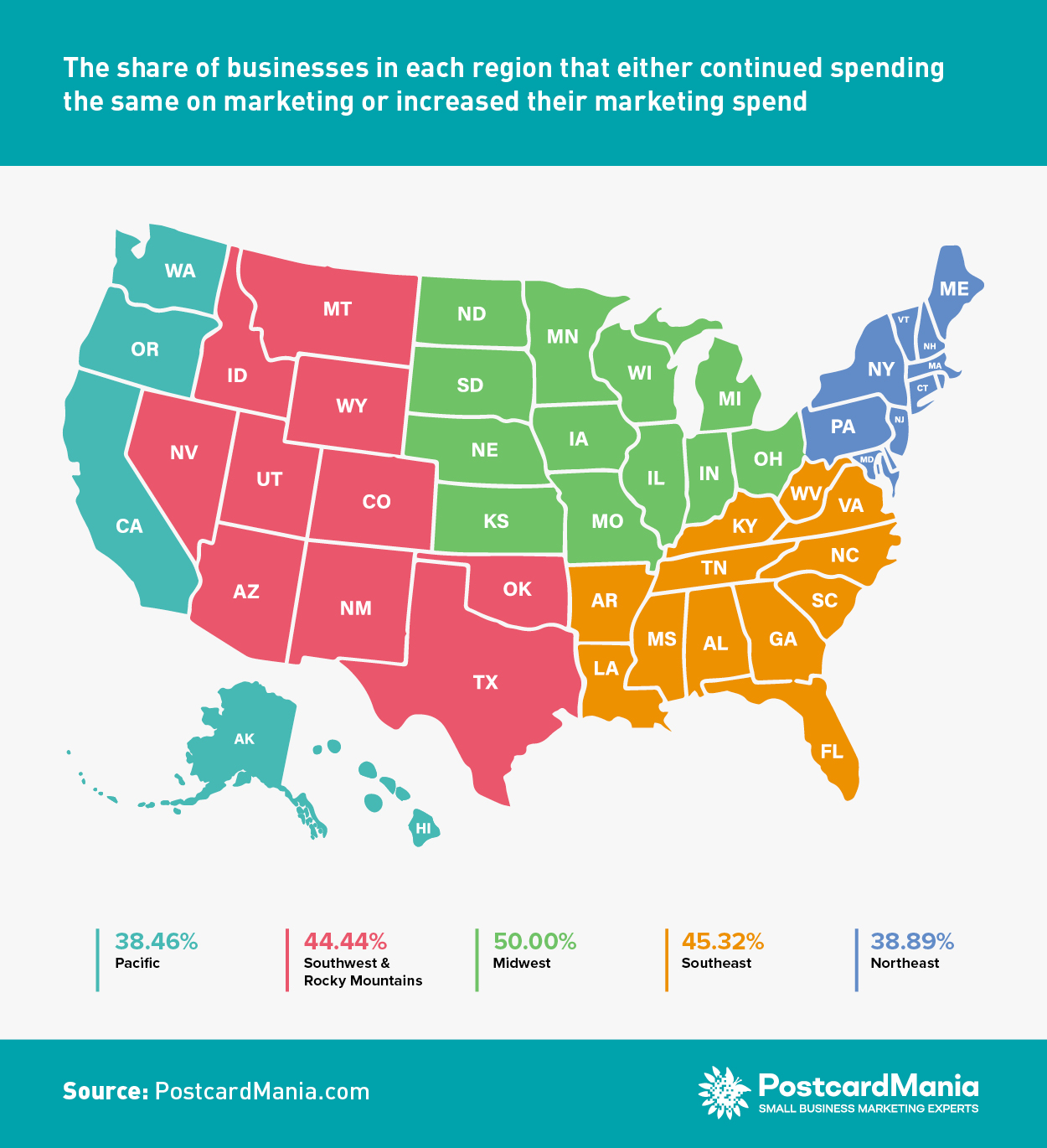

Regional Take: Not one respondent based in the Pacific region increased their marketing significantly — most of the respondents that did (38.47%) were located in the Midwest. The Southeast claimed the largest share (60.98%) of those businesses that said Covid-19 had no effect whatsoever on their marketing spend.

Marketing isn’t fully “back” yet for most small businesses

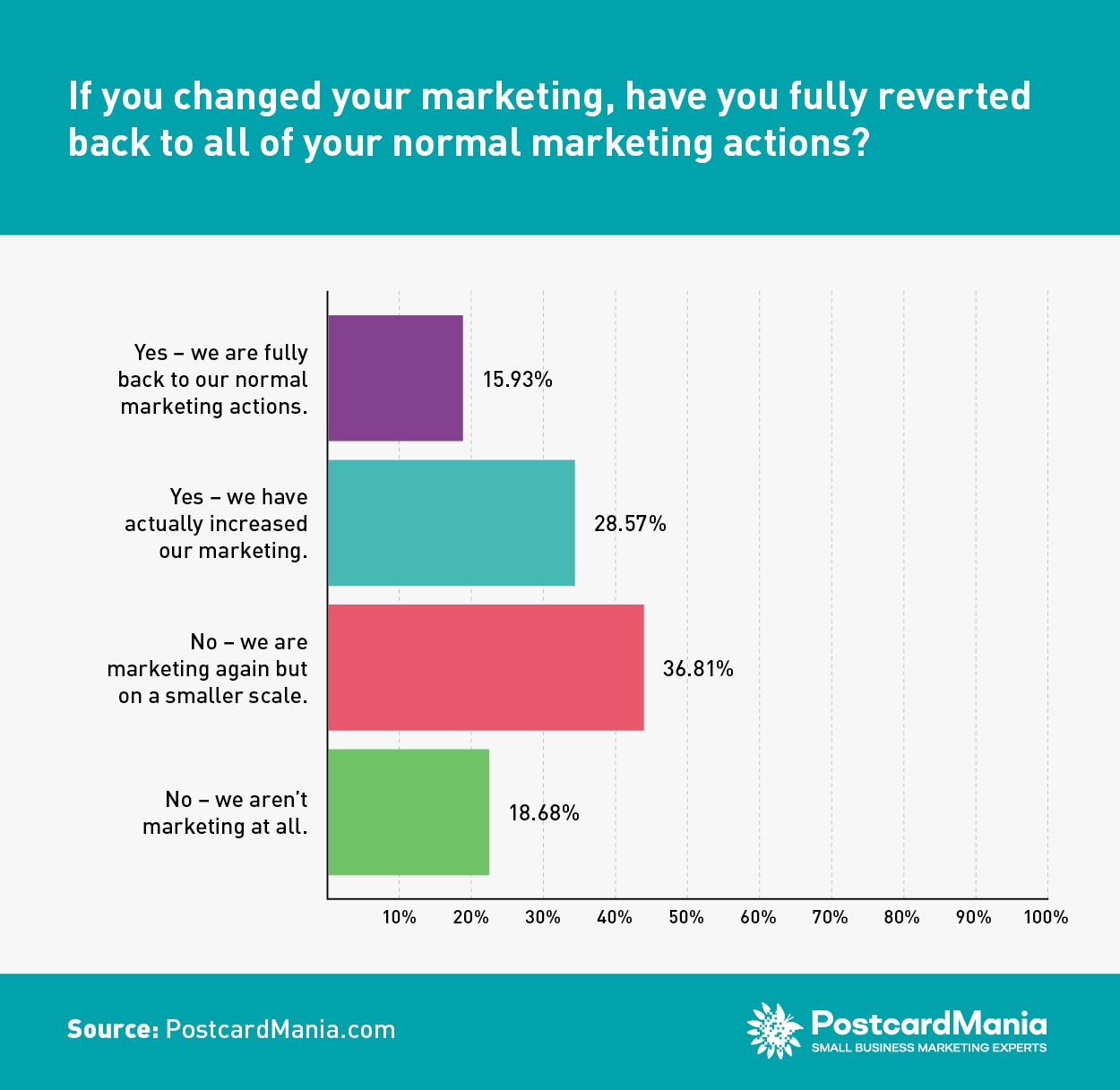

Key Finding: A majority of businesses (55.49%) are still hanging back on marketing, which might mean there’s room for even more revenue growth once businesses have the capital and confidence to begin marketing again.

It’s also worth noting:

Those who aren’t yet marketing may be losing market share to competitors.

While those who maintained normal marketing levels without change (15.93%) and those who actually increased marketing (28.57%) are likely in a better position to bounce back quickly, recoup any losses and even expand market share and revenues in the near future.

The correlation between economic downturns and how marketing can impact a business’s ability to bounce back is one that has yet to be widely scientifically studied.

There are a number of anecdotal claims that point to marketing and advertising as a key factor in how quickly a business rebounds — including our founder/CEO’s own testament to continue marketing without exception through any downturn, with the lived experience of surviving two recessions/downturns to back it up.

This year-long study by the Harvard Business Review analyzing the strategies and resulting performance of 4,700 public companies from the 1980s to 2002 may be the closest thing to “real research” on the topic.

In the study, recession responses were sorted into 4 categories:

“Prevention-focused companies, which make primarily defensive moves and are more concerned than their rivals with avoiding losses and minimizing downside risks.

“Promotion-focused companies, which invest more in offensive moves that provide upside benefits than their peers do.

“Pragmatic companies, which combine defensive and offensive moves.

“Progressive companies, which deploy the optimal combination of defense and offense.”

The approach that saw the best results?

Progressive companies that optimally balanced the task of saving capital (increasing efficiency over cut backs and layoffs) while investing wisely (such as developing new markets and bolstering their asset bases).

As far as marketing goes:

The study holds up Target as an ideal example of how a progressive company successfully maneuvered through multiple economic downturns.

And yes, they did increase their media/marketing spend.

Regional Take: The Pacific region has been the most aggressive at restarting their marketing with more than half saying they’ve now increased their marketing overall.

Almost half of the small businesses surveyed did not apply for PPP funding

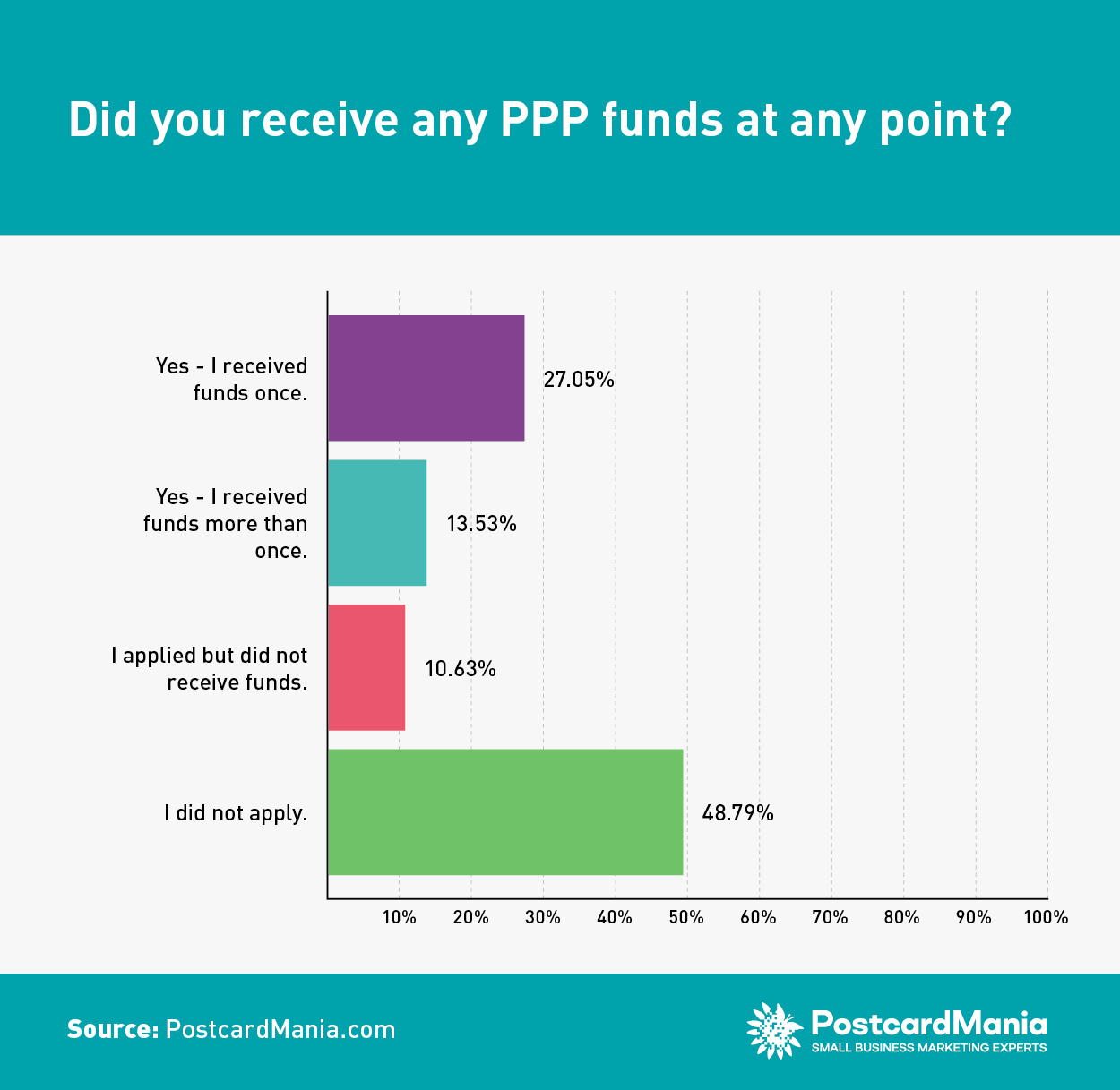

Key Finding: Most respondents applied for PPP funding (51.21%), but more didn’t even apply (48.79%) than received funds (40.58%).

The Paycheck Protection Program was established in March 2020 through the Small Business Association (SBA) to help businesses manage costs (primarily payroll, rent/mortgage and utilities) during the coronavirus crisis, when many were forced by the government to shut down. The program provides forgivable loans to businesses with fewer than 500 staff.

For respondents to this survey, it’s a close split between businesses that did and didn’t apply. The slight majority applied for PPP funding at 51.21% with 48.79% not applying for anything.

Regional Take: The Northeast had the highest share of businesses (55.56%) that did not apply for any PPP assistance. The Midwest had the highest share of respondents (20%) that received more than one round of PPP.

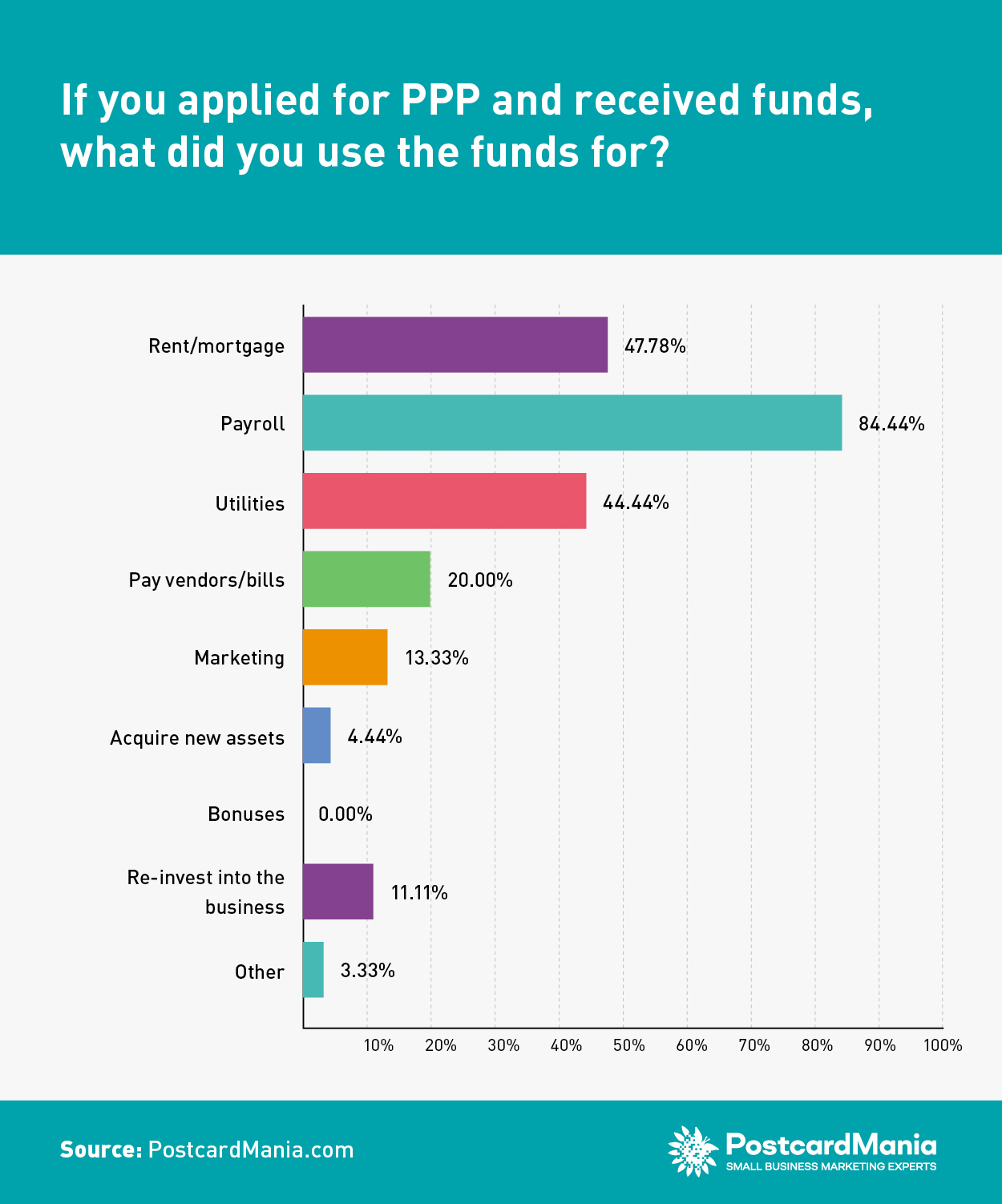

The overwhelming majority of small business owners used PPP funds to pay staff

Key Findings: Of those that received PPP funding, 84.44% used the funds to cover payroll. Rent/mortgage and utilities were the next most common usages at 47.48 % and 44.44% respectively.

One of the key provisions for PPP loan forgiveness states that at least 60% of the proceeds must be spent on payroll in order to qualify for full forgiveness.

As payroll far outpaced all other expenditure categories, it’s likely that most business owners are angling for full loan forgiveness.

Some of the “other” costs that were volunteered included: repairs, licensing, and being able to “hedge against” bankruptcy.

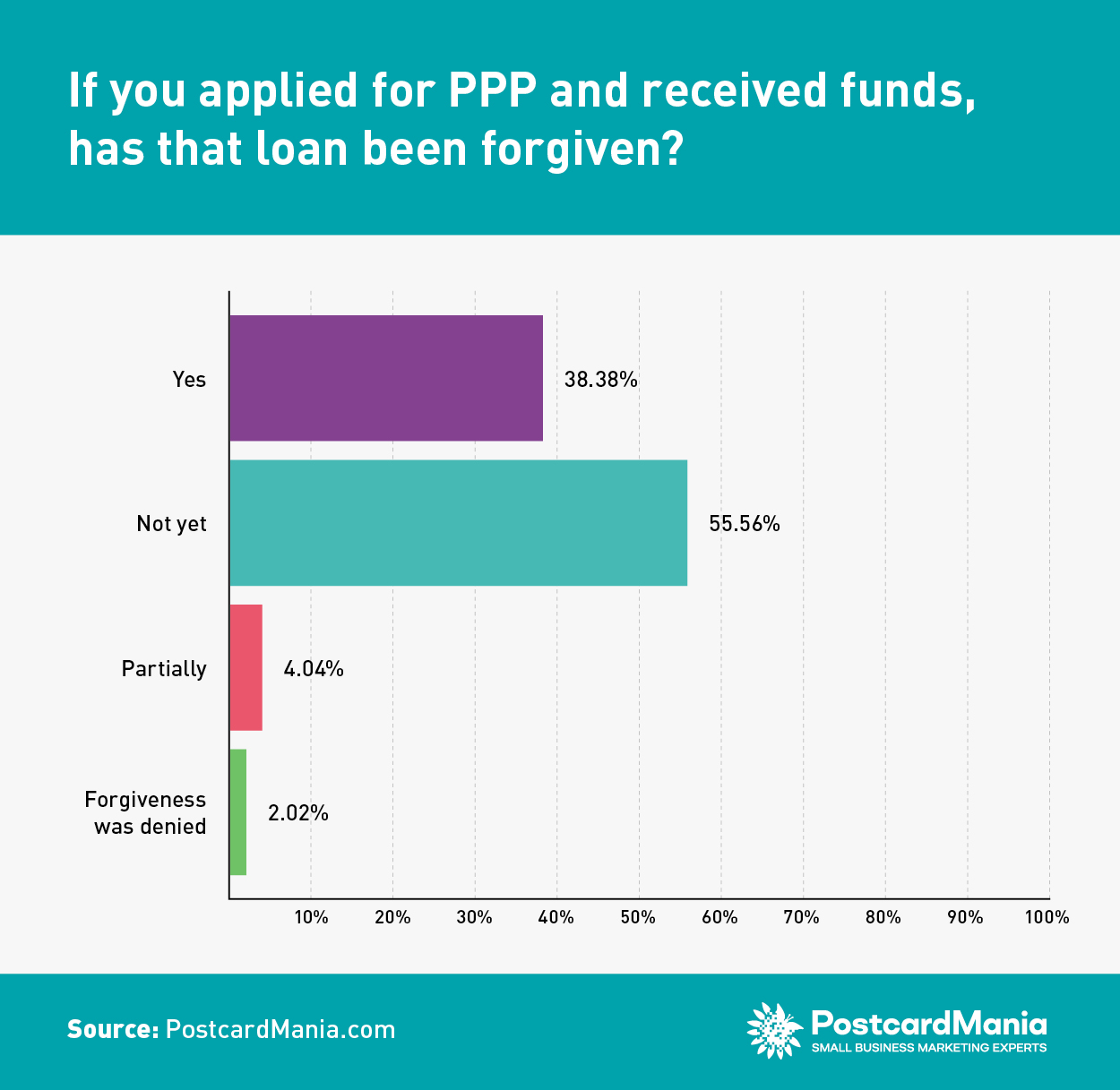

PPP loan forgiveness is still in progress for most business owners

Key Findings: A little over a third (38.38%) of respondents say that their PPP loans have been forgiven while a larger majority (55.56%) told us their loans were not yet forgiven.

SBA procedure states that the lender of a PPP loan has 60 days total from when they receive a loan forgiveness application from a business borrower to inform the SBA of their decision. Once the SBA reviews these documents and approves of a forgiveness amount, it will be refunded to the lender within 90 days. Then the lender can finally inform the business of their total loan forgiveness amount.

However, the SBA can initiate a review on their own as well, and there are no concrete timelines for their process.

So…it may be awhile. And unfortunately that’s leaving a lot of small business owners in limbo.

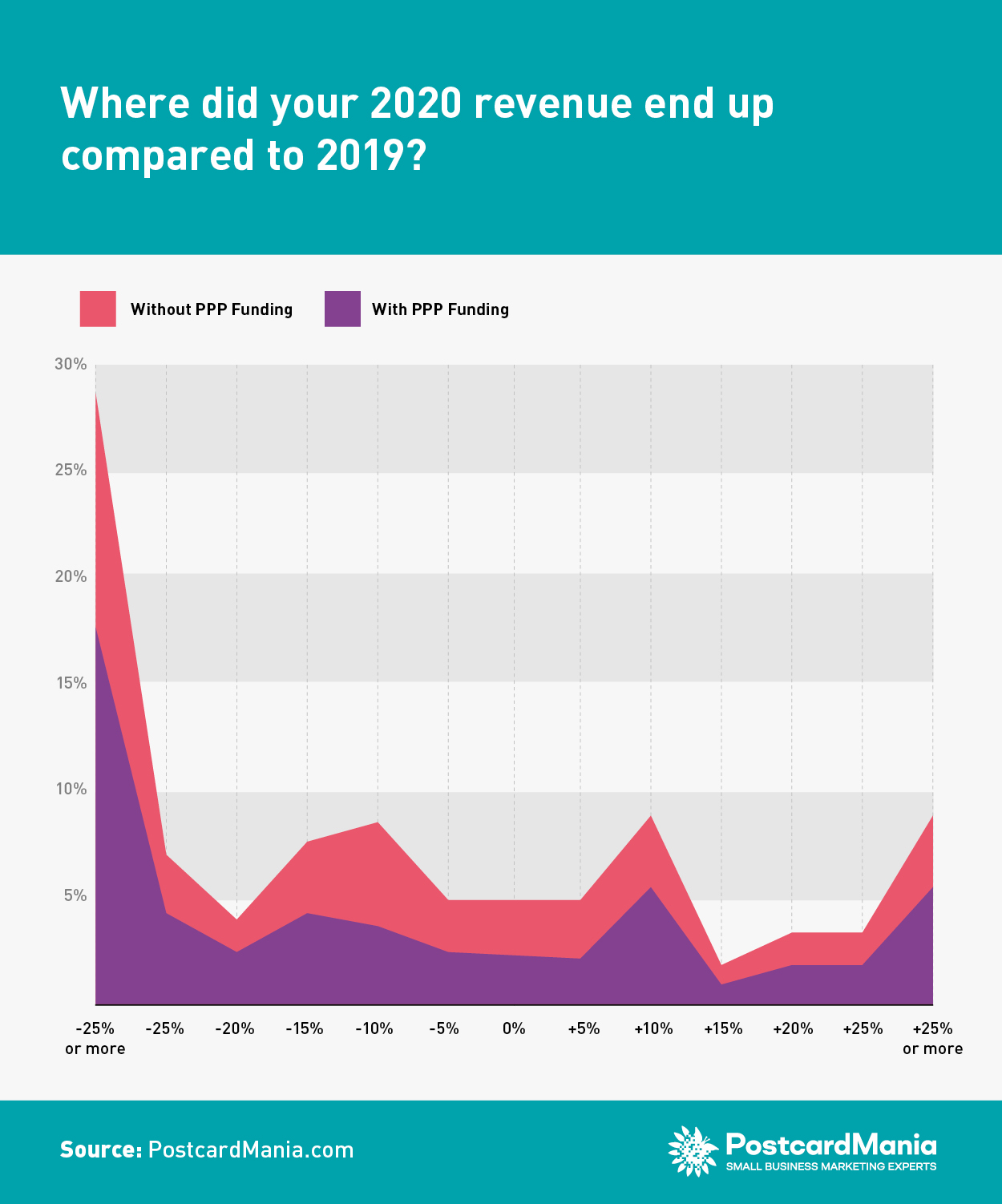

With or without PPP, most small businesses had a rough 2020 compared to 2019 revenue-wise

Key Findings: Despite pandemic conditions benefiting some, coronavirus hurt small business revenue — regardless of PPP assistance.

Not including PPP funding, 55.30% of respondents ended 2020 with revenues down more than 10% compared to 2019. When you factor in PPP, that number shrinks by 10.64% to 47.66%.

Those that did receive PPP funding? Not much changed. 65% were still down at least 25% or more, it just helped out those in the most abysmal circumstances decrease their losses from down less than 5% of their 2019 earnings (yikes).

This is even worse than their projections in our last survey, in which only 58% of respondents forecasted they’d be down 25% or more when compared to 2019.

Regional Take: Without taking PPP into consideration, the Pacific region saw the largest share of respondents (46.67%) that suffered revenue losses of 25% or more while the Southeast saw the fewest (27.27%). When taking the difference between PPP and no PPP into consideration, revenue drops of more than 25% were reduced by an average of 8.37% across all regions, making the smallest difference (2.27%) in the Southeast and the largest difference (11.9%) in the Southwest.

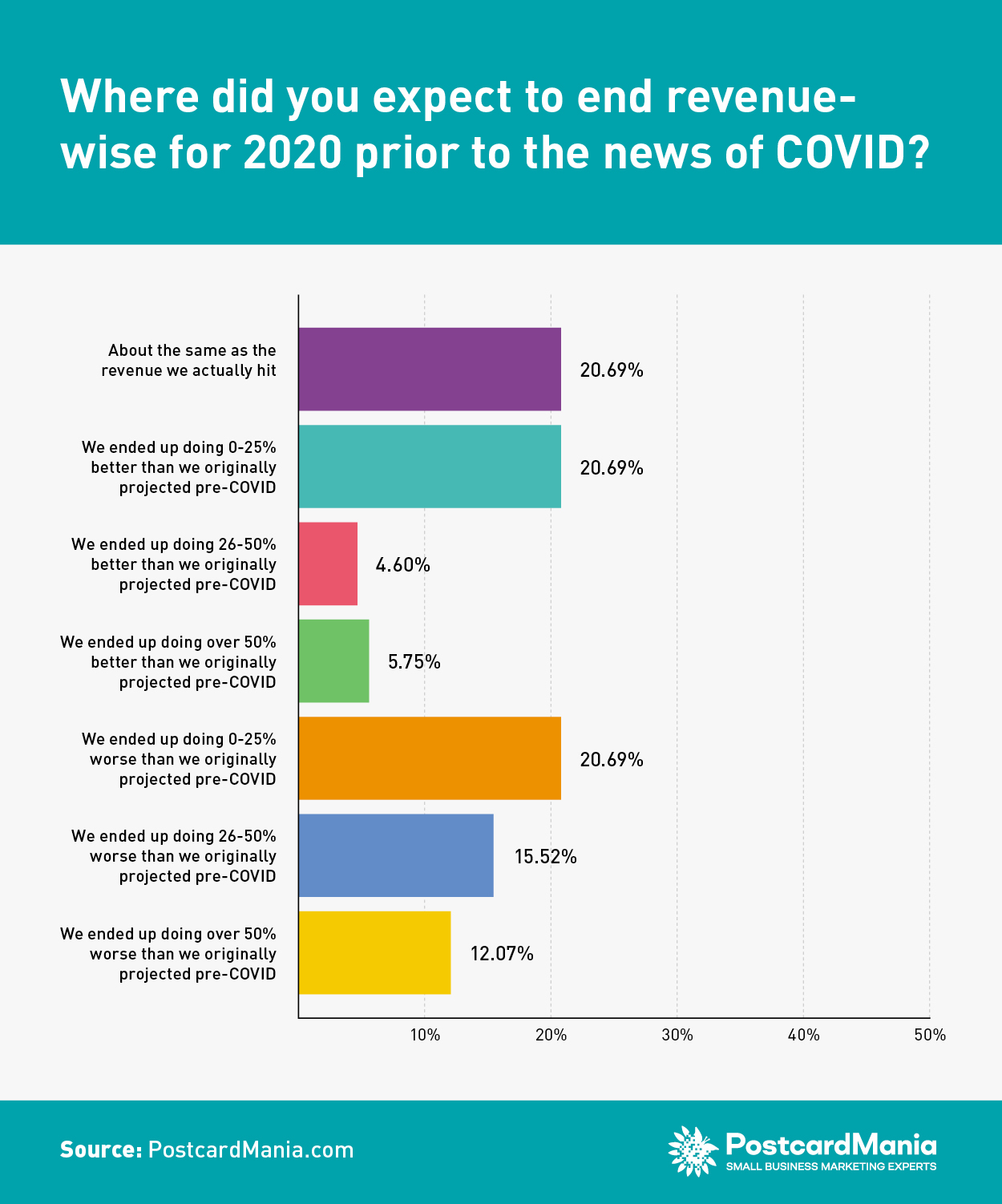

The majority of business owners were blindsided by Covid-19, ending 2020 well short of their initial pre-Covid outlooks

Key Findings: Only 20.69% of respondents said that their pre-Covid revenue projections were even in the same ballpark as where they ended the year, and 48.28% ended 2020 worse off than they thought they’d be at the start of it.

It’s fair to say that no one saw coronavirus and its full effect on small business bottom lines coming.

However, there are a couple a silver linings:

First — in June 2020, we asked small business owners where they expected their 2020 revenue to end up, and 57.94% expected to be down. Yet only 48.28% ended the year down from their initial pre-Covid projections. That’s a difference of 9.66% that may have fared better than anticipated in the months following our initial survey.

Second silver lining — almost a third of respondents (31.04%) to this year’s survey ended the year with better-than-expected revenues.

Also, here’s a third silver lining…

The number of businesses that projected they would end the year with the same number of staff in June and those that did end the year with the same number of staff is virtually identical

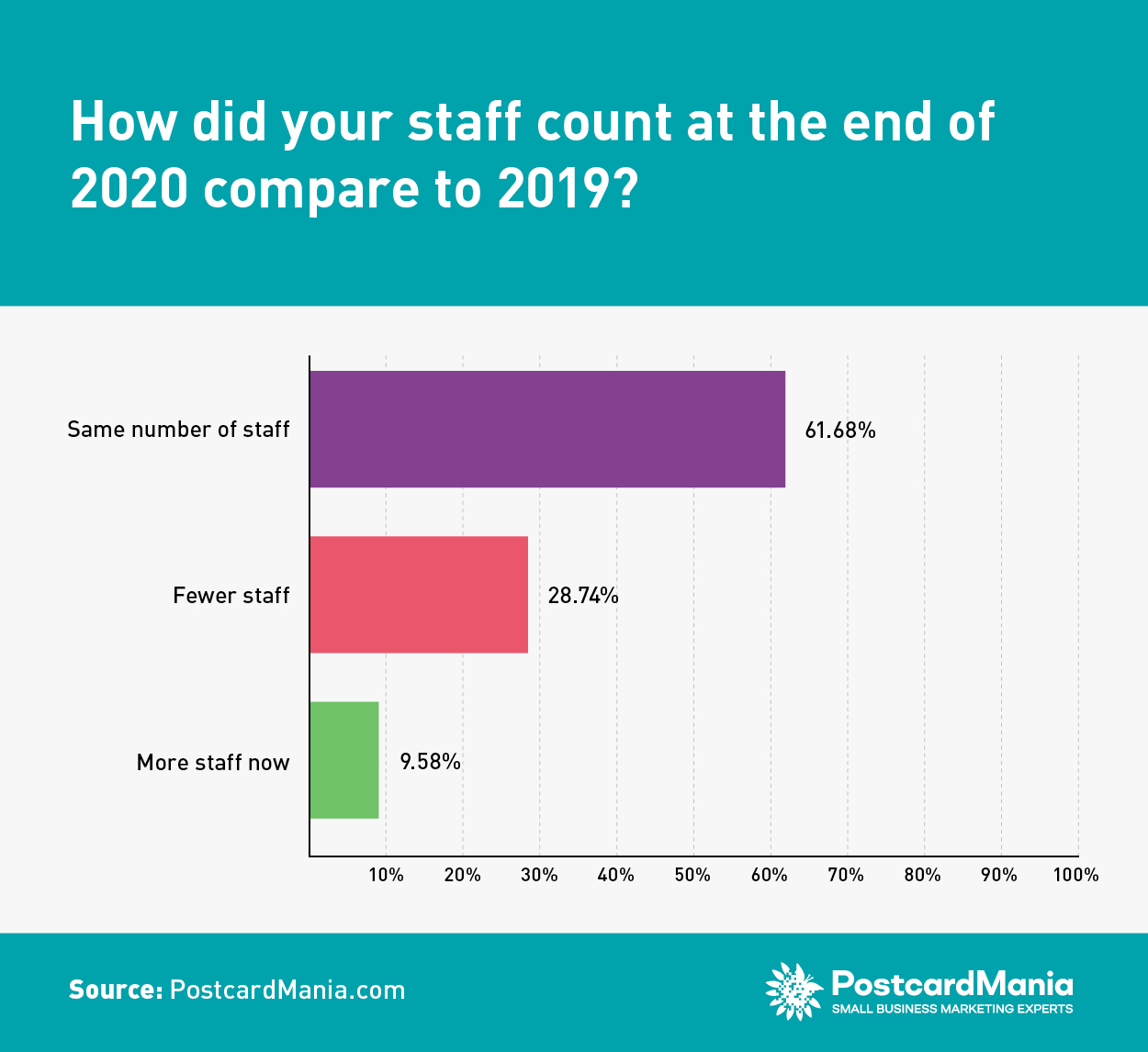

Key Findings: In June, 61.90% of that survey’s respondents expected to end 2020 with the same number of staff they began the year with. In this most recent survey, 61.68% confirmed they ended 2020 with the same number of staff they started with.

The optimistic projections for staffing counts made in June 2020 held strong through the end of the year as 71.26% of respondents confirmed that they did not cut back on jobs.

However, optimism can’t always trump reality, as only 19.05% of the respondents to June’s survey expected to end the year with fewer staff. This number grew to 28.74% in our 2021 survey.

Hopefully as we continue to adapt to the “new normal” and return to the “old normal” as states begin to lift the last of their restrictions, these businesses will be in a position to rehire the personnel they lost.

Regional Take: The Pacific and the Southeast regions tied for the highest rate of respondents (33.33%) who said they ended the year with fewer staff. However, the Pacific also shows the most growth, with 15.15% of respondents in the region saying they ended 2020 with more staff than when they started.

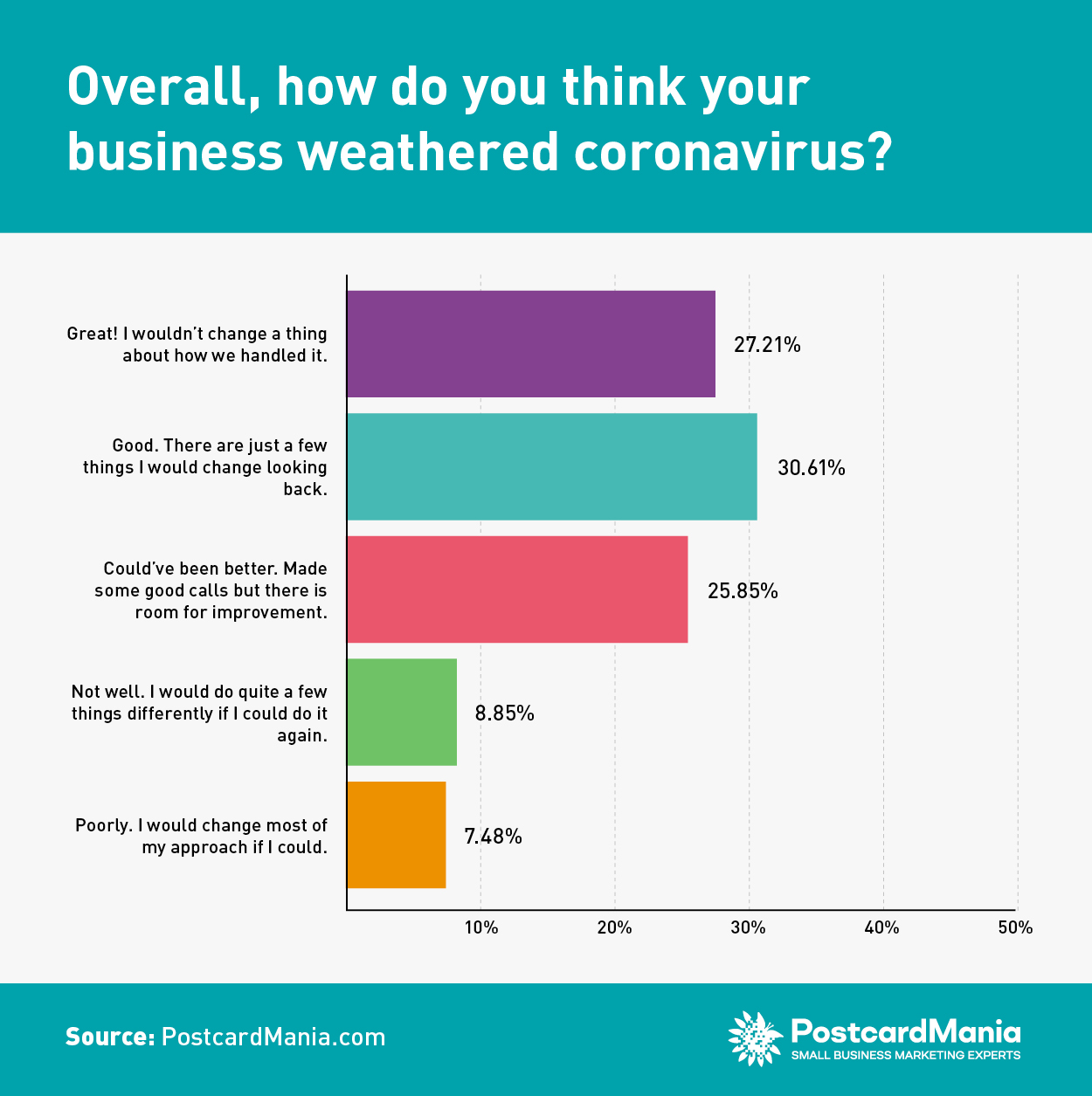

By and large, most small businesses rate their handling of coronavirus as good or better

Key Findings: The majority of respondents (57.82%) rated their business’s coronavirus response as good or great while only 16.33% said they would change quite a few to most things about their response.

The resiliency of small business owners prevails again.

Over half of the respondents had positive outlook on how they handled the pandemic, with more than a quarter (27.21%) saying they wouldn’t change a thing about how they responded.

It doesn’t get better than that for 1 out of every 4 respondents.

Without a doubt, the majority of small business owners are eager to put coronavirus behind them

Thankfully, it seems we may finally be approaching the light at the end of long tunnel with pace.

So, let’s look back at what small business owners learned in 2020 — in their own words.

“Bad things are going to happen and when they do… evolve, adapt, expand, and know when to retract. It’s ok to change the way you have been doing things to become something new.”

– Jennifer Greene, Original Hair Spa

“In bad times, market more!”

– Bill Massarone, Lexington Outdoor Lighting

“Putting your clients first by showing genuine caring is most important. if you do the right things the money will come. Being willing to be very flexible is key in my business. Feel out the comfort zone of your clients and come up with solutions that make them feel safe and happy always.”

– Lynn Smothergill, Keller Williams Town Life

“I credit using PostcardMania for helping to grow our newly established business… As a newly opened business, the ad campaigns we ran in 2020 paid off to the point we have doubled our customer base. The website traffic has increased and additionally, our customers are referring to family and friends their newfound hairstylist experience. If we find ourselves in need of additional advertising, PostcardMania will be the first call I make!”

– John Blanchette, Hair By Katy Salon

(Note: You can read about this marketing success on the Hair By Katy Salon case study page.)

“It has been a challenge but we are still here and starting to rebuild. We survived the great recession, and this feels a little like that era… Hold on, and look for ways to re-invent. People still need to move their products and slowly take their foot off the fear brake and carefully ease back into the sell lane. It all comes down to an honest dialogue from the government all the way down to the people. Yes, it has been a year of great fear because of so much unknown. But now we must be cautious and not live in fear — think it over, talk it over and trust your gut. The old gut never steers you wrong. And above all practice kindness. We all need more kindness in these trying times.”

– Anonymous Business Owner

“Customers have been really patient and we have learned a lot of new technology. If customers give us a chance and keep spending there is no limit to what we can accomplish. I think that goes for the entire economy as well. We are setup to run and do great things because of what we have learned over the past year!”

– Greg Conrad, Iowa Land Sales Report

“Times are tough but we are tougher…”

– Ellie Bowden, Bowden Realty

Ellie’s got the right idea.

American small businesses are renowned for their grit, adaptability and unshakeable drive to succeed against all odds.

If we’ve learned anything from this survey, it’s that 2020 is a true testament to that.